Integration Challenges: What not to do in Post-merger Integration

Operational Due Diligence: A Primer

M&A Mavericks: Tuluhan Erdemi – From Corporate M&A to independent consultant

M&A and Private Equity: the influence of PE in Merger and Acquisitions

M&A Due Diligence: The Guide

Welcome to the Fintalent M&A Blog.

Fintalent is the largest platform for M&A professionals. On this blog, our talents contribute valuable insights for M&A, Strategy, PE, and VC professionals.

Subscribe to the Fintalent Newsletter

Integration Challenges: What not to do in Post-merger Integration

Any post-merger integration project is a critical exercise: In case of failure it can take down

entire corporations, or at least their management.

Operational Due Diligence: A Primer

This article provides a primer to understanding ODD deeper; the areas and categories will likely need to be modified and adjusted depending on the industry

Cultural Due Diligence: The Underappreciated Tool To Ensure Post-Merger Integration Success

Navigating the complex human dimensions of mergers and acquisitions was long overlooked. But the concept of cultural due diligence is gaining momentum. This article dives

M&A Mavericks: Tuluhan Erdemi – From Corporate M&A to independent consultant

Tuluhan Erdemi, former Head of Corporate M&A at n26 and M&A Manager EMEA at PwC, unpacks his shift into M&A freelancing – and offers a

M&A and Private Equity: the influence of PE in Merger and Acquisitions

We explore the pivotal role of Private Equity in M&A deals, highlighting its influence, dynamics, and impact on the global transaction landscape.

M&A Due Diligence: The Guide

The devil is in the details. Effective Due Diligence can contribute to the best M&A deal outcomes. This guide will explore M&A due diligence and

M&A Trends 2023: Latest Mergers and Acquisition Trends

In this article we explore the latest M&A trends and explore the outlook going forward for M&A.

M&A Process: The Ultimate Guide

This comprehensive guide examines the entire M&A process, looking at its definition and scope, and the various roles and responsibilities involved. It also explores the

Inside Strategy at JobRad, with Holger Tumat

Holger Tumat, CEO, introduces the JobRad Strategy team.

Never Split The Difference: Using FBI Hostage Negotiator Tactics to Close a long-standing & profitable M&A deal

How M&A leaders can learn from FBI hostage negotiation experts to close deals better and more sustainably.

Charting the Course for Decarbonizing Real Estate: Inside Strategy at ista

Michaela Hitzberger, the CTO and Head of Corporate Strategy at ista, shares the excitement and challenges of defining corporate strategies for a rapidly evolving industry.

Understanding IT Services & Software M&A Trends in 2023Q1: An Outlook

The business of mergers and acquisitions (M&A) is cyclical, fraught with highs and lows that often leave market players grappling to plan their next move.

M&A News – 40 Best News Sources For Dealmakers [2023]

There are so many websites to cover M&A news on the internet – so where do you start? We sum up all the most relevant

Inside M&A at… sonnen

sonnen powers the renewable transition. Now, they aim to add anorganic growth to their ambitious strategic initiatives.

How to prepare for a headhunter interview

How do you make a headhunter your ally? Don’t underestimate the interview.

Post-merger Integration: Guide for the first-time buyer

Master the fundamentals of post-merger integration & avoid value loss with our guide for first-time acquirers. Discover best practices, common challenges, and how to create

Navigating family matters, PE and VC investments inside the World of Family Office Management: Jan Voss of BLN Capital

A Look at the Challenges, Rewards, and Insights of Working in the Family Office Space with Jan Voss, an Experienced Family Office Manager

Inside M&A at… JobRad Holding SE

Let’s take a look inside of the M&A department at JobRad Holding SE with Tobias Oeftering, Head of M&A.

The state of the FinTech ecosystem in Germany [Report]

What is the current state of FinTech in Germany?

How to customize your resume

How do you adjust your resume to the job you’re applying for?

Video interviews: tips from the battlefield

A video interview is always better for you than a voice call. You can use your body language, gestures and facial expressions to complement your

Top 20 M&A Consulting Companies (By Deal Count) [2024]

Who are the leading global M&A consulting companies? We went through the deal tables and summarized them in this post.

Inside M&A at… Viessmann Investment

Climate Tech and a family-run business that doesn’t integrate – a formula for M&A success? Timo Tauber, Managing Director at Viessmann Investment GmbH, gives us

Introducing Neo Boutiques: Meet the all-new Fintalent.io talent dashboard

The new platform makes the application process more transparent and allows you to connect with others to form Neo Boutiques.

Equity Waterfalls: 3 Harmful Mistakes to Avoid

Rising private equity fundraising is causing more managers to use complex profit-split structures, known as Private Equity Distribution Waterfalls, which can harm investor-manager relations. Proper

How To Name Your Freelance Business

Is just your name enough? Or do you need to provide a proper company name in order to be taken seriously? Our guest blog gives

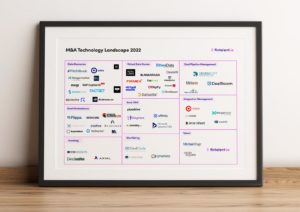

M&A Technology Landscape 2022

Which technology providers move the M&A industry? We’ve collected the first edition of the M&A technology landscape.

Fintech: Exit Checklist for Founders

The time has come to sell your FinTech. But what steps do you have to take to get ready?

Fintech Product-Market-Fit And How To Get There

Fintech has changed banking. But competition is fierce. How can founders still move their Fintech towards Product-Market-Fit?

Comparables valuation: The underestimated secret weapon for tech valuations

Valuations don’t have to be all that complicated. Especially in the tech sector, the comparables valuation is still an underestimated secret weapon.

What Research Says About M&A Synergies

Potential future synergies are the main argument behind many consolidation efforts. But how positive are these synergies when put to the test? In this article,

How To Stand Out As M&A Freelancer: Personal Branding Basics

What is a personal brand, really? And how can I build my personal brand as freelancer to stand out from the rest, and win more

Stop The Snooze: How To Host Engaging Panels In web3

Navigating web3 can be tiring. Can online panels be a successful way to build engagement?

How entrepreneur-first investment banking creates sell-side M&A success

The gap between entrepreneurs and investment bankers is real. So how do we level with entrepreneurs to help them sell their business?

A Corporate M&A Professional’s Biggest Red Flags in Due Diligence

If a deal is too good to be true, it likely is. Melik Salmi, Director Corporate Development & Strategy at SAP, has screened hundreds of

Why M&A Mega-Deals Fail (And How To Avoid It)

We’ve seen how the Musk-Twitter merger saga didn’t play out as planned. But 10% of all large M&A activities suffer the same fate in any

E-commerce Due Diligence: How To Ensure Successful Deals

From DTC to marketplaces and Shopify: E-commerce requires a fundamentally different Due Diligence approach than brick-and-mortar stores. In this article, Max Mishin breaks down the

5 Rules To Keep Your Creativity Alive Next To A Full-Time Job

A common cliche about consultants is that they’re just number-crunchers. They are the exact counterpart to the romantic, free-thinking creatives that we consider artists to

The Buy and Build Checklist – Can we execute it well?

Buy & Build strategies are the fuel for the most successful businesses of our time. But they are only viable for huge corporations with deep

3 Challenges of web3 (And how to fix them)

The web3 community likes to stay within their own bubble. But that creates some real challenges. How can we fix the most urgent challenges of

How ESG is taking over the M&A Process

ESG has become an important consideration in the entire M&A deal cycle. In this article, Dr. Steffen Blase, who’s leading Group M&A at Volkswagen, provides

6 Key Elements To Sell M&A Deals Internally

Internal approval is one of the most overlooked elements of a successful M&A transaction. But how do we get there? Srikanth Malladi lays out the

Practical Guide To Successfully Hire and Leverage Freelancers in M&A Teams

M&A Freelancers can bring your deal sourcing and execution to the next level. But how can you leverage them in the best way possible?

Due Diligence Checklist for India – What you should pay attention to

India boasts the 6th largest GDP of any country in the world, and is projected to soon overtake China as the country with the largest

10k in 37 minutes: How Freelancing changed the life of this Dutch-Kenyan banker

Naomi Roba was on the brink of a successful, traditional investment banking career: ING, Rothschild, Goldman. But why did she choose to be a freelancer

5 Crypto-Takeaways from EtHCC in Paris

What was there to learn from the hottest Ethereum conference this summer? Nadia Sergejuk shares her insights.

The key issues of earn-outs, and how to avoid them

Earn-outs are a popular tool in for structuring M&A deals, and are getting more popular by the year. But they’re not without challenges. So how

4 Key Skills of Corporate M&A Professionals (According to them) [Survey]

What are the core skills that Corporate Development and M&A professionals need to be successful?

Inside M&A: From Origination to Execution [Survey]

How strategic do corporations approach their M&A deal flow? And is M&A crucial for the successful execution of their corporate strategy? We surveyed M&A leaders

Inside M&A: How Corporate M&A Leaders collaborate inside their organization [Survey]

We surveyed our community of Corporate Development leaders about their work. In part 1, we’ll be diving into the inner works of the M&A department.

Salary Guide For Freelance M&A Consultants [Infographic]

Investment bankers demand high salaries. So what happens when they decide to go freelance?

How crypto could turn into a mainstream VC Vertical

VC investments in crypto have gained significant traction. But is it safe to say that they are a mainstream VC vertical, yet?

Best Paying Jobs In Finance: Comprehensive List

The finance industry is renowned for its high-paying jobs and attractive compensation packages. A career in finance can be lucrative, stimulating, and competitive, with roles

How Talent-as-a-Service (TaaS) benefits your M&A team

M&A is too volatile a function to sustainably build a team with all the right skillsets in-house. That’s where Talent-as-a-Service solutions can really shine. Let’s

5 Key Roles Every M&A Team Needs To Fill

Buying or Selling a Business comes with many pitfalls that are avoidable if you have the right roles filled in your M&A team with professionals

Teleworking is a necessity during times of crises

Start Today For a Greate Future

Are fintech startup valuations really that crazy?

Cash seems to pour into fintech startups. But are the high valuations really justified?

The Little Guide on Valuation

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends.That

How to do a Competitive Analysis Right and Pitch.

Tell me about the Background of the Company Does what? Has a market share of? Does it how (capacity, assembly, service, etc)? Sells it how (partners, in-house sales,

Remote M&A Talent-as-a-Service

Changing Working Habits The rapid escalation of COVID-19, resulting in unprecedented levels of social distancing measures, isolation and quarantines, is forcing white-collar employees to work