Raising capital is a critical endeavor for businesses of all sizes and industries. It works as the lifeblood of growth and sustainability of an organization. Capital raising enables companies to seize new opportunities, fuel innovation, and address financial challenges. Without adequate capital, businesses may find it difficult to expand, weather economic downturns, or invest in the resources needed for success.

Capital Raising is a process that includes collecting money from third-party sources outside of your company or customer base. A reliable capital raising advisor can help you do this task more efficiently. So let’s waste no time and explore the right process to hire freelance capital raising consultant best suited to your business.

Why Should You Consider Capital Raising Consulting Services?

There are several compelling reasons why businesses may need to raise capital:

Business Expansion: Companies often require additional capital to fuel their growth. This business expansion can involve expanding into new markets, opening new locations, or increasing production capacity.

Capital for Acquisitions: Mergers and Acquisitions can be a strategic way to enter new markets and gain growth in the business landscape. An organization may need capital to fund the purchase when acquiring another company.

Working Capital: A healthy level of working capital is crucial for day-to-day operations and new product development. You may need capital-raising specialists to help you cover operational expenses, manage cash flow fluctuations, or invest in inventory.

Research and Development: Companies in research-intensive industries often require capital to support ongoing research and development efforts, ensuring they stay competitive and innovative.

Asset Purchasing: Growing businesses need to invest in new properties, plants, and equipment. With the help of capital raising services, these firms can achieve this task quickly.

Market Entry: Expanding into new geographic areas or international markets can be capital-intensive. Capital raising helps businesses adapt to different regulatory environments, consumer preferences, and market dynamics.

Debt Restructuring: In cases where a business’s current debt terms are unfavorable, raising capital can be used to refinance existing debts with more favorable terms, reducing the financial burden.

Crisis Management: In challenging economic times or unexpected crises, businesses may require capital to weather the storm, maintain operations, and preserve jobs.

Innovation and Technology Adoption: Staying competitive in today’s rapidly evolving business landscape often requires investments in cutting-edge technology and innovation, necessitating additional capital.

What Are the Most Effective Capital Raising Methods?

Capital raising depends upon the type and needs of your business. Here are some of the most known methods to raise capital:

Equity Capital Raising:

In this type of capital raising, the company sells its share to the investors. It is like selling off its little pieces to raise capital. The main examples of equity capital raising are:

- Venture Capital: Venture capital consultants help you invest in early-stage companies with high growth potential. They provide capital in exchange for equity ownership.

- Private Equity: Private equity firms invest in reputable and established companies to improve operations and sell the company at a higher valuation. To navigate this intricate landscape, private equity consultant serve as invaluable partners in optimizing strategies and maximizing returns within the private equity domain.

- Angel Investors: These individuals or groups of investors strive to provide funding to startups in exchange for equity. They often bring industry expertise and networks.

- Crowdfunding: There are many platforms you can use for capital raising via crowdfunding. Companies have the option to secure capital by persuading a significant number of individuals to invest.

Debt Capital Raising:

In this method, companies take loans from third-party entities and return them on specific terms. Examples of Debt Capital Raising Include:

- Bank Loans: Traditional loans from banks and financial institutions can be used for various purposes, such as working capital, real estate purchases, or equipment financing.

- Corporate Bonds: Firms issue bonds as a means of raising capital. Therefore, to receive periodic interest payments and the return of the principal amount when the bonds mature, Investors acquire these bonds.

- Alternative Lenders: You can also use online lenders and peer-to-peer lending platforms to raise capital for your business. This option comes with more flexible terms and faster approval processes.

Initial Public Offering (IPO)

Companies can go public by offering shares to the public through an IPO. This effective method allows them to raise substantial amounts of capital from a wide range of investors. If you’re considering publicizing your company, an IPO consultant provides invaluable insights to ensure a successful Initial Public Offering.

Strategic Partnerships

Collaborating with established companies can provide access to capital, resources, and distribution networks. These partnerships can involve joint ventures, licensing agreements, or strategic investments.

Asset Sales

Selling non-core assets or subsidiaries can generate capital for the business. This is especially useful when a company wants to streamline its operations.

Convertible Debt

Companies have the option to issue convertible debt, which initially functions as a loan but have the potential to be transformed into equity at a later stage, typically upon the company reaching a specific valuation or achieving a significant milestone.

Bootstrapping

While not a traditional method of raising capital, bootstrapping involves using a business’s own resources and profits to fund its operations and growth. This method avoids taking on external debt or equity partners.

Revenue-Based Financing

Some companies opt for revenue-sharing agreements in which they receive capital in exchange for a percentage of future revenues.

What Skills Should You Look for in a Capital Raising Advisor?

Industry Knowledge: Look for a consultant with a deep understanding of your specific industry. Their industry expertise is essential for tailoring capital raising strategies to your sector’s unique dynamics and opportunities. A reliable capital raising specialist should also be able to provide due diligence consulting to help businesses understand the latest trends.

Financial Acumen: The consultant should have a strong command of financial concepts, including financial modeling, valuation, and risk assessment. This expertise will help in structuring financial documents and negotiating terms effectively.

Network and Connections: A well-connected consultant can provide access to potential investors, lenders, and strategic partners, increasing your chances of successfully raising capital.

Track Record: Prior success in raising capital for businesses similar to yours is a critical indicator of a consultant’s effectiveness. Request references and assess their past performance to ensure a solid track record.

Communication Skills: Effective communication is crucial for presenting your business to potential investors and lenders. A consultant with strong communication skills can make a compelling case for your capital needs.

Negotiation Skills: A consultant should be skilled in deal structuring and contract negotiations. The ability to secure favorable terms with investors or lenders is essential for a successful capital raising process.

Steps to Follow While Hiring a Freelance Capital Raising Services:

When hiring a freelancer for Capital Raising services, it’s essential to bear in mind various crucial factors and follow specific steps to make the most informed choice:

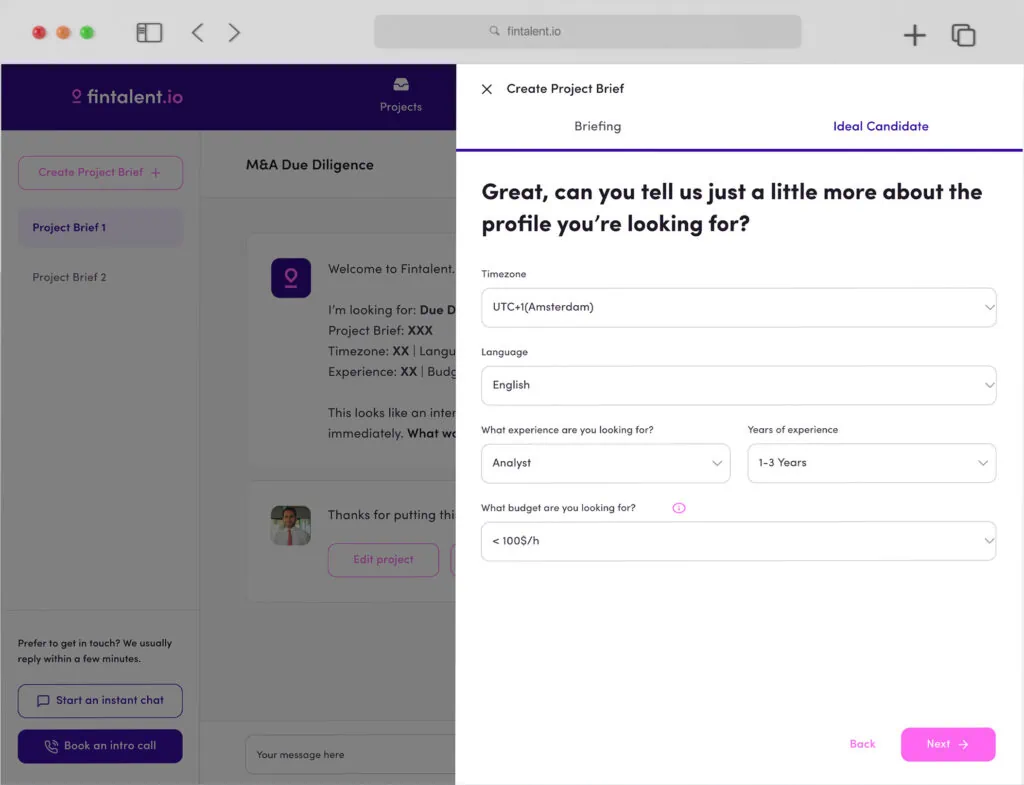

- Define Your Needs: Before you initiate the hiring process, clearly define your capital raising needs. Determine the amount of capital required, the purpose of the funds, and the timeline for the project. Having a well-defined scope will help you identify the right consultant.

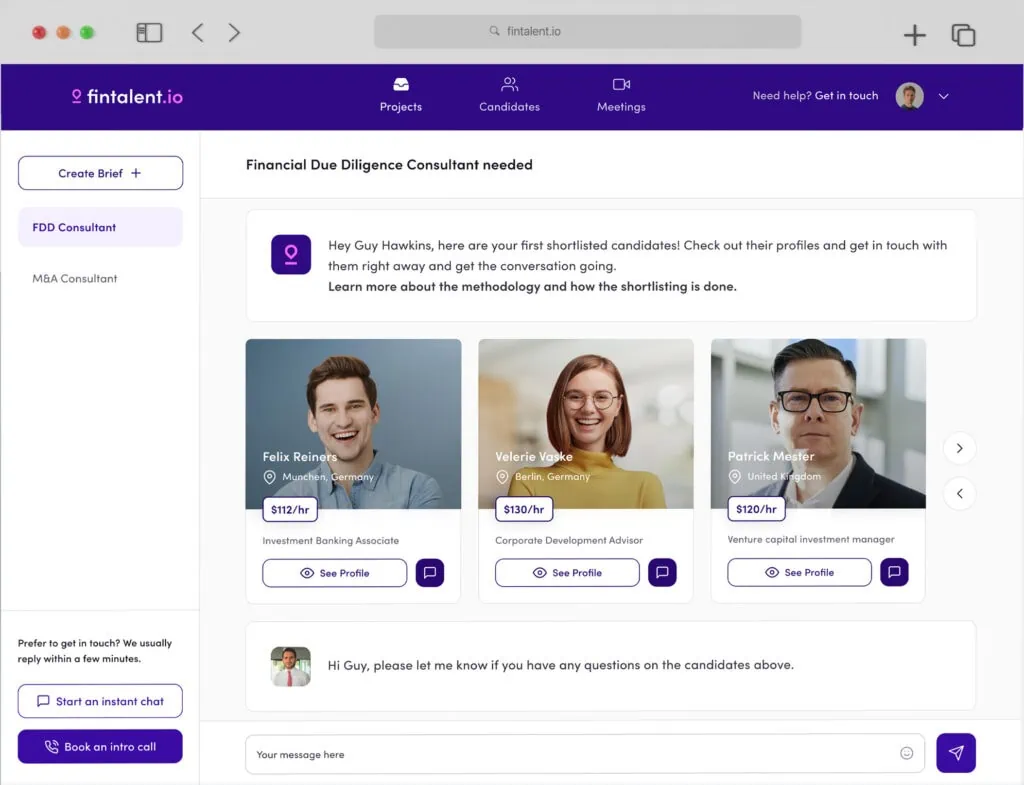

- Conduct a Thorough Search: Start by conducting a comprehensive search for potential consultants. You can explore freelancing websites, industry-specific forums, and professional networks. Personal referrals from trusted sources can also be valuable.

- Review Credentials and Track Record: Assess the credentials, experience, and track record of each consultant. Look for evidence of successful capital-raising projects and their ability to work with businesses in your industry or at your growth stage.

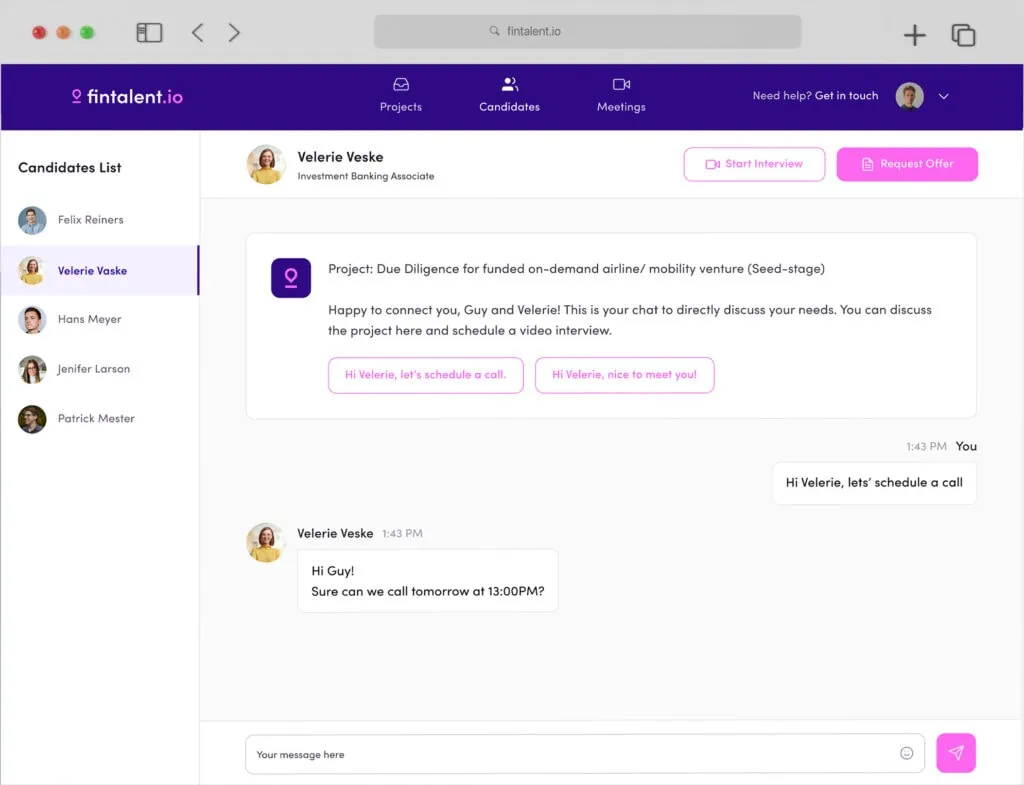

- Conduct Interviews: Interview potential consultants to gauge their expertise, communication skills, and understanding of your business. During the interview, ask about their approach to capital raising and their strategy for your specific needs.

- Check References: Request and contact references from previous clients. Inquire about the consultant’s performance, their ability to meet goals, and their professionalism during the engagement.

- Evaluate Fees and Contracts: Carefully review the consultant’s fee structure. Understand whether they charge a percentage of funds raised, a flat fee, or a combination of both. Ensure that the contract terms are clear and align with your expectations.

- Confirm Availability: Ensure that the consultant has the availability to dedicate the necessary time and effort to your project. A busy consultant may not provide the attention your capital raising effort requires.

- Consider Compatibility: Building a positive working relationship is crucial. Ensure that you and the consultant have good chemistry and can collaborate effectively.

- Set Clear Goals and KPIs: Establish clear goals and key performance indicators (KPIs) for the capital raising project. This will help both you and the consultant track progress and measure success.

- Finalize the Agreement: Once you’ve selected a consultant, finalize the agreement with clear terms and expectations. Ensure all parties are on the same page regarding the scope of work, deliverables, and payment terms.

Conclusion:

In conclusion, hiring the right freelance Capital Raising Consultant is a crucial step in securing the necessary funds for your business’s growth and success. By defining your needs, conducting a thorough search, and following a systematic approach, you can identify a consultant with the skills and experience necessary to navigate the complexities of capital raising. Remember that the right consultant will not only help you raise the capital you need but also provide valuable insights and strategies to optimize your business’s financial future. With the right consultant by your side, you can take your business to new heights.