What is a Pre-IPO?

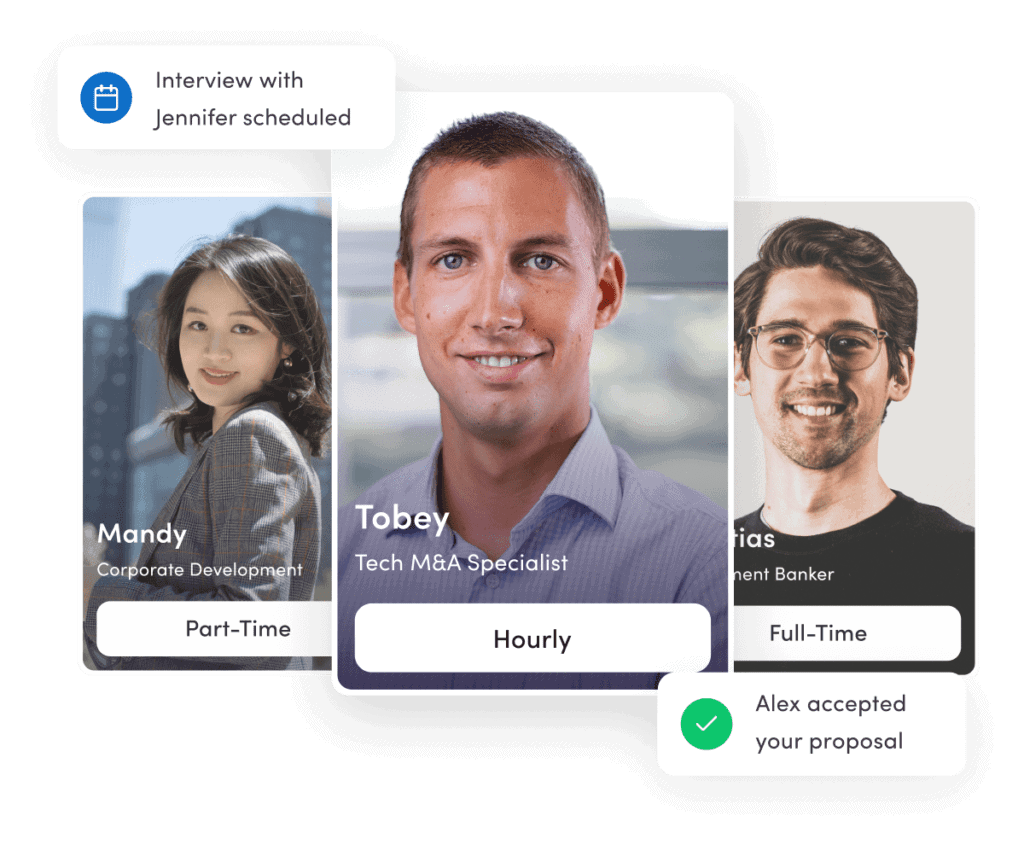

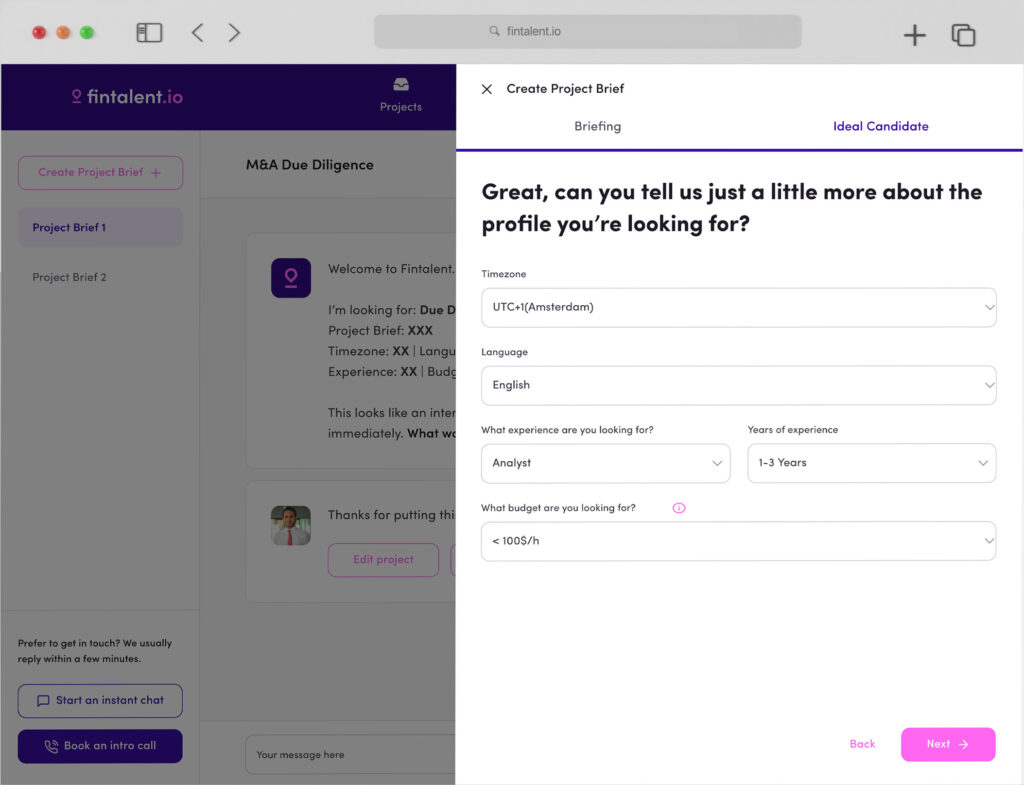

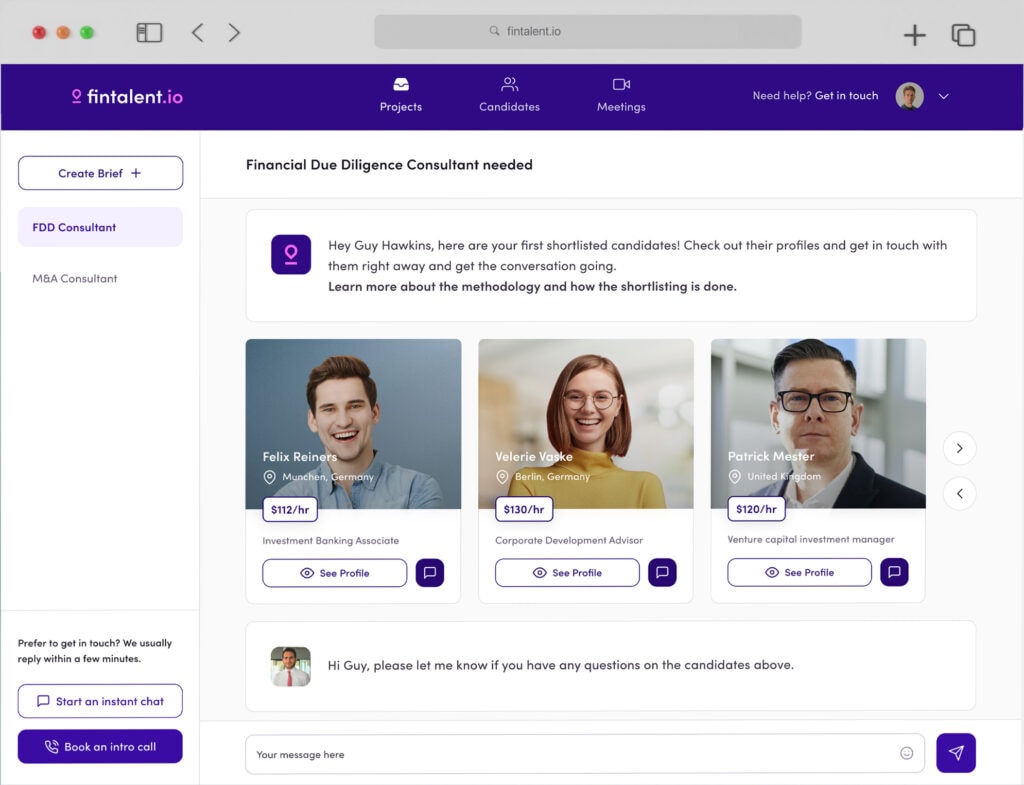

A Pre-IPO, also known as “pre-listing”, is when a company in the initial stages of development announces that it will go public in the near future. This means that they are selling shares to the public before their official offering. This may be followed by an IPO or initial public offering (IPO) depending on how well it goes. The most notable Pre-IPO companies include Facebook, Google, and Amazon. Fintalent, the hiring and collaboration platform for tier-1 Strategy and M&A Professionals has a large pool of Freelance Pre-IPO Consultants available to help new businesses raise desired capital. In this piece, we share some insights from Fintalent’s Freelance Pre-IPO Experts and Capital Raising consultants.

How do Pre-IPOs Work?

A company can announce its intention to sell shares through an SEC Form 10 (or S1 if it’s filed with the Securities and Exchange Commission) called a Preliminary Offering Circular. The company can raise funds by giving out stock to private accredited investors (that is, those who are qualified to buy stocks either because they make high incomes or have high levels of assets) at discounted prices before listing on an exchange.

When the price is listed on an exchange, it’s done with a ticker symbol, which is how stocks work. This means that when you hear someone say “XCOM shares spiked today,” it means something about the valuation of the company based on its share price. In this case, it means the stock went up in value from what it was before.

Pre-IPOs are often used to help companies better execute their road map, revenue goals, and marketing strategies. This is because the company can use this extra capital to advertise themselves and raise awareness about their product or service. Pre-IPOs are sometimes used as a way to reward employees who invested in the company early on by allowing them to purchase discounted shares before it goes public. One of the most notable examples of this was with Facebook employees who were able to purchase the stock for $18 per share before it went public for $30 per share.

The companies that engage in this process hope that by attracting larger investments during this phase of development they will expand their customer base and be able to make more revenue after going public. To protect the company from overexposure and prevent a drop in value, a Pre-IPO is a limited time period.

IPO Vs Pre-IPO

The main difference between an IPO and pre-IPO is that during the pre-IPO process only accredited investors are allowed to purchase stock, whereas anyone can purchase stock during an IPO. The companies that go through the pre-IPO process give investors a chance to benefit from their business during an early stage. This also gives the company more money to expand and make more profit, thereby helping the company grow and become more profitable as time goes on.

The most common way for companies to go public is through an Initial Public Offering (IPO). Listed below are characteristic features of a pre-IPO, an IPO and a stock exchange.

Characteristic Features of an IPO, Pre-IPO and Stock Exchange:

Company Type:

1) Company goes public via IPO – Investors purchase shares of the company with the anticipation that the company’s business will grow and produce stockholder value.

2) Company begins Pre-IPO – A company begins to offer its shares on the market to accredited investors with the anticipation that their business will grow and produce shareholder value.

3) Stock Exchange – Shares of companies listed on a stock exchange are available for purchase by the general public at anytime.

Shares:

1) Company goes public via IPO – Shares of stock in a company listed on the company’s prospectus.

2) Company begins Pre-IPO – Shares of stock in a company listed on the company’s prospectus.

3) Stock Exchange – Shares of stock in companies listed on that stock exchange.

Price:

1) Company goes public via IPO – A set price for shares during its opening day. This can be higher than anticipated and cause people to buy immediately and lose money if they bought on the first trading day.

2) Company begins Pre-IPO – A set price for shares during its opening day. This can be higher than anticipated and cause people to buy immediately and lose money if they bought on the first trading day.

3) Stock Exchange – The price is determined by supply and demand based on how many shares are available and how many people want to buy them.

4) Money made from stock exchange – If you sell a share, you can make a profit or a loss based on supply and demand of that share. The more popular the company, the more expensive the share becomes.

Amount of Shares:

1) Company goes public via IPO – A predetermined amount of shares. The company offers more shares during the process to create more revenue.

2) Company begins Pre-IPO – A predetermined amount of shares. The company offers more shares during the process to create more revenue.

3) Stock Exchange – Only as many as people are willing to purchase so their price does not change significantly.[6]

Current State:

1) Company goes public via IPO – The company’s business is being run efficiently and their business plan is being followed closely by its employees

2) Company begins Pre-IPO – The company’s business is being run efficiently and their business plan is being followed closely by its employees.

3) Stock Exchange – The company’s business is being run efficiently and their business plan is being followed closely by its employees.

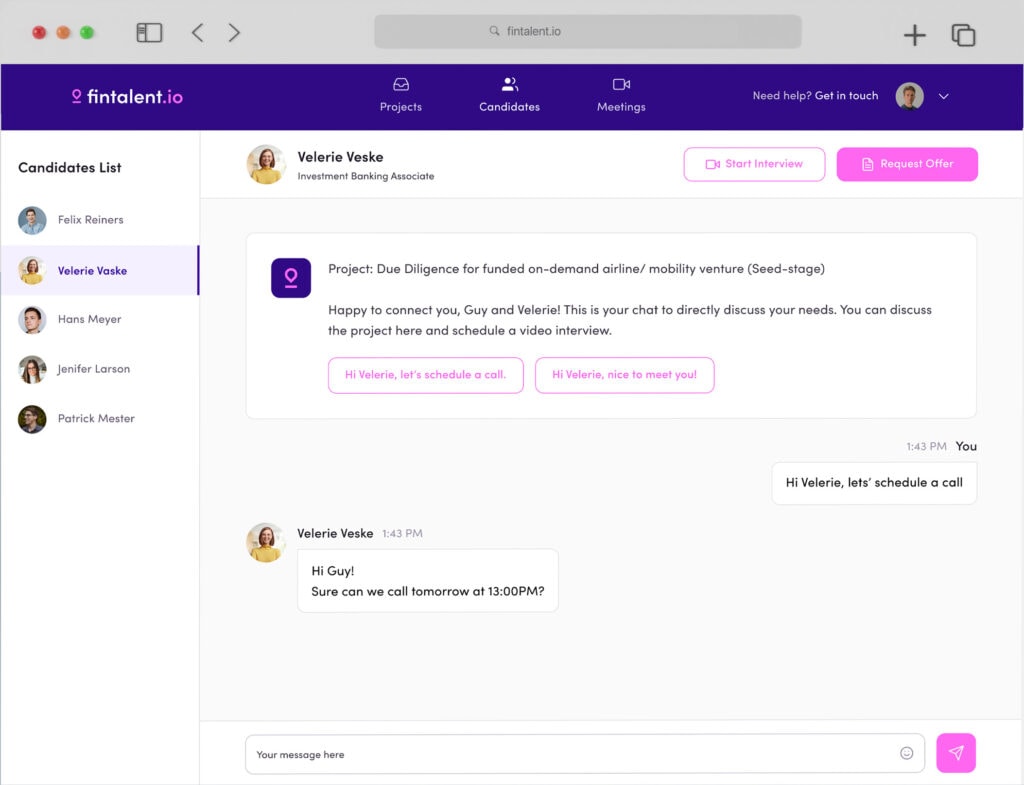

How Can Freelance Pre-IPO Consultants Help Your Business?

They key to investing in Pre-IPO advisory services is to do your research before you invest to ensure that it’s worth the risk. If you aren’t investing at the earliest opportunity that the company provides, then you may miss out on some of the potential rewards it could offer. Fintalent’s freelance Pre-IPO consultants can help you carry out the required research and advise on the best place to invest your money. For organizations considering making private or public offers, Fintalent’s Freelance Pre-IPO Consultants can help you meet both the regulatory and ethical requirements needed for a listing while also helping to see out the process.