What is Investor Relations?

The definition for “investor relations” varies depending on the context of the discussion. In general, however, it refers to activities undertaken by companies primarily with a focus on communicating with stockholders and other stakeholders through financial reports, public events and shareholder communications.

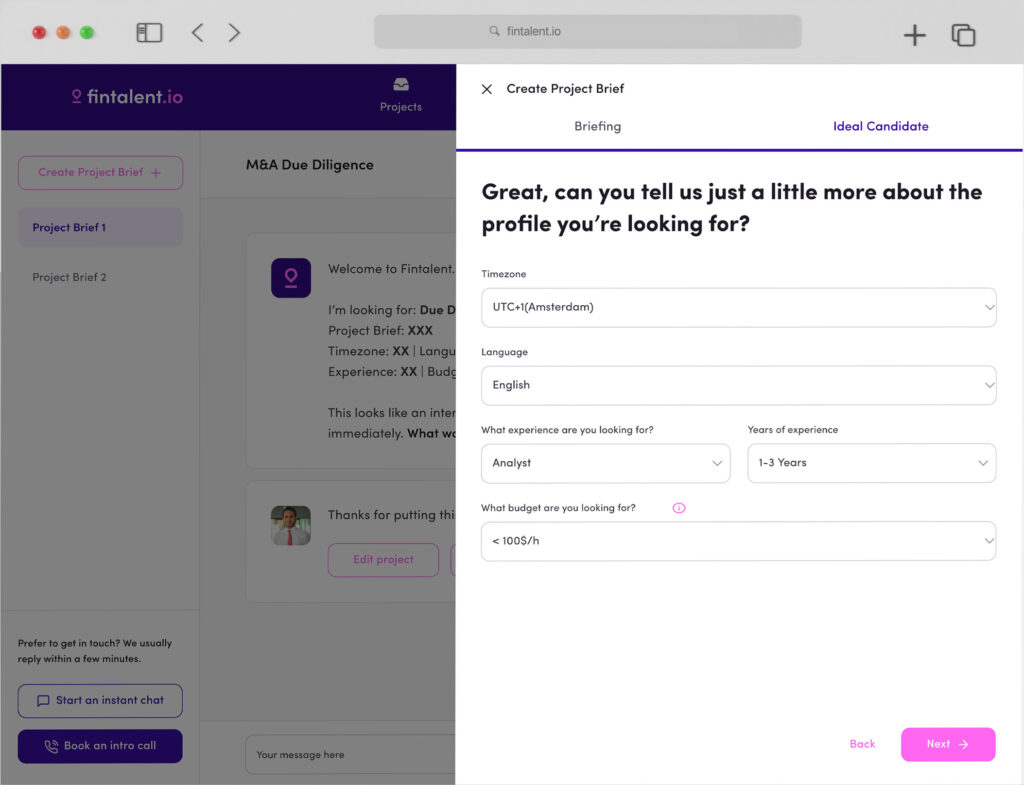

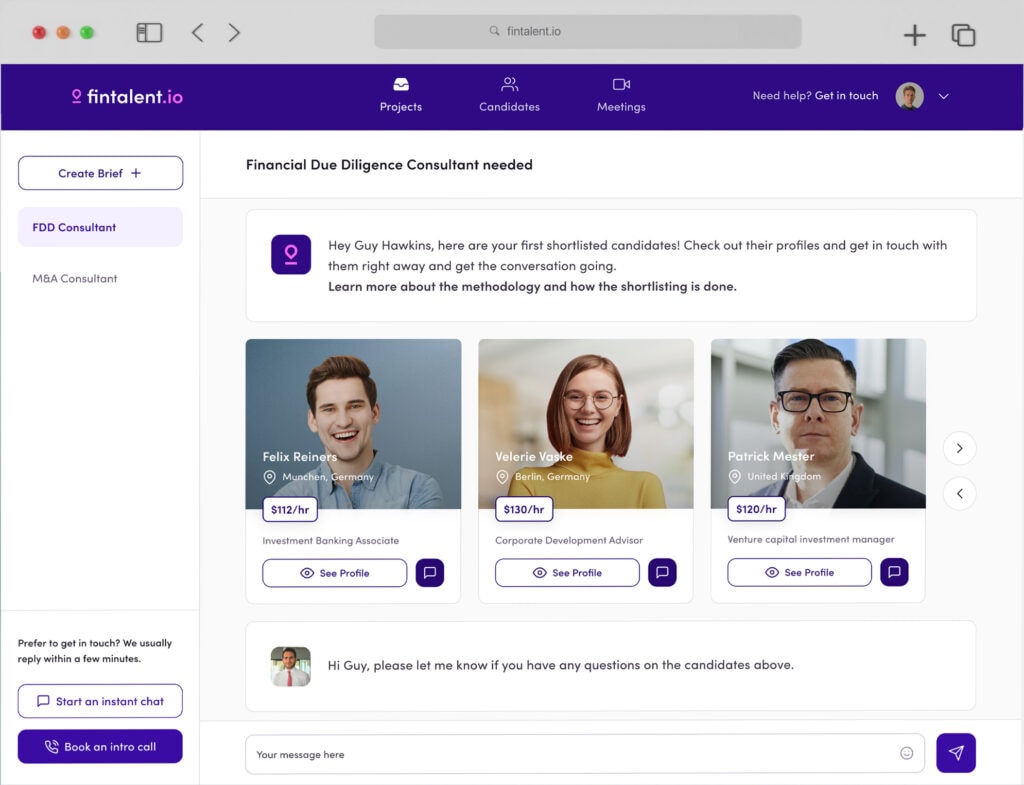

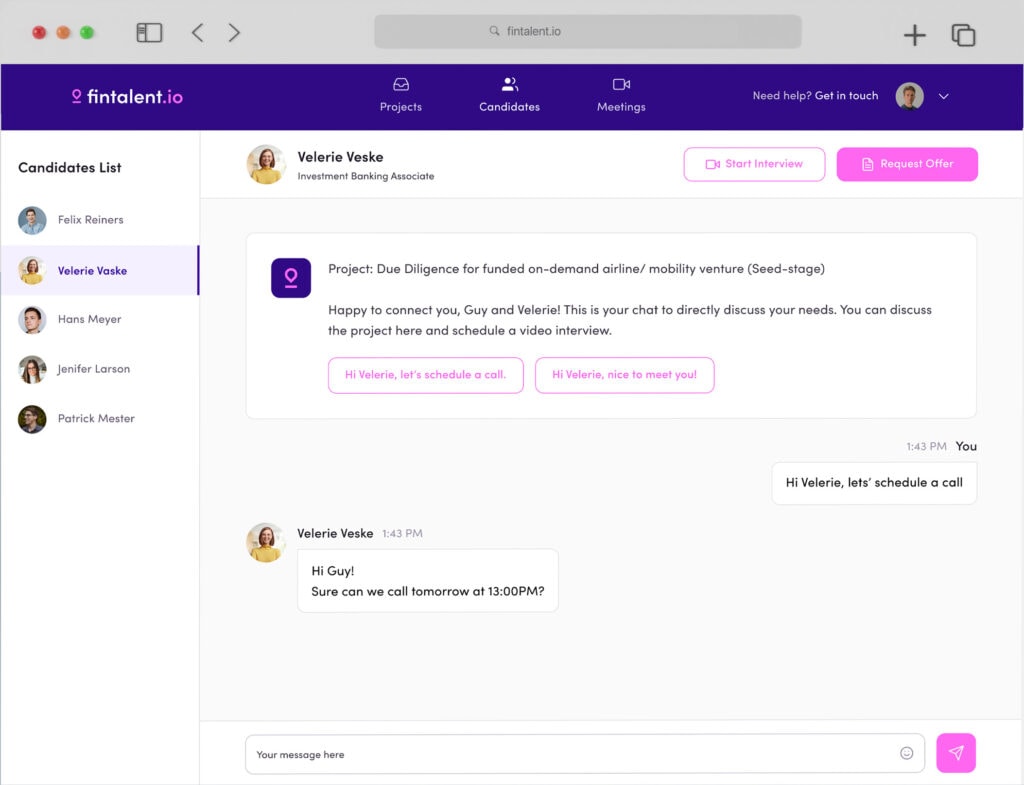

As noted by Fintalent’s Investor Relations Consultants, this is an inherently complex activity since there are multiple ways in which organizations involved in investor relations can engage with these stakeholders including offering educational materials and providing data via public disclosure channels. This article will highlight some of these key practices identified within the space while exploring how they impact companies’ bottom lines.

Investor relations is a broad term that encompasses several different practices some of which are not directly related to investor communications. Corporate communication is the overall process that companies use to communicate with the public, including stockholders and the financial community. Typically this involves: Media relations (e.g., press releases, analyst calls, shareholder meeting communications) Financial reporting (e.g., quarterly earnings reports, proxy statements, 10-K’s) Government affairs (e.g., lobbying for favorable legislation in Washington) It also incorporates activities that are not specifically investor oriented but often serve as foundational steps for other efforts such as: Strategic planning (e.g. lead-in to Q3 earnings call) Crisis management (e.g. in the case of a major cyber breach).

Both corporate communications and investor relations are typically conducted by members of the Investor Relations (IR) team. In situations where the team is relatively small, the IR professional is simply tasked with communicating with both investors and non-investors. Where the team is larger, it could be split into two separate departments: corporate communications and investor relations.

Organizing as such can help to clarify responsibilities in terms of time management, resource allocation, internal reporting and performance evaluation. However, in some companies these departments are combined anyway so it may not make a major difference in practice.

Types of Disclosures

Within the investor relations field, all public disclosures can be divided into three categories:

Earnings releases: A report about a company’s financial performance for a specific period. Its purpose is to communicate key metrics (e.g., sales, earnings, cash flow) and related information (e.g., outlook and guidance) to relevant parties including investors, the media and employees. Earnings announcements typically result in positive gains in stock prices, particularly if they are perceived as positive surprises (i.e., when their results outperform expectations). However, if they are perceived as negative surprises or if they turn out to be inaccurate then stock prices are likely to fall quickly after their release.

A report about a company’s financial performance for a specific period. Its purpose is to communicate key metrics (e.g., sales, earnings, cash flow) and related information (e.g., outlook and guidance) to relevant parties including investors, the media and employees. Earnings announcements typically result in positive gains in stock prices, particularly if they are perceived as positive surprises (i.e., when their results outperform expectations). However, if they are perceived as negative surprises or if they turn out to be inaccurate then stock prices are likely to fall quickly after their release.

Annual reports: An annual report that summarizes the past year’s financial activity of a public company, typically focused on financial statements on a GAAP basis. It includes financial metrics, executive summaries and strategies for the upcoming year. The report is typically released in the fall of each year.

An annual report that summarizes the past year’s financial activity of a public company, typically focused on financial statements on a GAAP basis. It includes financial metrics, executive summaries and strategies for the upcoming year. The report is typically released in the fall of each year.

News releases: A communication that is issued by a company’s CEO or other officers to announce an event, issue or issue resolution (such as a legal settlement). Its purpose is to provide timely information to shareholders and other stakeholders. Its content usually comes from various sources such as press releases and “marketing materials.” Press releases typically contain key information that is of critical importance to stakeholders.

In addition to the above disclosures, companies also issue other types of disclosures such as corrections of errors in earnings reports and related news releases and other forms of announcements.

Other additional types of Investor Relations Include:

Press release: A communication that provides an update about a company’s recent activities. While press releases can be issued on any subject (e.g., announcing a product launch, changes in the executive team or corporate structure), their primary focus is on financial performance and corporate strategy issues. They are becoming more commonly used as the place where companies first announce financial results and regulatory filings (such as quarterly earnings reports, stock offerings and asset sales).

A communication that provides an update about a company’s recent activities. While press releases can be issued on any subject (e.g., announcing a product launch, changes in the executive team or corporate structure), their primary focus is on financial performance and corporate strategy issues. They are becoming more commonly used as the place where companies first announce financial results and regulatory filings (such as quarterly earnings reports, stock offerings and asset sales). Presentations: A presentation by management to a group of investors or media representatives to communicate key aspects of the business to them. Its purpose is to educate them about the company’s prospects, strategies, its operations and related matters.

A presentation by management to a group of investors or media representatives to communicate key aspects of the business to them. Its purpose is to educate them about the company’s prospects, strategies, its operations and related matters. Internal Communications: A communication that is sent internally within the company with the objective of providing information to its employees. Like external communications, internal communications are also organized into several categories: Annual reports: An annual report that summarizes a public company’s activities during the past year and summarizes key financial data regarding its performance and outlook for future growth. It typically contains a rundown of recent developments (including mergers and acquisitions), operational highlights (such as customer wins), financial data (e.g., sales figures) and industry trends. Newsletters: A communication that is sent to employees on a periodic (e.g., monthly or quarterly) basis, which contains information about a wide range of topics such as recent developments, performance metrics and future plans. It contains some written content (such as articles) but it relies heavily on graphics and other elements, such as video. Webcasts: A webcast is a live or pre-recorded audio-visual presentation (such as a slide show) that can be viewed via the Internet. It is usually used to deliver key information to employees at their convenience.