Hiring a capable CFO consultant is crucial to making well-informed decisions that positively impact your company’s financial future. They can help your organization navigate complex finance & accounting processes and make plans to increase profit while mitigating risks.

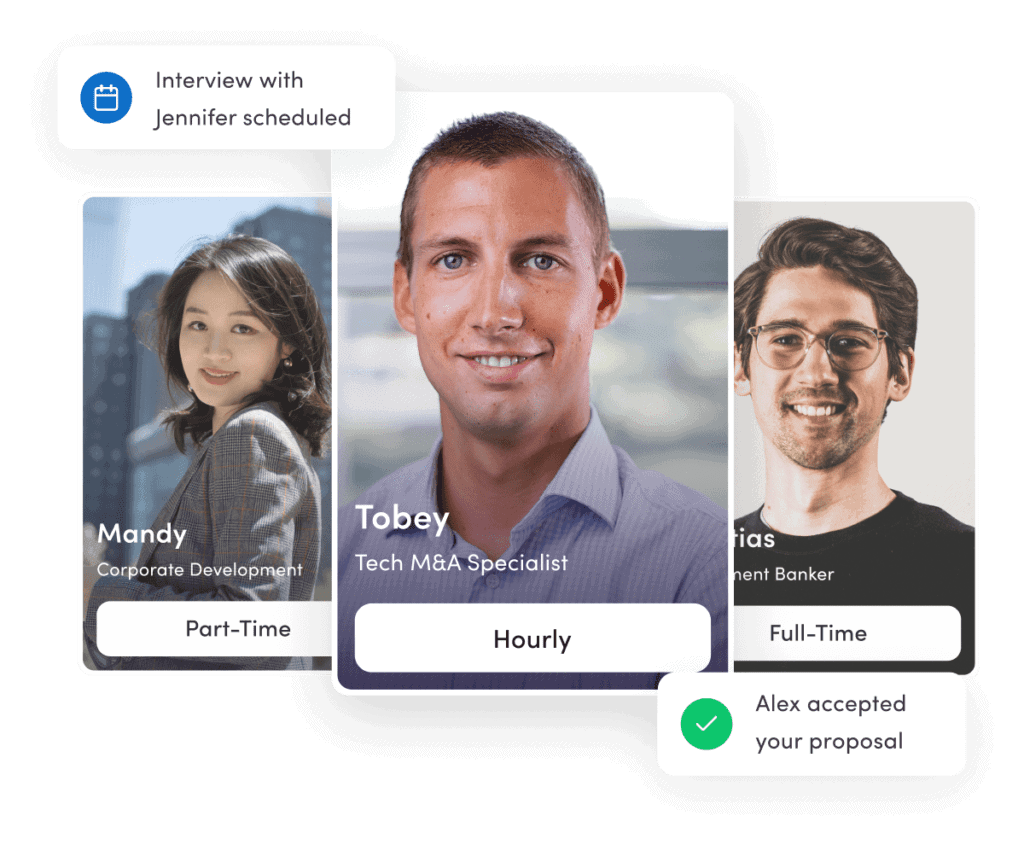

But the problem is in numbers! We connect you with 3,000+ skilled Chief Financial Officer consultants. So, join us as we assist you in understanding the role of these professionals in your business and the proper process to hire CFOs.

What is a CFO Consultant?

A CFO or Chief Financial Officer Consultant is an experienced finance executive who offers strategic guidance and services to businesses. They work on a temporary or part-time basis. These consultants provide expertise in financial matters, make strategies, and offer insights to improve the financial health of an organization. CFO advisors commonly address specific economic challenges, lead financial projects, or assist companies in need of senior financial leadership on a short-term basis.

Roles and Responsibilities of CFO Consultants:

- Financial Strategy: Your chief financial officer consultant can provide their expertise in financial strategy consulting and make plans that align with your company’s goals.

- Financial Management: They also oversee financial operations and provide budgeting & forecasting advisory to ensure financial health and sustainability.

- Risk Management: During business deals and financial operations, CFO consultants can identify and mitigate financial risks to prevent any kind of loss.

- Cash Flow Management: freelance CFO services include managing cash flow, working capital, and financial resources.

- Financial Reporting: They ensure accurate and timely financial reporting, often including preparing financial statements and reports for stakeholders.

- Capital Management: They help with decisions regarding capital structure, funding, and investment strategies.

- Mergers and Acquisitions: Companies undergoing mergers & acquisitions or divestitures need an expert to manage their financial processes. A CFO Consultant can provide expertise in M&A consultancy and financial due diligence advisory for effective deal structuring.

- Compliance: They ensure that the company complies with financial regulations and legal reporting requirements.

- Financial Technology (FinTech): They may assist in the implementation of financial software and technology systems to streamline financial processes.

- Cost Optimization: A good CFO advisor also plays a crucial role in identifying opportunities for cost reduction and operational efficiency.

- Capital Raising: These professionals can also help with fundraising strategy consultancy and investor relations advisory required to strengthen your ongoing and upcoming projects.

These Consultants are normally hired to provide financial expertise without needing a full-time CFO. They can be particularly valuable to startups, small and medium-sized enterprises, or companies undergoing significant financial changes or challenges. Their insights and expertise help businesses make informed decisions and navigate complex financial situations. So,

What Are the Characteristics of a Quality CFO Consultant?

- Broad Experience: A quality CFO Consultant possesses a rich and diverse background in finance, having worked in various financial roles and industries, which equips them with a wide range of experiences to draw upon in their consulting role.

- Industry Knowledge: They demonstrate a deep understanding of the specific industries they serve, allowing them to tailor financial strategies to industry-specific challenges and opportunities.

- Technical Knowledge: In today’s technology-driven world, CFO Consultants should be proficient in financial software, analytics tools, and emerging financial technologies, ensuring efficient financial management.

- Leadership Ability: They exhibit strong leadership skills, guiding finance teams and organizations to success, particularly during times of financial transformation or crisis.

- Communication Skills: Effective communication is a hallmark of quality CFO Consulting experts, as they can translate complex financial data into clear, actionable insights for non-financial stakeholders.

- Problem-Solving Skills: They excel at identifying financial challenges and implementing innovative solutions, contributing to the organization’s financial health and sustainability.

- Risk Management Ability: A quality consulting CFO is adept at assessing and mitigating financial risks, protecting the organization from adverse financial outcomes. Hire CFOs who possess a strong ability to manage processes with minimum or no risk.

- Connections Making: They often have an extensive network of contacts in the financial and business world. It can be valuable for accessing resources, sharing best practices, and staying informed about industry trends and opportunities.

Full Time vs. Freelancer CFO Consultant

Full-Time CFO – A full-time or in-house CFO is a financial executive who works for the company as an employee. Organizations hire them for an extended period of time on a salary basis.

CFO Consultant – A freelance CFO consultant is a professional who works for a company for a limited time period. They provide guidance and make strategies to enhance the financial health of an organization. Companies can hire them as Interim CFOs or Fractional CFOs.

- Interim Chief Financial Officers – Interim CFO Consultants work for a particular time period, especially during the transition of a full-time CFO or financial crisis.

- Fractional Chief Financial Officers – Fractional CFO Consultants work on a part-time basis and are hired to build up specific financial functions.

Qualifications and Official Background of a CFO Advisory Candidate

Education: The minimum requirement for a freelancer CFO consultant is a bachelor’s degree in finance, accounting, or business administration. Some candidates also come with advanced degrees that can provide a deeper understanding of financial management and strategic planning.

Professional Certifications: Some high-profile CFO advisory candidates come with special certifications like CPA, CFA, and CMA. These certifications ensure that your candidate is an expert in their field.

Extensive Experience: Successful CFO consultants usually have a track record of working in senior financial roles within various organizations. They may have held positions such as Controller, Finance Director, or provided CFO consulting services in different industries with at least 8-10 years of experience.

Strategic Financial Planning: They should have experience in strategic financial planning, budgeting, and forecasting. This includes the ability to develop financial strategies that align with an organization’s goals and drive growth.

Regulatory Compliance: A deep understanding of financial regulations and compliance is crucial, as they must ensure that the organization adheres to relevant financial laws and standards.

How to Check the Freelancer CFO Consultant’s Work Quality?

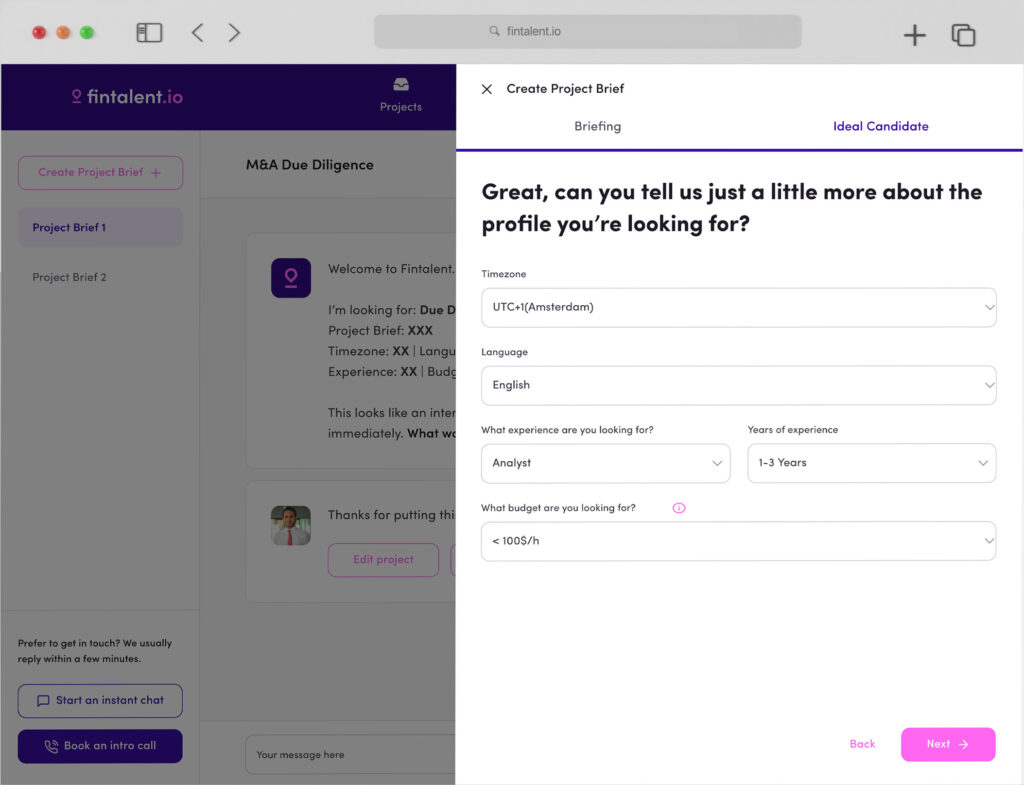

Freelancers usually connect with you online. So, it becomes highly important to evaluate the work quality of your consultant. It will help you ensure that the CFO advisory candidate can manage your financial process and your business is in good hands.

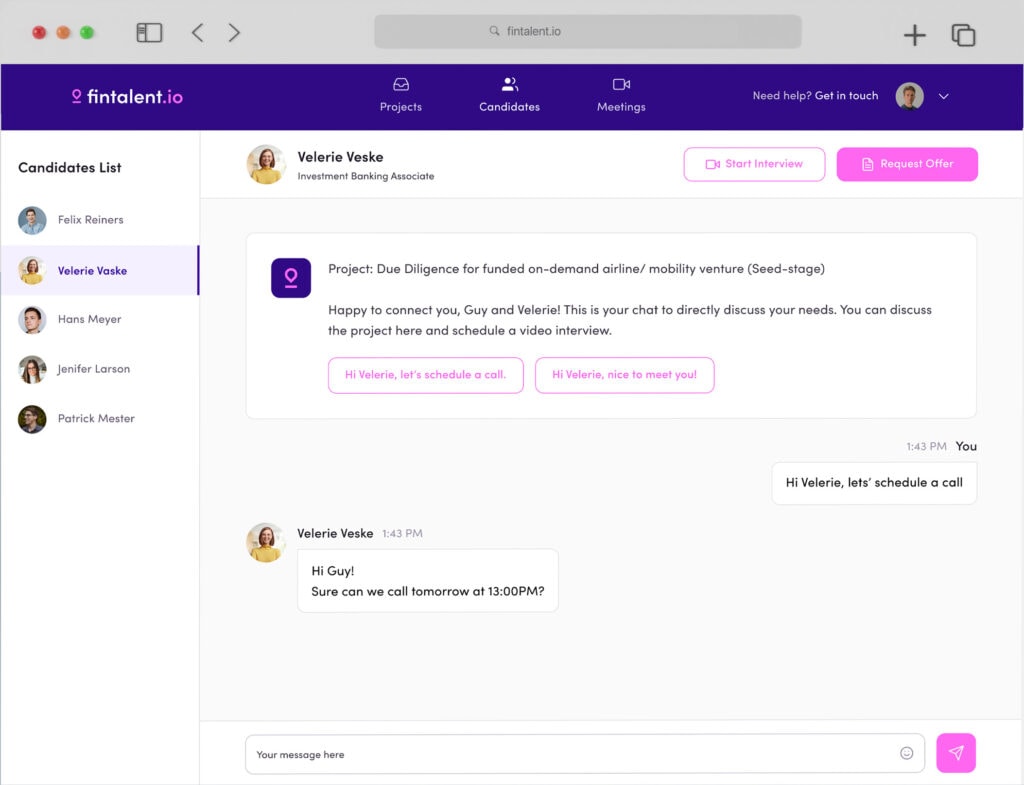

The simplest thing you can do is to check client testimonials and reviews on the freelancer’s profile. You can also get in touch with freelancer CFO’s previous clients to know more about their work approach. Ask the client about the result quality, ability to meet deadlines, and communication skills of the freelancer. You can also ask the candidate to share case studies and project samples to have a closer look at their work style.

Conclusion

In summary, a CFO consultant plays a pivotal role in optimizing your business’s financial health and strategic planning. Whether you hire CFOs on a full-time basis or as a freelancer, the decision should align with your organization’s unique needs. Ensure your selected consultant possesses a solid educational background, relevant certifications, extensive experience, and a deep understanding of financial regulations. Your business can achieve financial success and long-term growth with the right freelance chief financial officer consultant on your side. Sign up and Hire now!