When two companies decide to merge or acquire one another, it can be difficult to read the financial statements of each company. One reason is that they may report using different accounting methods and formats. For example, one company might use cash based accounting while the other uses accrual based accounting. As such, even if they are using the same accounting principles, if they differ on reporting certain transactions then there will be differences in their results. The discrepancies in accounting between the companies can be very difficult to overcome and can cause serious problems for the merger or acquisition.

Accounting is a field of business that encompasses one of the most important parts of any company: money. Generally speaking, accountants manage money with three objectives: first, they keep track of the company’s cash flow; second, they record transactions; third, they analyze data to give management insight into trends and patterns over time . Accounting is important because it provides a picture of the financial health of a company. It helps management make decisions such as what job to lay off employees and whether or not to take on more debt.

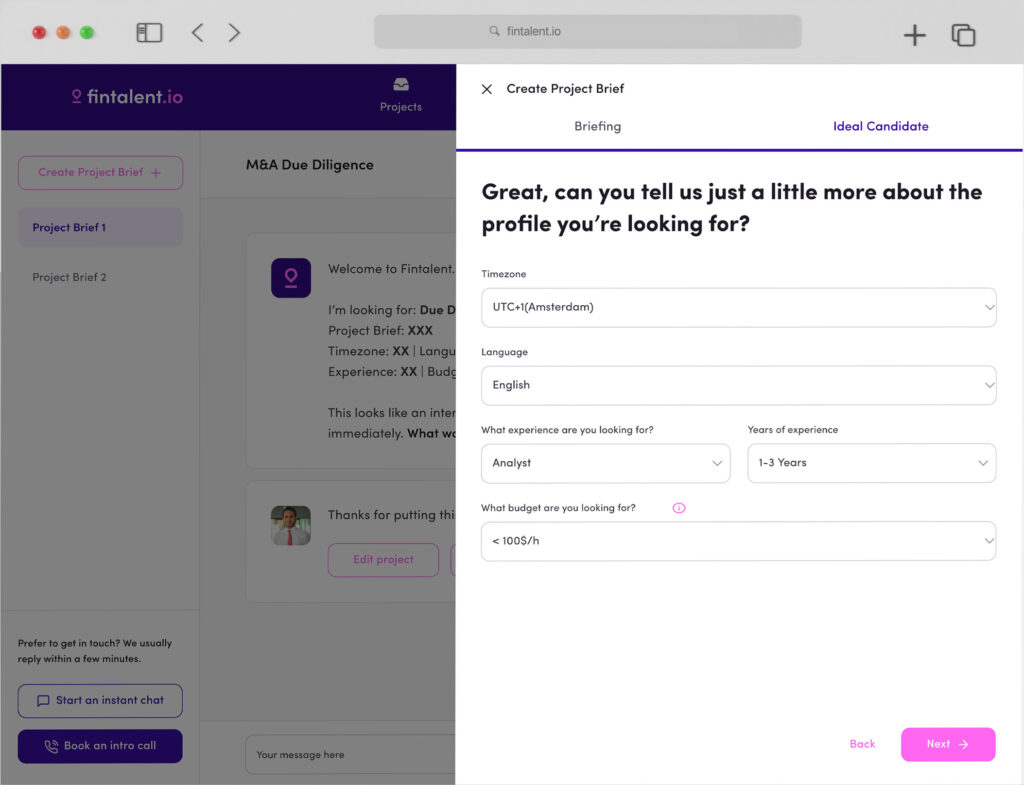

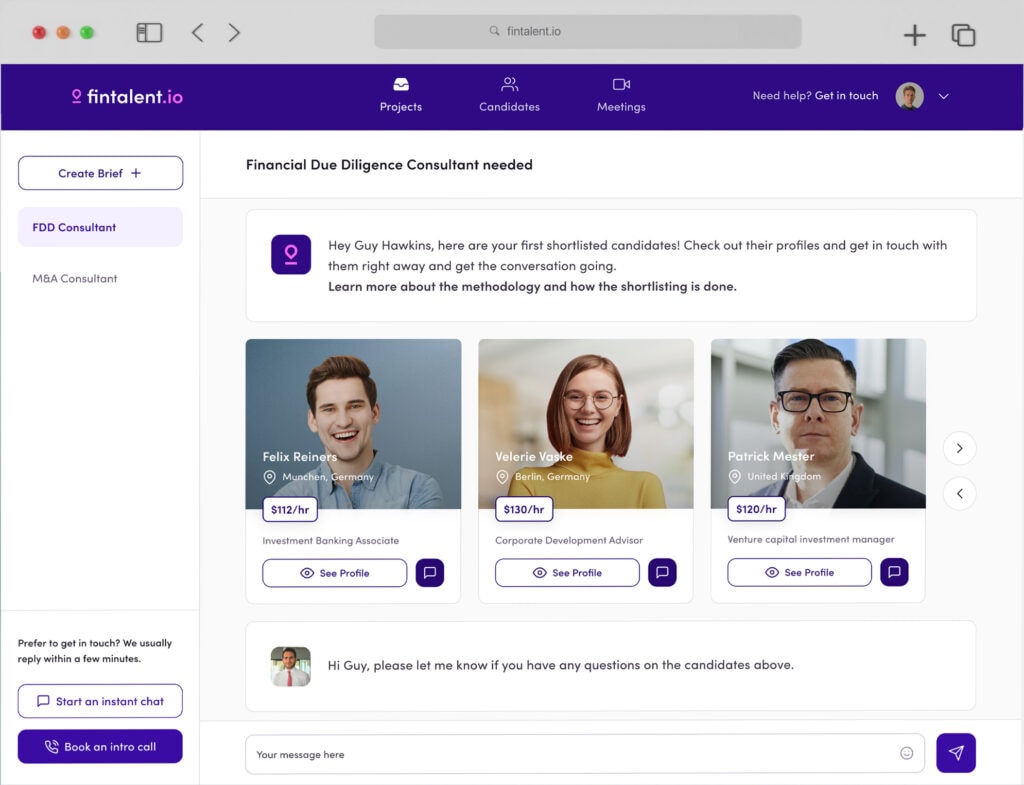

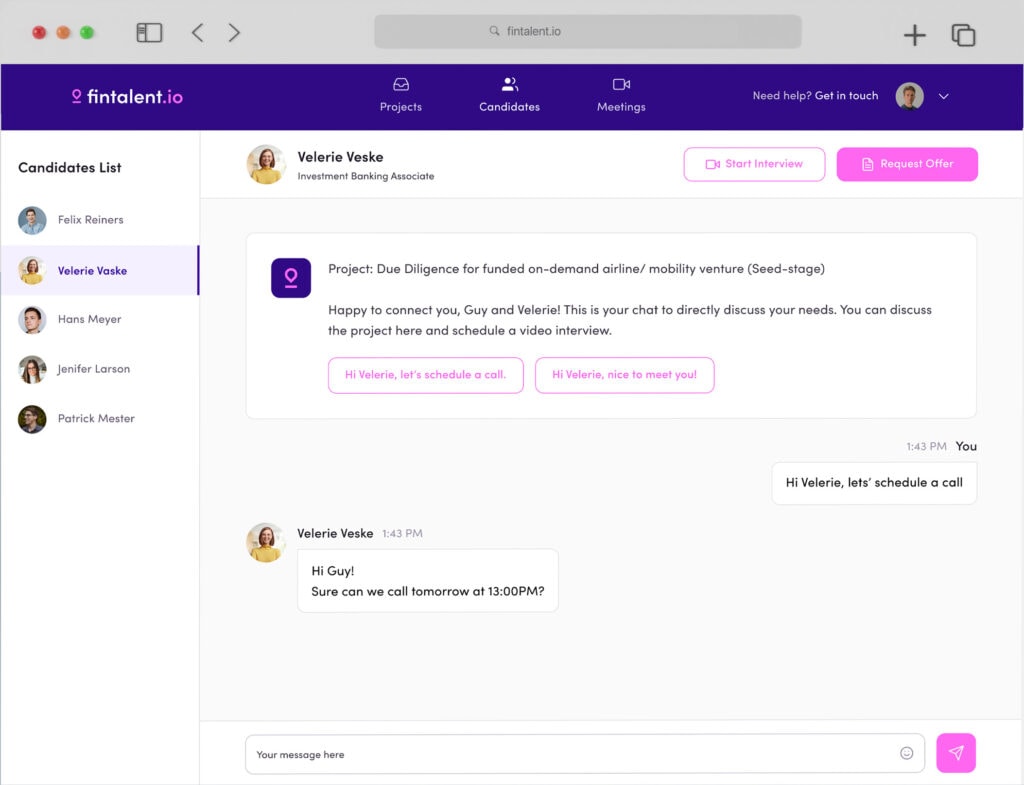

Accounting provides useful information to both parties in an M&A transaction. Fintalent’s Accounting Consultants observe that any company considering an M&A must remember that their business model can be affected by the accounting treatment. For instance, if one company manages its cash line item as a deposit, and its competitor treats the same deposit as loan proceeds, then this may influence how market share is valued.

Accounting treatments in an M&A can also affect tax liability. For instance, if one company treats a cash purchase of $10,000 as income in the year of acquisition, while another company accounts for it as deferred income over several years, the second company may accrue a larger tax liability if their taxes are based on net income.

Accounting for Goodwill

The definition of goodwill is: “a favorable reputation and image that exceeds the actual value of a company’s assets” . Goodwill is often carried on the balance sheet as a separate item in the “Other Assets” section, or is classified under “Intangible Assets”. If a company has significant goodwill, it may be more attractive to its competitors as it puts more value on the acquiring firm.

Goodwill that is acquired typically is amortized over several years and will have very little effect collaterally on the acquiring company. It does not qualify for tax purposes. In any case, most companies treat goodwill as either “deferred income” or “intangibles”; both are ignored for tax purposes.

Factoring

Factoring is a transaction in which the buyer agrees to pay the seller “at cash”. The seller, therefore, receives no cash but instead “pays” by delivering a promissory note to the buyer that must be settled upon delivery of the goods. The two companies will track all transactions as if they were cash transactions, with no entry or debit in their books.

The advantage of factoring is that it guarantees payment to a seller in an industry where payment can be delayed. In fact, buyers sometimes guarantee to pay more than invoice and use factoring as a back-up plan. The disadvantage is that factoring results in a zero balance on the balance sheet, and hence any inflows will show as “other income”.

Accounting for Deferred Revenue

This accounting treatment is for when one company purchases another and the transaction is recorded at a gross value. The reason for this treatment is that the buyer makes no assumptions regarding credit risk: however, it does not assume that all revenues are received.

The buyer will track both companies separately, with no netting or offsetting of assets against liabilities. Under deferred revenue accounting, revenues are recognized when received (unless it can be proven or estimated that they cannot be received). The buyer will know its post-merger revenue, but it will not know if revenue exceeds expenses until after all post-merger revenue is received.

Accounting for Liabilities

Generally speaking, a company pays no fees to acquire another company. The buyer assumes the seller’s liabilities at face value and any accrued interest. This treatment is not typical of private companies (who generally use “purchase method”), but it is common in situations where the acquirer expects to hold the acquired company’s net assets for a short period of time (such as a bank selling a loan portfolio). The buyer can then immediately reissue debt in most cases.

Accounting for Goodwill and Purchased Intangible Assets

When a company purchases another, it must account for goodwill and purchased intangible assets. The two approaches are:

1) Purchase method, which is used for private companies; or

2) Fair value method, which is more common in an M&A setting.

Purchased Goodwill

The tax code allows a company to deduct the cost of purchased goodwill over 15 years if it is not being amortized on the balance sheet. In fact, if the original purchase price was $100,000 paid in cash and the current market value has fallen to $50,000 after 5 years then the buyer can write-off $8333 per year. The difference between the purchase price and book value will look like a gain on the income statement, but it is actually a non-cash expense.

Purchased Intangible Assets

The underlying asset value of an intangible asset purchased from another company is considered taxable by the IRS (for example, fees paid to consultants). There are three methods for accounting for intangible assets purchased in an M&A:

· Purchase method: Used by private companies; assets are carried at cost.

· Fair value method: Used by public companies; assets are carried at fair market value. This treatment will be discussed in more detail below.

· Amortization method: Used by private companies as they amortize the intangible asset over 15 years.

Fair Value Method

As mentioned above, this is the same method required for publicly traded companies. Valuation methods used to determine fair value could include DCF calculations, discounted cash flow analyses, or another method deemed reasonable by management.

The accounts receivable are valued at “book” value (unrecognized revenues) plus any unpaid interest and discounts; new debt is valued at “face” value; equipment may be purchased from a third party and revalued on an auction basis. Other assets are narrowed down to major categories where it can be reasonably estimated what the fair value is today.

A pro forma statement is then prepared that shows the value of the purchased company’s assets, liabilities, and goodwill. The buyer will then record its purchase price by debiting “purchase price” and crediting “purchase of business”. It may also be necessary to record an impairment charge for tangible assets or purchased intangible assets (such as various forms of goodwill).

Public versus Private Companies

The tax code has different rules governing non-arms-length sales; in an M&A transaction, this makes a big difference in terms of what method is used to account for goodwill.

When a private company buys another private company, it must carry the transaction at cost. To simplify accounting, the debits and credits are generally:

1) book value of “purchased assets” less “debit for purchase price”;

2) “debit for purchase of business”; and

3) non-cash expenses such as interest and amortization.

In an M&A setting when there are no arms-length transactions, the transactions are generally carried on a fair value basis. The seller’s assets are valued at book value plus any accrued interest or discounts. The buyer’s assets are valued at book value less any accrued interest or discounts. The goodwill is valued at book value less any accrued interest or discounts.

This approach is common in the financial world of publicly traded companies, but less so in private companies due to the tax treatment inherent in this method. In general, the IRS considers goodwill amortized over 15 years (a method known as the “accelerated amortization” method).

Key Financial Information

In many cases, accounting for an acquisition is done as a capital integration project. In this case, the focus is mostly on key financial information that will be used to evaluate the performance of the newly acquired company and to estimate future cash flows. These include:

· Ratios-Net Income Before Taxes (Nett) to Net Income (Nett)

· Return on Sales (ROS)

· Return on Invested Capital (ROIC)

Ratio vs. Profit Statement: The Nett Ratio

The most commonly used profitability measure is Net Income before Taxes (Nett). Nett is the company’s interest and dividend income, plus depreciation expense. This measures what is left to earn after paying off debt, investing in plant and equipment, and general administrative expenses.

Return on Sales

In a capital integration project when the company is being acquired, the focus will be on growth – especially if it has been in decline. ROIC can be used to find underperforming companies; however, it has limitations as a measure of a business’s value due to its heavy adjustments for inflation. For example:

· Returns are adjusted by subtracting a constant value (typically 5% inflation) which automatically assumes that 5% of ownership should be reinvested back into the business each year.

· The asset base is subject to inflationary adjustments (depreciation expense).

· Returns are adjusted for taxes, which are assumed to remain constant.

The Return on Sales ratio is a measure of profitability based on the sales of a business. It takes operating profits before depreciation out to get sales and then compares these numbers with the company’s revenues. This helps peers more accurately compare the performance between two businesses because it is not affected by asset management.

Return on Invested Capital: The Return Question

ROIC measures how effectively capital is being used in the business; it measures the productivity of invested capital and how it impacts return for shareholders.

It is important to be able to calculate ROIC for the new business since it will be used as a measure of its performance. Return on Invested Capital can be calculated for a single fiscal period (e.g., four quarters) or an annualized amount over the entire period. In the case of an acquisition, it might be useful to look at ROIC over several years, as this provides insight into the company’s ability to grow and how much debt is needed to do so.

Pre–Acquisition Deal Checklist

An M&A transaction is one of the most complex aspects of any business environment. As such, structuring a deal involves precision and attention to detail. Here is a pre–acquisition checklist that you can use until your own system is established.

1) Calculate the fair market value of equity consideration. This must be done for each type of security (e.g., cash, stock, debt) and for each class of security issued by the target entity.

2) Calculate the fair market value of any new equity issued by your company (or obligor) in the transaction.

3) Calculate what your company will have to pay if there are contingent payments or earn-outs; this must be done separately for each class of securities issued by your company (or obligor).