Hiring a financial modeling consultant can be a strategic move to ensure that your financial models are not only accurate but also tailored to your specific needs. We connect you to a wide network of professional financial modelers. They can bring a wealth of expertise to help you navigate complex financial scenarios. They also provide valuable insights that drive your business forward.

This guide will help you in the process of hiring the perfect financial modeling consultant services. Keep reading and get the necessary knowledge to make an informed decision.

Who Needs a Financial Modelling Consultant?

A financial modeling expert can provide valuable assistance and expertise to a wide range of individuals and organizations. Here are some examples of who may benefit from hiring a financial modeling consultant:

Investment Banking

Financial modelers assist Investment bankers with complex financial transactions, including M&A, IPOs, debts, and financial restructuring.

Private Equity

Private equity firms and venture capitalists rely on financial modeling consultants to evaluate potential opportunities and create financial models to support their investment thesis.

Corporations

Large corporations frequently require financial models to analyze their financial aspects and make informed decisions.

Real Estate Developers

Real estate developers use financial models to evaluate the profitability of property investments, analyze construction costs, estimate cash flows, and determine the feasibility of development projects.

Investors

Individual investors or investment firms may hire financial modeling consultants to develop custom investment models and tax strategies. A good advisor will assess the target investment and provide insights to make an informed decision.

Academic and Research Institutions

Universities and research organizations may utilize financial models for academic research, economic forecasting, and policy analysis. Consultants can assist in developing and validating these models.

What Are the Main Responsibilities of a Financial Modeling Consultant?

- Financial Modeling and Analysis: They develop and enhance a company’s financial models and conduct quantitative analysis to evaluate the impact of various factors. It helps businesses minimize risks and make informed decisions.

- Corporate Development: The financial modeling consultant works with corporate development teams to evaluate potential growth strategies, including mergers, acquisitions, joint ventures, strategic partnerships, and capital structure analysis. It helps organizations evaluate strategic investments and assess divestitures.

- Exit Readiness: A reliable financial modeling consultant also prepares clients for potential exit scenarios, such as IPOs, mergers, or selling the business.

- Sell-Side M&A: They build effective financial models that showcase the company’s financial potential to support clients in sell-side M&A transactions.

- Valuations: They conduct detailed valuations of businesses to make accurate and defensible valuation reports and give recommendations to clients.

- Due Diligence: Financial Modeling provides accurate information about a business’s potential and current position. It can also help Due Diligence Consultants to understand the business more effectively.

- Risk Assessment and Mitigation: With deep analysis and future testing skills, financial modeling consultants can Identify financial and operational risks. Once the threat is identified, they Collaborate with clients to make effective risk mitigation plans.

Qualifications and Expertise to Look for in a Financial Modeling Advisor

Educational Background and Professional Certifications

Always look for candidates with strong academic backgrounds in finance, mathematics, or related fields. Look for the certificates like CFA or CPA. A solid foundation and professional qualifications are required in a Financial Modeling Consultant.

Technical Skills and Modeling Expertise

While choosing the right freelance financial modeling consultant, look for candidates with excellent Excel proficiency and knowledge of financial modeling software. Check their track record for building accurate and error-free models.

Industry-Specific Knowledge

Try to hire a consultant with expertise in your specific industry. By doing this, you can ensure that the consultant understands sector-specific nuances, regulations, and KPIs. It will make their models more relevant and insightful.

Quantitative Analysis and Valuation Techniques:

Look for a financial modeling advisor with the knowledge to conduct quantitative analysis, including statistical modeling, and familiarity with various valuation methods.

Communication and Problem-Solving Skills:

Prioritize freelance financial modeling specialist who can communicate complex financial concepts clearly and concisely to non-experts. Additionally, they should have good problem-solving abilities to mitigate risks.

Hiring Process – Practical Steps to Follow

Here are some steps to follow while hiring the right financial modeling consultant:

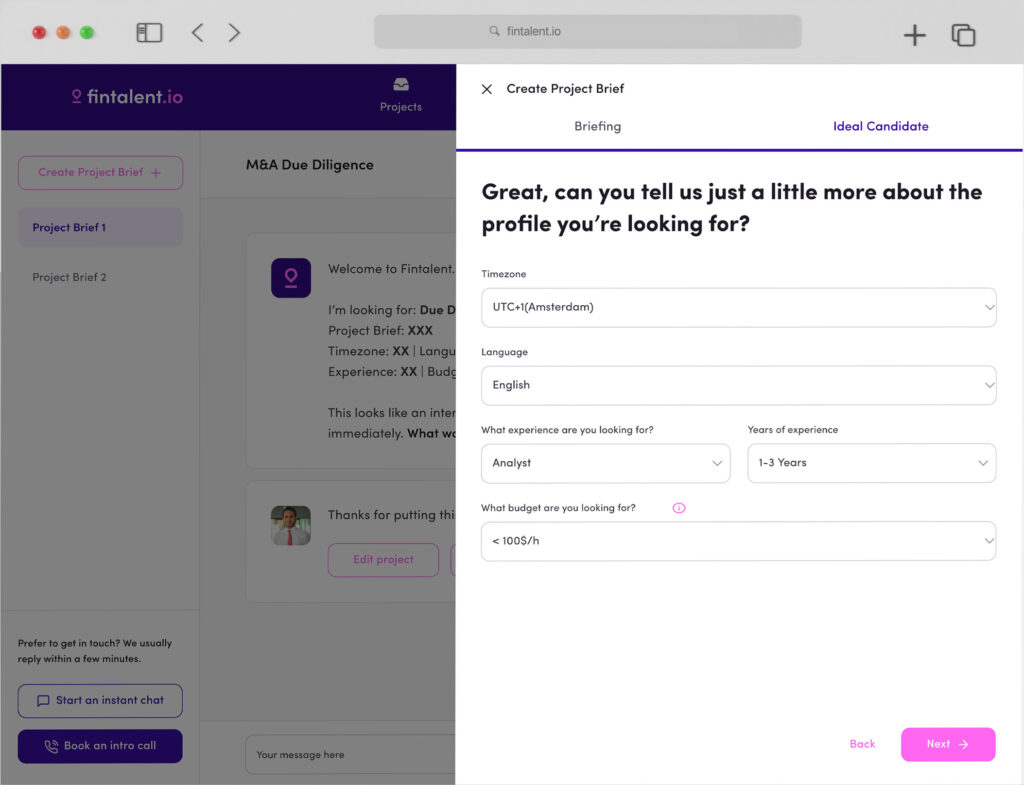

- Define Project Requirements: Your first step should be defining your project requirements. Outline your project’s scope, objectives, and deliverables clearly. You can include specific tasks, timelines, and budget constraints.

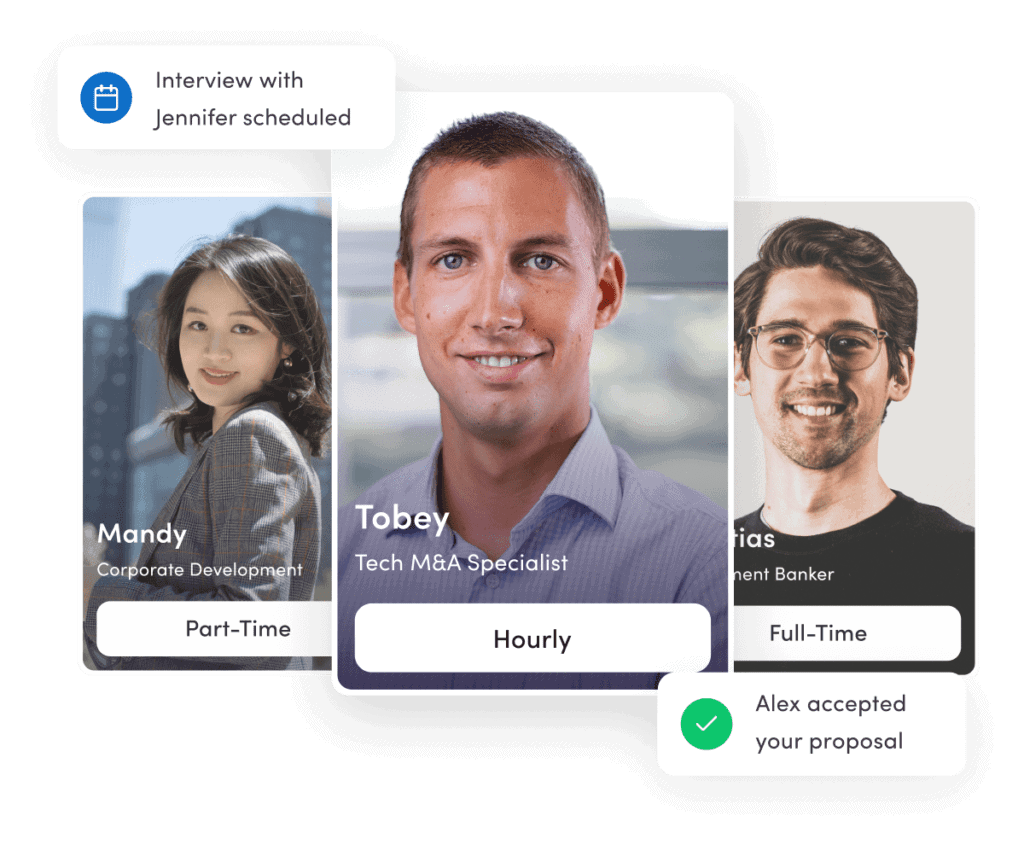

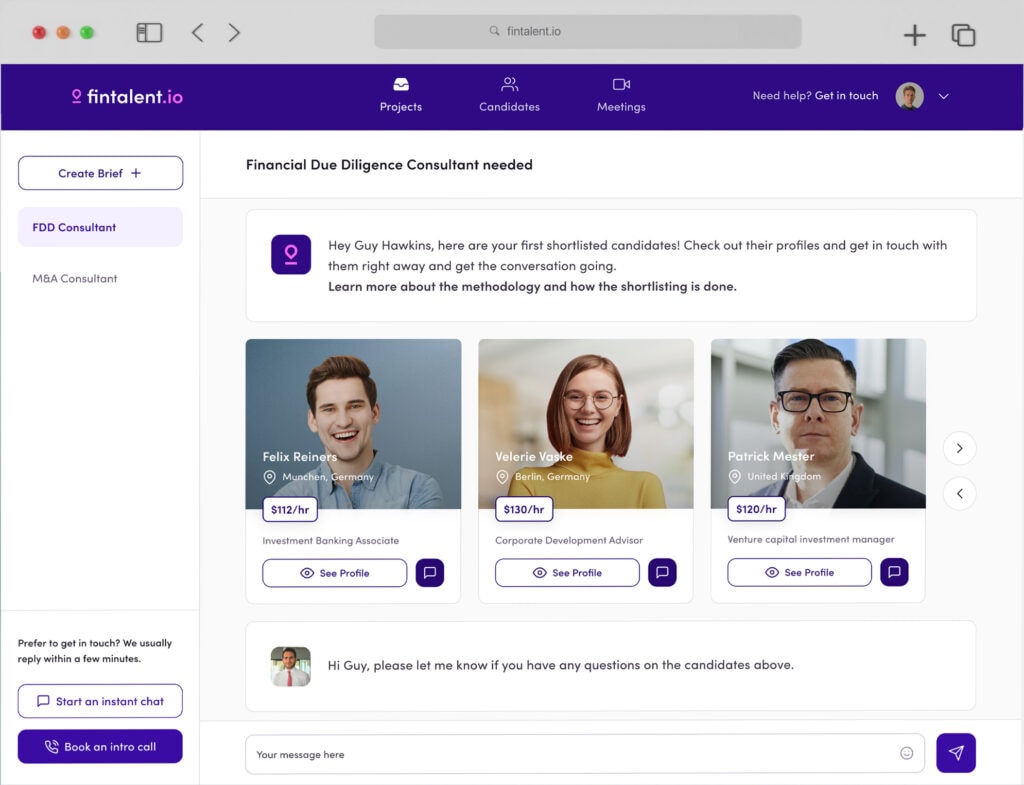

- Search and Shortlist Candidates: Search for your desired consultant category and shortlist candidates that are eligible and close to your project’s expectations. Additionally, check for relevant certifications like CFA, FMVA, etc.

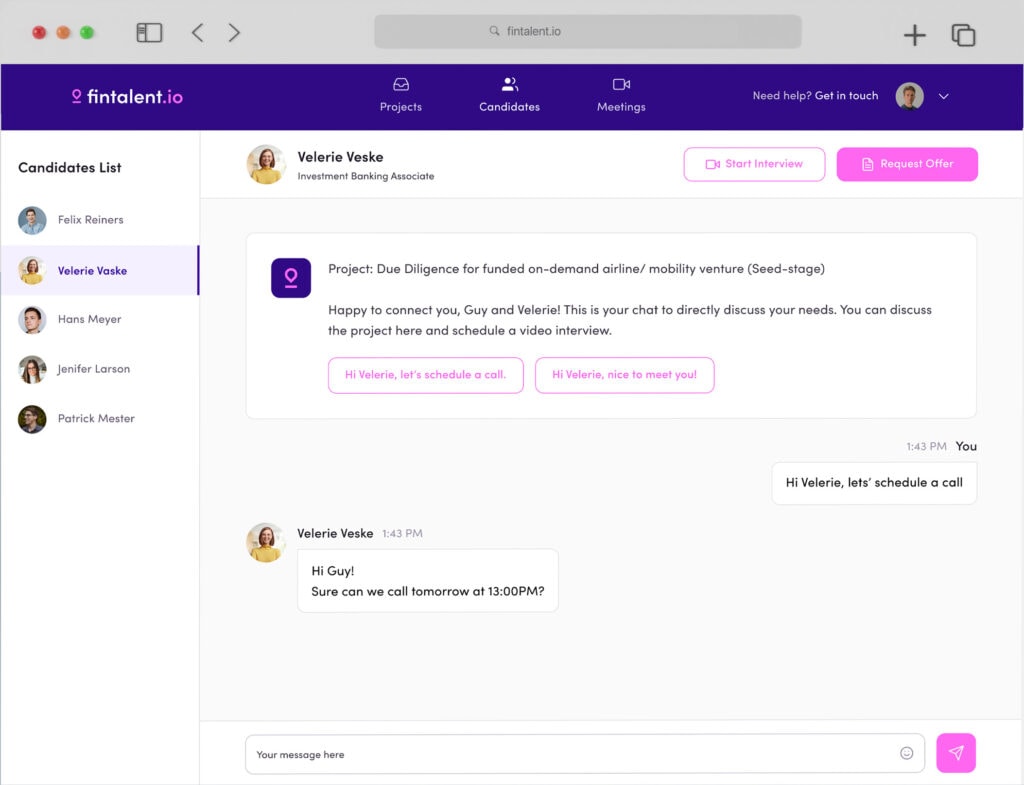

- Interview and Assess: Your next step will be conducting interviews. Discuss their past projects and evaluate their financial modeling skills. Don’t hesitate to ask questions and ask their previous clients for feedback.

- Make a Contract: Once you have chosen the right candidate, draft a clear freelance contract that includes project scope, payment terms, deadlines, and confidentiality agreements. Always set clear expectations for communication and reporting for the project duration.

- Monitor and Review: It is crucial to ensure your project’s success. Try to maintain regular communication with the consultant during the project. Keep monitoring the progress and review the quality of deliverables to ensure they meet your expectations.

In Conclusion:

Hiring a reliable consultant can benefit your business significantly. However, the wrong one can have no impact or negative impact on your organization’s performance. So, It becomes highly important to choose the right one.

All freelancers on our platform are highly skilled and have the essential knowledge to manage your projects. Remember that every project is different and requires specific expertise. Follow the steps carefully and be patient to choose the perfect candidate for your financial Modeling consulting needs.