What are Transaction Advisory Services?

Transaction advisory services in finance are specialized advisory services that focus on particular transactions or groups of transactions. These may include major acquisition, divestiture, restructuring or risk management activities. Examples of transaction advice include advice provided in connection with the purchase, sale or restructuring of non-retail businesses (e.g., business acquisitions and divestitures), leveraged buyouts (LBOs), recapitalizations and distressed asset investments. Transaction advisors are typically hired by both sellers and buyers before a transaction is consummated. Once hired, transaction advisors work with both buyers and sellers to facilitate the transaction process.

The administration of an investment institution with respect to financial risk management typically includes the following areas:

- Transaction Advisory Services

- Enterprise Risk Management (ERM) Team Structure

Transaction Advisory Services for Big Buyers

A transaction advisor is usually hired by both sellers and buyers during the due diligence process in connection with an acquisition. Assume that a buyer is seeking to acquire a company from its owners. The buyer may hire a transaction advisor to assist in the acquisition process because this advisor is usually independent and does not have a vested interest in whether the acquisition occurs or not. In addition, the transaction advisor may be able to provide other important benefits to the buyer, including assisting it in evaluating potential transactions. This allows the buyer to concentrate on its core competencies while still obtaining all the necessary information it needs about potential acquisitions. The transaction advisor may be able to locate potentially attractive companies that the buyer would not have been able to find on its own.

In a cash tender offer, the target company’s board of directors is typically formed from independent members of management and may include representatives from the financial community. These individuals evaluate a potential acquirer to determine whether it is a suitable buyer. The transaction advisor assists in this process by collecting information about the buyer and advising the target’s board of directors about potential alternatives, which may include recommending an outright rejection of a proposed acquisition.

A transaction advisor usually takes responsibility for collecting information about a potential acquirer in connection with an acquisition or sale, such as reviewing financial statements and issuing reports that analyze this information. In addition, a transaction advisor will typically ascertain information about the buyer’s management team and evaluate its strengths and weaknesses. In the event of a merger, this advisor is usually responsible for collecting information about the target company’s membership on its board of directors. This advisor will also determine whether the target company has any other committees or any other possible sources of conflicts of interest.

A seller should decide before hiring an investment bank to act as its financial advisor if it will hire an independent transaction advisor or not. This type of decision should be made prior to deciding which investment bank to hire for this purpose because the relationship between the target company and its financial advisors can be complex. It is possible for a company to have internal financial, legal and tax departments that perform some of the same functions as a financial advisor. There are instances where a seller chooses not to hire a transaction advisor at all. Doing so may possibly reduce the overall costs of the transaction because independent advisors usually charge higher fees than those who have a vested interest in whether the transaction occurs or not. In addition, hiring an advisor may be unnecessary if your firm already has strong internal resources that can adequately perform these functions.

Why Your Business May Need a Transaction Advisor

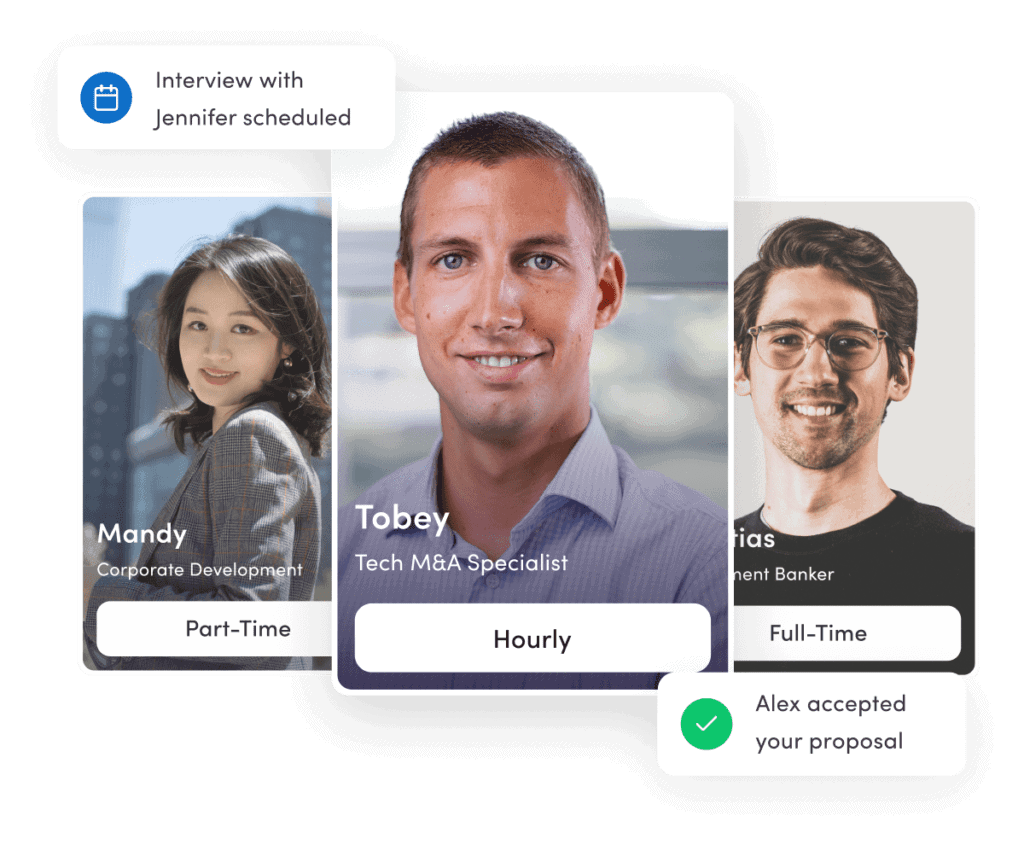

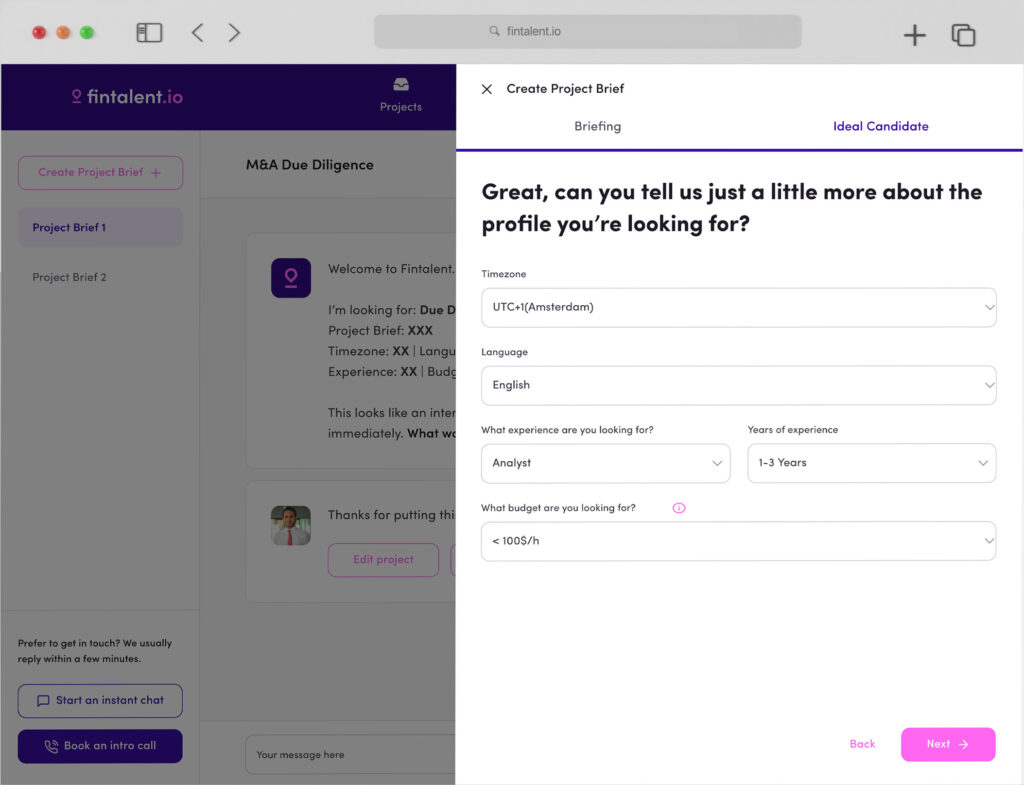

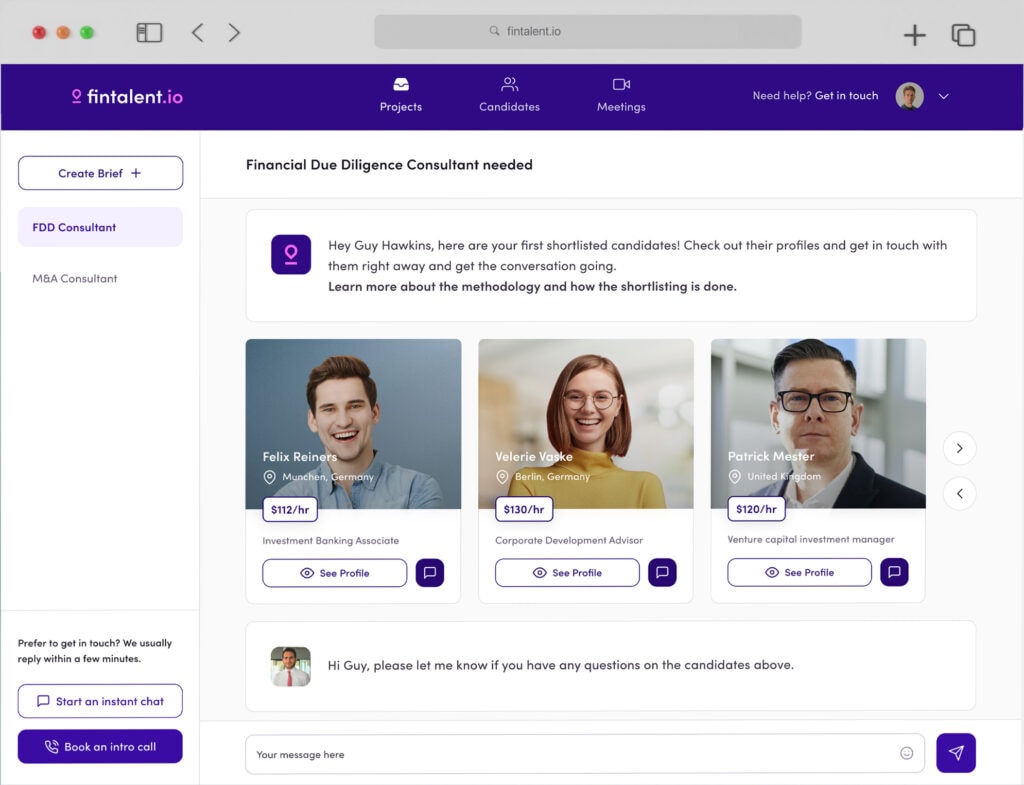

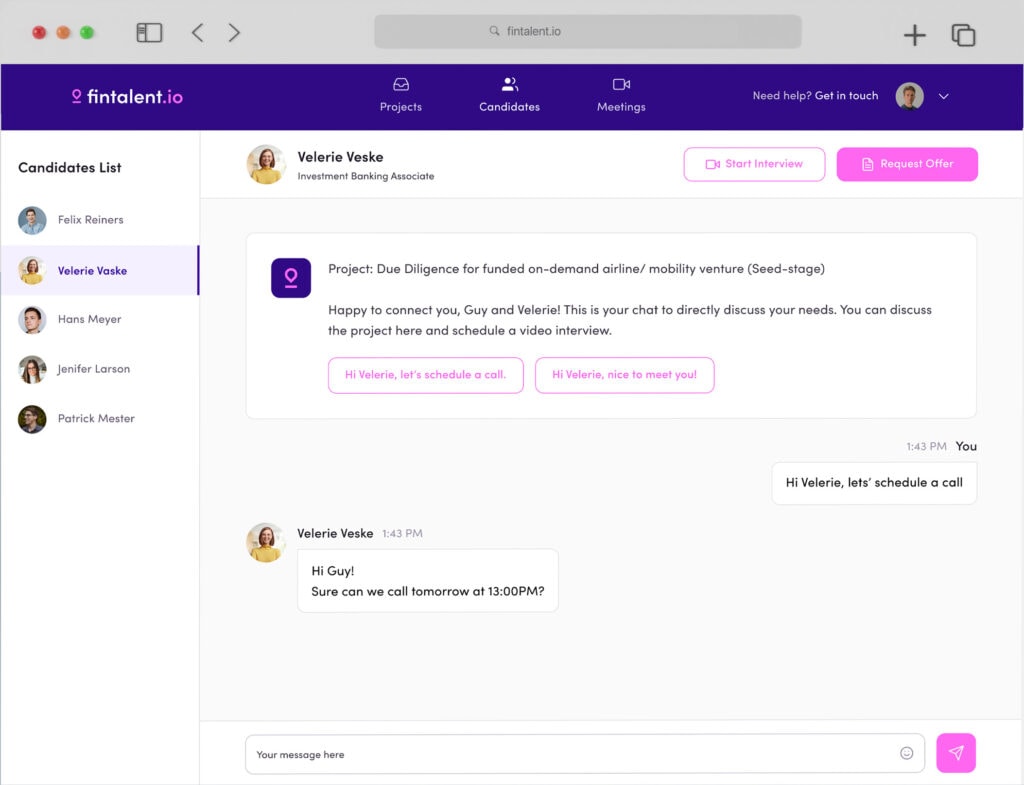

There are three primary reasons you might consider hiring a transaction advisor. You may not need any transaction advisor services at all; your company may have internal resources that can effectively perform these functions for you. Even if your company has internal resources, however, there may be good reasons to hire a freelance M&A advisor from Fintalent. Primarily, a transaction adviser is a business advisor. He or she is not a technical expert and does not have to be an expert in any particular area. All that matters is that he or she has the knowledge and expertise to provide you with the services you need.

Two other primary reasons to hire a transaction advisor are as follows:

- A buyer’s financial advisor may require assistance in identifying potential sellers.

- A seller’s financial advisor may require assistance in determining if a particular buyer is a suitable acquirer for his company. Note: This article will not focus on advice concerning acquisitions by investment banks for private equity funds, because these transactions are typically incorporated into private equity transactions as part of an overall fund formation process (described briefly below).

A transaction advisory service will assess the risk of a transaction using historical data to determine the likelihood that a particular action will happen from one point in time or from another point in time. They then provide advice on how to mitigate any risks that may arise from the action. A competent transaction advisor from the foregoing is an indispensable part of the growth of businesses. Managers with little capacity can avail themselves of the opportunity presented by Fintalent to hire freelance financial consultants that can handle all areas of their financial advisory needs.