In this competitive business landscape, financial expertise is a crucial pillar of an organization’s success. With the help of a skilled chief financial officer, businesses can streamline their financial process and mitigate any potential risks. However, hiring a full-time CFO is not possible or required for small or mid-sized companies.

That’s where Fractional CFO services come into play! These professionals work with organizations on a part-time or project basis. They are cost-effective and can help your business improve its overall financial health or develop specific functions. In this guide, we will help you find the best way to hire the right fractional chief financial officer. Keep reading till the end!

Understanding Fractional CFO Consultants

Fractional chief financial officers work the same as a normal CFO. They provide businesses with financial management services and make effective strategies to eliminate potential risks. The main difference between a Fractional and a full-time CFO is the availability of their services. Fractional Chief Financial Officers work on a part-time or project basis. These individuals are mainly hired to create a specific function or during a financial crisis. People also hire a fractional CFO for startups to help them as needed without spending on a full-time professional.

What Is the Difference Between Interim and Fractional CFO Consulting?

Interim Chief Financial Officer and Fractional Chief Financial Officer roles share some similarities with normal CFO Consultants. But they serve different purposes and have distinct characteristics. Let’s understand the both separately:

Interim Chief Financial Officer (CFO):

An Interim CFO consultant plays a critical role in organizations during transitional or crisis periods. These financial leaders step in on a full-time basis, providing immediate financial leadership, stability, and decision-making expertise. Their engagements are typically of short duration, often lasting a few months to a year, and conclude when the immediate crisis or transitional period is resolved.

Fractional Chief Financial Officer (CFO):

Fractional CFO services are flexible and cost-effective for financial leadership in an organization. These professionals work on a part-time or project-specific basis, serving multiple clients simultaneously. Small and medium-sized businesses turn to these CFOs to access high-level financial expertise without the need for a full-time professional.

How Can a Fractional CFO Help Your Business?

A Fractional Chief Financial Officer can provide significant value to your business in several ways:

- Financial Strategy and Planning: They may also help you with financial strategy consultancy and make plans that align with your organizational goals. They also create financial plans, including budgeting, forecasting, and financial modeling, to ensure your business’s financial stability and growth.

- Cost Control: Fractional CFOs are experts in cost management. They can analyze your business’s expenses, identify areas where costs can be reduced, and implement cost-saving measures.

- Cash Flow Management: Maintaining healthy cash flow is crucial for the sustainability of your business. A Fractional Chief Financial Officer can help you optimize cash flow by managing accounts receivable, accounts payable, and working capital efficiently.

- Financial Reporting and Analysis: Fractional chief financial officers are skilled at generating financial reports that provide insights into your business’s financial health. These reports can help you make informed decisions, identify trends, and plan for the future.

- Fundraising and Capital Acquisition: If your business is seeking funding or investment, Fractional CFO consulting services can assist you. They prepare essential documentation, provide financial due diligence consultancy, and present a compelling financial case to potential investors or lenders.

- Risk Management: Fractional chief financial officers can assess and mitigate financial risks in your business. They can implement risk management strategies to protect your assets and investments.

- Mergers and Acquisitions (M&A): If your business is involved in Merger and Acquisition activities, a Fractional chief financial officer can provide M&A Advisory along with due diligence, financial valuation, negotiation, and integration planning to ensure a smooth transition.

- Financial Systems and Technology: Fractional chief financial officers can advise on and implement financial systems and technologies to streamline financial processes, improve data accuracy, and enhance financial reporting.

- Compliance and Regulatory Guidance: Fractional chief financial officers can help ensure your business follows all relevant financial regulations and stays updated on changing compliance requirements.

- Savings and ROI: Fractional CFO Consulting benefits the company by identifying opportunities for savings, optimizing financial operations, and increasing profitability. The return on investment (ROI) from their expertise can be substantial.

- Fractional CFO for Startups: These financial strategists help startups make informed decisions, secure funding, and establish financial processes. They offer valuable insights and financial guidance, ensuring that the company’s financial foundation is strong and sustainable, which is essential for achieving long-term growth and success.

How to Assess Your Needs for Fractional CFO Services?

The first step to hiring the right Fractional CFO consultant is to know your company’s specific needs. A one-size-fits-all approach simply won’t work when it comes to financial advisory services.

- Define your goals – Start with defining your company’s goals and objectives. Know about the financial outcomes you are aiming to achieve. Are you looking to improve profitability, manage cash flow more effectively, or secure funding for expansion? Understanding your business objectives is the cornerstone of finding the right Fractional CFO consulting services.

- Identifying Financial Challenges – Take a deep look at your current financial challenges. Are you struggling with budgeting, forecasting, or financial reporting? Do you need help with mergers and acquisitions, risk management, or financial strategy? Pinpointing the specific areas where you need assistance is crucial in finding a consultant with the right expertise.

- Determining the Scope of the Engagement – Once you’ve identified your goals and challenges, it’s time to determine the scope of the engagement. Do you need a consultant for a short-term project, or are you looking for ongoing, part-time support? Understanding the duration and intensity of the engagement will help you in your search for the ideal Fractional CFO consultant.

- Set A Budget – After finalizing the needs of your business, set a clear budget and expectations to begin your search. It will help you stay organized and cut off extra costs throughout the process.

Evaluating Qualifications and Experience:

- Qualifications: Your consultant must have a bachelor’s or master’s degree in business, finance, accounts, or related field. You can also choose a candidate with a CPA or MBA.

- Relevant Experience: Consider the consultant’s past work experience and successful projects related to your needs. They should also have the necessary financial skills and industry-specific knowledge.

- Professional Certifications: Look for certifications such as Certified Public Accountant (CPA) or Chartered Financial Analyst (CFA).

Skills to Look for in Potential Candidates

- Financial Expertise: Strong financial acumen and expertise in areas like financial analysis, budgeting, and forecasting consulting for strategic financial planning.

- Industry Knowledge: Understanding the specific challenges and dynamics of your industry allows them to make tailored financial strategies.

- Analytical Skills: Proficiency in data analysis, enabling them to extract valuable insights from financial data and make data-driven decisions.

- Communication Skills: Effective communication skills to convey complex financial information in a clear and understandable manner to non-financial stakeholders.

- Project Management: Ability to manage financial projects effectively, ensuring they are completed on time and within budget.

- Regulatory Compliance: Business owners normally hire a fractional CFO for startups or small and medium-sized organizations. So, their familiarity with financial regulations and compliance becomes necessary to avoid any legal issues.

- Problem-Solving Skills: A strong problem-solving mindset to address financial challenges and find innovative solutions that benefit your business.

Conducting Interviews

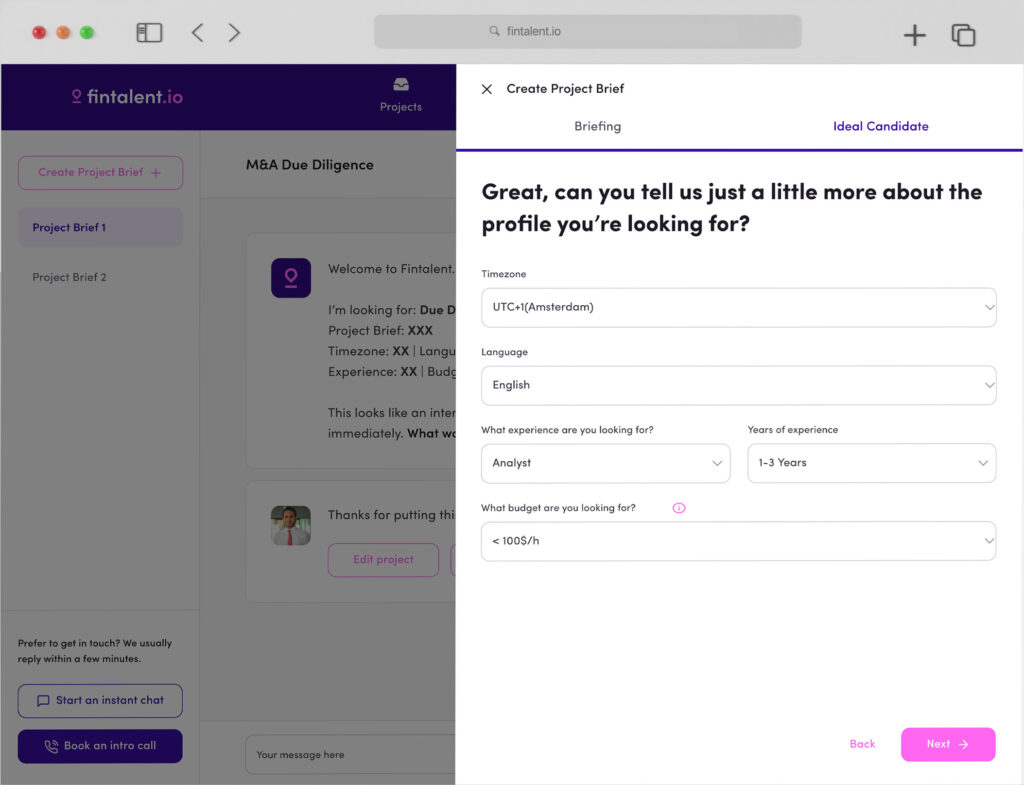

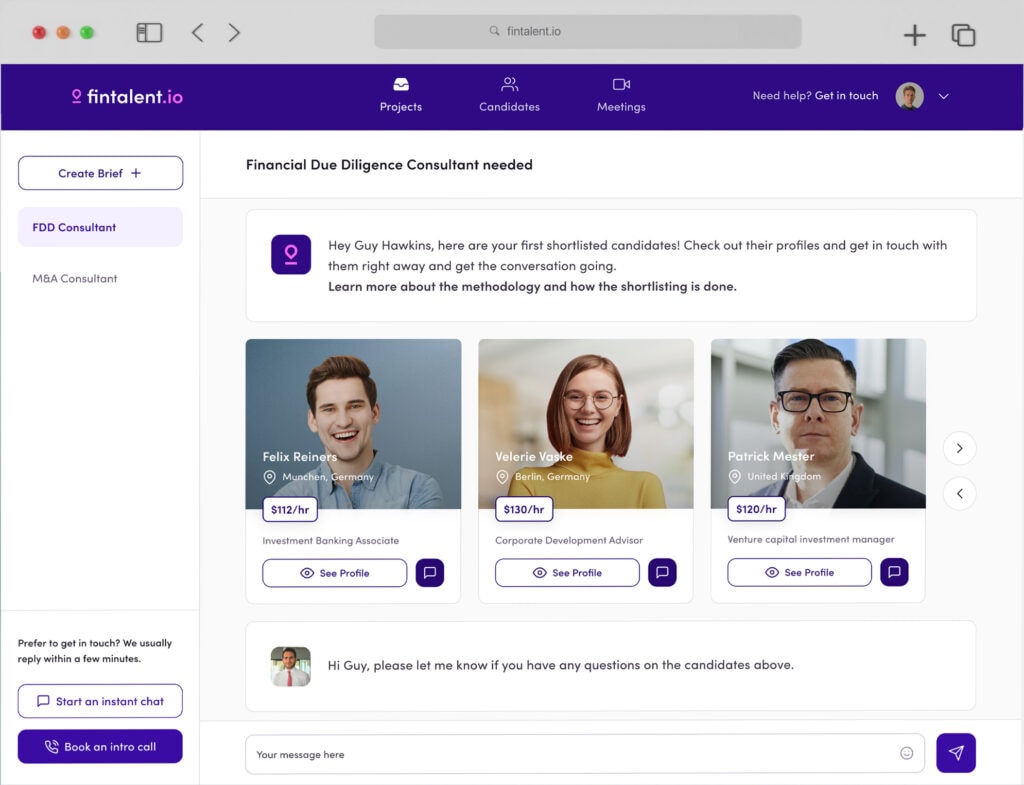

After careful evaluation of all the fractional CFO consulting candidates, make a shortlist of freelancers best suited to your business needs. Make a list of questions that cover key areas like their financial expertise, industry knowledge, and problem-solving skills. Now, conduct online or face-to-face interviews with potential candidates. Know about their work approach and how they handle the situations. Ask for their work samples or case studies to understand their approach better.

How to Make the Final Decision?

Selecting the right Fractional CFO services requires a thoughtful process. First, assess candidate responses, ensuring their skills and expertise match your needs. Consider their cultural fit within your organization and seek references to gauge their track record. Weigh cost proposals against the potential return on investment. Take into account feedback from your team and align candidates with your business objectives. Finally, trust your instincts and experience to select the right candidate.

Wrapping it Up:

Hiring the right Fractional CFO consultant is a pivotal decision for your business’s financial well-being and success. In today’s dynamic and competitive business landscape, having access to financial expertise is more critical than ever. Read the entire guide carefully and follow the steps to hire fractional CFO services for your business. Get connected with professional freelancers and Hire now!