What is Intellectual Property Valuation?

Intellectual property (IP) can be defined as anything that results from an idea that has been translated into a product or service, which includes patents and copyrights. Valuing IP requires a qualitative analysis of legal documents, formulas, and calculations using well-established mathematical models designed to express intangible assets in monetary terms. Intellectual property valuation is therefore an analysis of the value of an intellectual property like a patent, trademark or copyright. Fintalent’s intellectual property valuation consultants note that the invention can be a product, process, design or any other creative output. It is also known as “intangible assets” valuation.

In the context of business, intellectual property valuation is an advanced process that involves specialists from a variety of fields, many of whom have a full understanding of IP, patents and copyrights. Intellectual property can be broken down into three categories: patents, which describe the technological features and functions of a product; trademarks and service marks, which are unique identifiers recognizing the source of products or services; copyrights, which enable people to commercially use literary works. This article will focus on patents and trademarks only. Copyrights are very similar to patents in terms of their value but may be assumed to have little value if you do not own the copyright or license it. This is because copyrights are usually limited to non-transferability. For a more in-depth discussion on the difference between trademarks and copyrights, check “Intellectual Property Valuation for Patents, Trademarks and Copyrights”

In finance, intellectual property valuation refers to the process of determining what constitutes a company’s intangible assets. It is a fairly complicated and tricky process that often requires the assistance of experts in different fields and legal professionals. This article will give you a brief overview on how to go about doing this for your company, as well as some example questions you might come across during the process. The premise is that with an understanding of how to value intellectual property, you can make better decisions while working towards profitability or compliance with statutes or rules. While intellectual property itself can be intangible, your efforts to value it should never be.

The process involves understanding the nature and scope of the intellectual property and its commercial potential along with market factors that affect its attractiveness to buyers. Intellectual property valuation can be complex in some instances and it requires sufficient knowledge about market dynamics for the respective asset class.

Purpose of Intellectual Property Valuation

The purpose of intellectual property valuation is to identify and quantify the value of intangible assets that a company may own. Because most people do not understand business concepts such as revenue-generating capacity and risk-adjusted discount rates, IP valuation also requires expertise in accounting, investment banking and management consulting.

Patent Valuation Process

Gathering primary financial data – It is important to gather historical financial data from previous years that relates to revenue, net profits and cash flows. This information gives you insight into how your company has performed in previous years as well as expected performance going forward.

Conducting secondary research on patents – When valuing patents, it is important to conduct research on any intellectual property that has already been created. This research helps you understand how other companies have achieved similar achievements, as well as help you develop your own competitive advantage.

Conducting interviews with the patent owner – Depending on the type of patent involved, an independent evaluator may need to sit down with a representative from your company and discuss details about the product or service covered by the patent. This gives the evaluator an inside look into how much time and money was spent creating this product or service.

Comparing patents to products and services – An IP valuation includes comparing patents to similar products and services in order to provide added value for shareholders. This is done by determining what methods are being used by companies that are most likely infringing your patents. These methods are then assessed in terms of infringement risk, which may include the ability to be sued for patent infringement.

Analyzing the potential market – Analyzing the potential market is an important part of IP valuation, as it helps determine what kinds of revenue can be generated and at what cost. Valuing patents is more complicated than valuing other intangible assets such as copyrights and trademarks. This is because patents are more difficult to identify, quantify and protect from infringements.

How do you value a patent?

There are many different methods being used by investors and analysts when it comes to valuing a patent or intellectual property (IP). The most common methods are to use an income approach or a market approach. The income approach is the method used by Securities and Exchange Commissions (SEC) to value IP. The income approach begins by examining the financial condition of the company and its actual or projected future earnings. It then divides shareholder equity into two parts:

Intangible assets – These are assets that cannot be touched, such as patents, copyrights, goodwill, trademarks and brand names, etc. Tangible assets – These are tangible assets that can be seen and touched such as equipment, machinery, inventory and cash.

An example of the income method is to estimate future net cash flow from an asset using a discounted cash flow analysis. You must use various assumptions to determine this projected future net cash flow.

The market approach to IP valuation is the most common method and involves looking for comparable or similar assets that have been recently acquired or sold. An example of this would be a company such as Google, which has been using the market approach by buying out other companies that have patents and copyrights related to their business model. This is just one example of how the market approach can be used in IP valuation.

Other methods involve comparing an IP asset with similar assets, estimating a discounted cash flow analysis and comparing revenue potential with costs, among other things.

There are many factors that go into calculating the value of a patent, including the amount invested in creating it, the amount of revenue generated through licensing the patent, possible infringement of other patents and so on. It is for this reason that it is important to use specialized IP valuation specialists.

How to value trademarks

The trademark valuation process involves first researching existing trademarks and establishing how they were valued before attempting to estimate how much money you could actually get from selling them. Although you can use the market approach when estimating what your trademark would be worth by comparing similar trademarks recently sold, you should not just assume that they are an accurate reflection of what your property might be worth.

The market approach involves putting your trademark in a similar group to see what similar trademarks are selling for. For example, you could have a group of trademarks that have been sold recently, then calculate the average price achieved by these similar trademarks sold and compare that to an estimated value of your trademark. If you find that your name is on a comparable trademark and has been sold, then it should be valued using the income method. If not, then you should use another method to value your property.

The income approach involves calculating the average amount of money earned over time by the trademark owner in royalties and sales of its products or services, as well as subtracting any legal fees associated with gaining protection for its trademark application. This is a great way to determine the value of your trademark because it only relies on information that is already in the public domain. Using this method you can easily see whether or not your property has been valued fairly or whether you could have done better.

You can also choose to use the market approach by creating a similar group of trademarks according to your own criteria, then estimate the average price achieved by these similar trademarks sold. You can then compare this estimate with actual sales to find out if you are getting a good value for money. If not, then it may be worth trying a different method such as the income approach.

How much is a trademark worth?

As mentioned above, the market approach includes comparing similar trademarks that have recently been sold, which can be an advantage when you are trying to evaluate an IP asset. However, this method has its own disadvantages. For example, it will not necessarily reflect how the value of your trademark would be if it was actually licensed or how it could be affected by other trends in the market. This is why many IP valuation specialists prefer to use another approach such as the income approach instead of relying on comparisons alone.

The income approach takes into account a number of factors to determine what a trademark’s value is as well as how this compares to similar trademarks that have recently been sold or acquired. The most important thing to remember is that there is no single way of valuing an IP asset. It all depends on how much research you are willing to do in order to determine the value of your property.

There are many factors that can affect the value of your trademark, such as; Royalty projections, market penetration by competitors and growth potential, whether or not it has received trademarks in other countries, the value it has been given and the actual sales made for similar trademarks in other countries, the history and details about the trademark and its use, including any litigation over its ownership, the duration of the IP protection term, the cost of defending or maintaining this property etc.

Once you have determined the value of your trademark, you can use this information to negotiate the best possible price for your IP assets. This can be a difficult process and only a specialist IP valuation firm such as those available on Fintalent can give an accurate estimation of how much your property is worth.

Conclusion

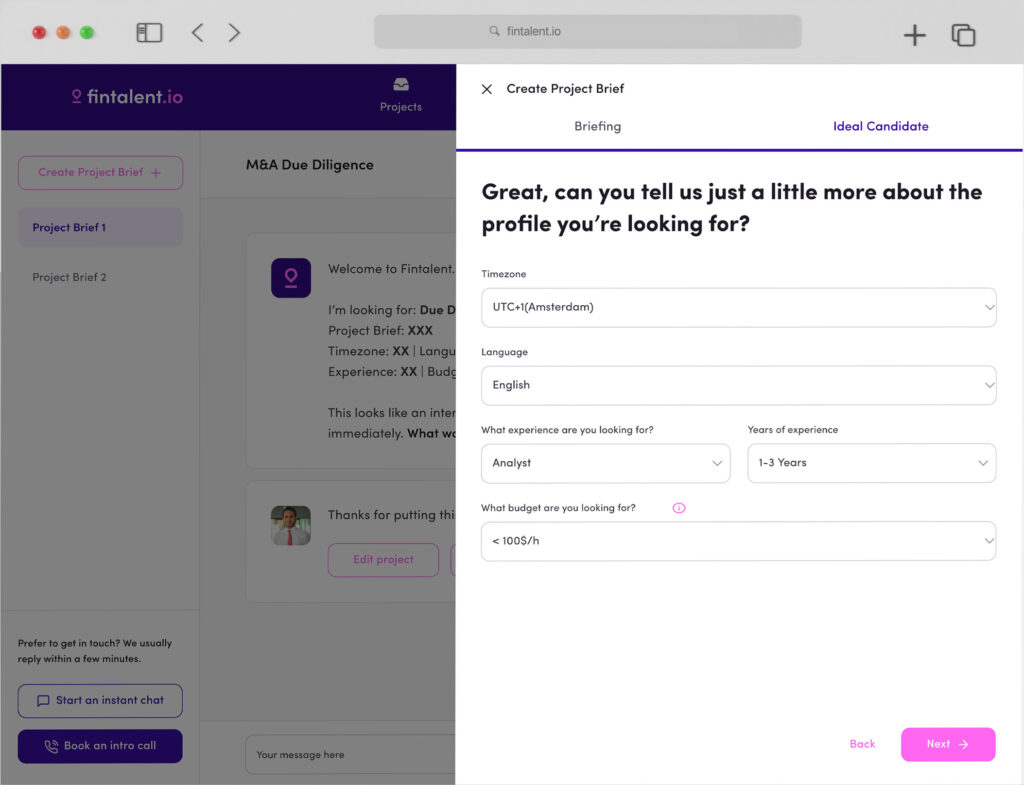

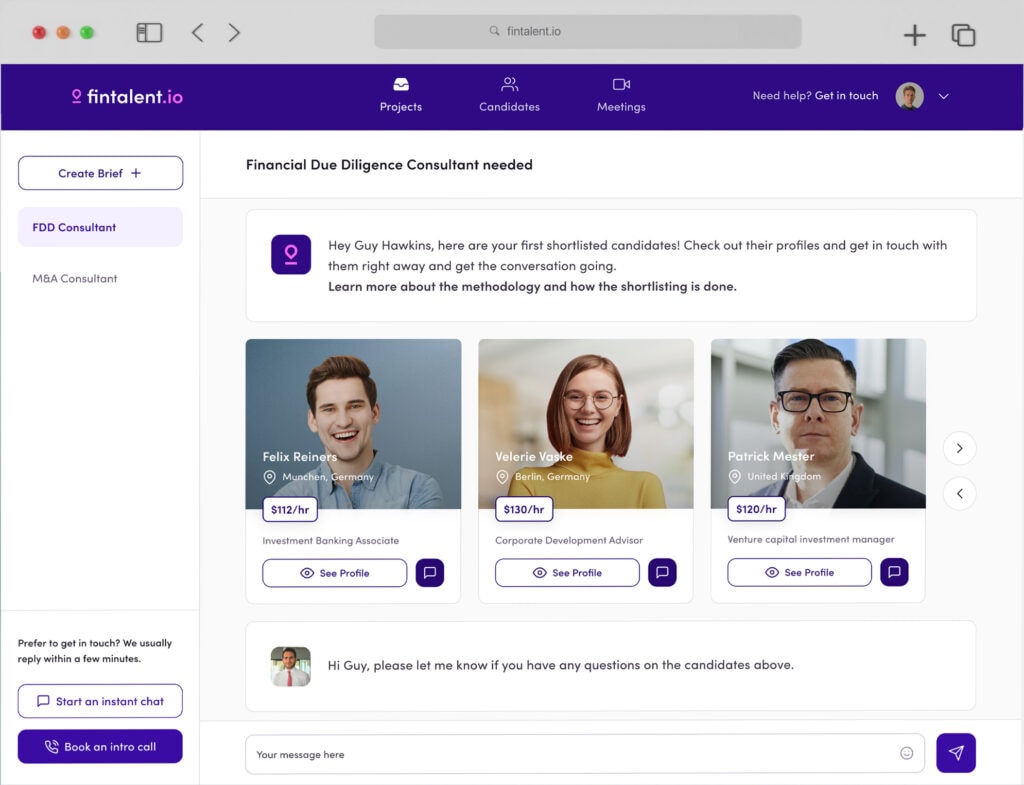

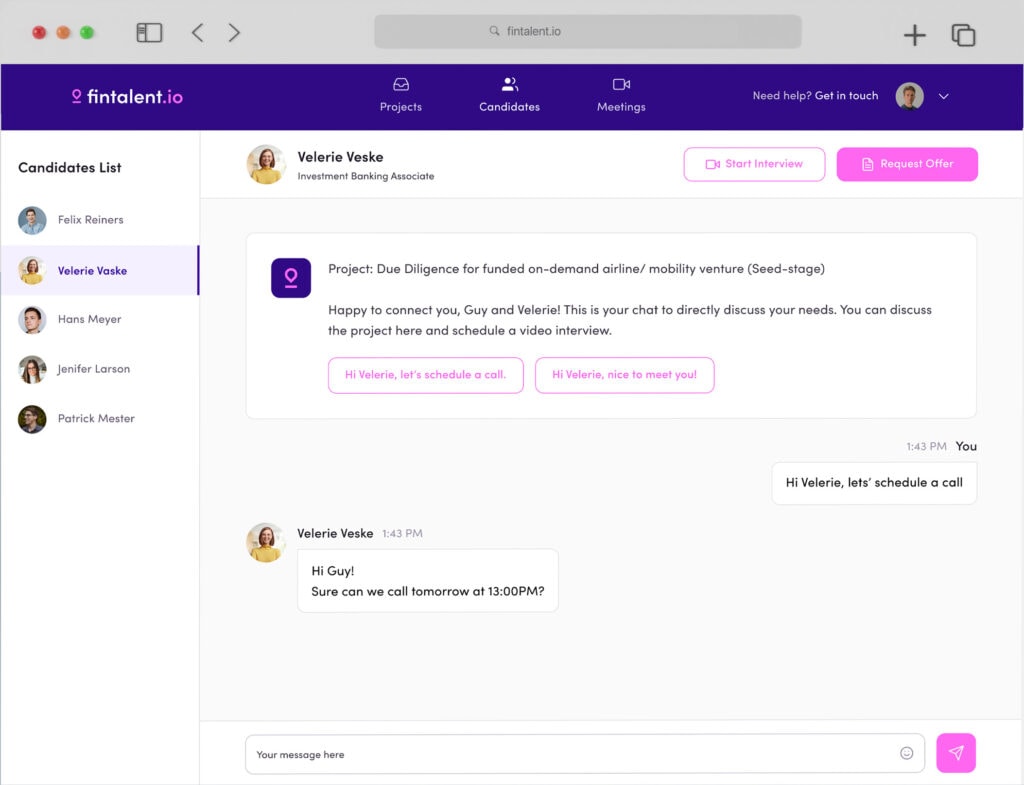

Working with intellectual property valuation services and consulting with an IP valuation expert enables teams to leverage their core strengths while adding flexibility. Interested in learning more? Get in touch via the chat or our client dashboard.