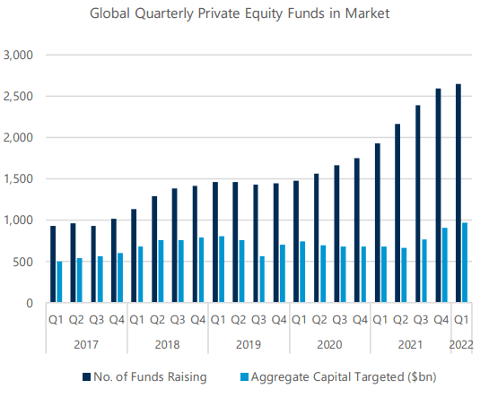

Data compiled by Preqin and condensed in a Q2 2022 report by Paul Weiss shows that at present there is a record number of private equity funds (2,650) in the global market, a 2% increase from Q4 2021, resulting in the most funds in the market at any time over the last five years. Additionally Bain & Company has recently published in its Global Private Equity Report 2022 that global private capital raised is at a historic record high.

Increasing capital-raising activity and a multiplying number of funds mean a growing number of managers and investors find themselves in need of setting up equity waterfalls to determine how they will split equity contributions and distributions.

While contributions, when properly structured, are meant to be foreseeable, immediate, few, and arranged; distributions, contrarily, tend to be more uncertain, distant, irregular, and erratic. Let’s look at the following graphic examples of equity contributions and distributions.

Because of the irregular nature of distributions combined with their intricate relationship with sweat equity, investors and managers need to put in place complex equity waterfall structures to split those returns. When appropriately set up, waterfalls align interests, ensure fairness, foster relations, and increase value creation.

However, waterfalls are difficult to understand and more difficult to model, yet they are essential to most private equity investments because they determine the way in which partners split distributions. This difficult nature of equity waterfalls often leads to mutually harmful investor/manager relations, such as unfair distribution splits or ill-timed cash payouts.

I have worked in real estate private equity for more than 11 years, structuring and modeling complex waterfall structures of deals which, as of now, account for a total aggregated capital worth c. USD$2.5bn. Throughout this experience I have noticed that most managers and investors lack the expertise to properly set waterfalls up: either they completely ignore how waterfalls work, or, if they have a solid understanding, they lack the modeling skills to effectively crystallize their knowledge into a spreadsheet.

Their calculations often oversimplify or inaccurately produce flawed results, which accrue and exponentially aggravate as the volume, complexity, and risk of their transactions increase. Even for seasoned investors, who are accustomed to the mechanics of waterfalls, these structures can be complex.

Private equity is a unique industry and requires specialized knowledge to be navigated successfully. This is not easy to accomplish without solid fundamentals.

I therefore below:

a) list three common mistakes that, based on my observation, partners fall into when structuring waterfalls,

b) explain how expert structuring and modeling would correct those mistakes

c) provide external links to institutional-grade, expert-level models

Harmful to managers: neglecting managers’ pari-passu distributions

A vital step in preventing underperformance is making sure partners mutually trust the fairness of the waterfall structure throughout the duration of the venture. Providing this assurance is critical because the last thing the involved parties would want is midway interest misalignment as this may lead to a downward spiral in business plan execution.

Unluckily, there is a common mistake, often made inadvertently, that arises when managers also play a co-investment role: omitting from total distributions the manager’s pari-passu when the promoted interest kicks in, which in financial modeling terms is diagnosed by calculating disjoint pre-promote IRRs.

This structuring and modeling bug unfairly diminishes the manager’s promote, potentially becoming the cause of latent partners disagreements around thousands, if not millions of dollars. Unfortunately, both managers and investors may often not realize this calculation glitch until years after the venture has started.

A precautionary measure to start off on the right foot consists of isolating the promoted interest from the JV’s and the manager’s cash flows to check whether all parties are treated equally prior to promotes allocation. When the exercise is done correctly, the manager, the investor and the JV naturally make identical pre-promote IRRs.

The table below helps illustrate this concept with a fictitious example:

In this example:

- The manager puts up 10% of the equity capital.

- The manager returns the invested capital on a 90/10 pari-passu distribution basis.

- The manager generates an 8% preferred return (also through pari-passu distributions).

- The manager is susceptible to earn a 15% promoted interest on any profits between an 8% and a 10% IRR, and so forth.

However, of the remaining profits within that same 8%-to-10% IRR tier, the manager is also entitled to its 10% pari-passu distribution, represented in the graph below with the second yellow bar from left to right. Ultimately, what we want to avoid is neglecting the pari-passu distributions depicted below in yellow in hurdles 1, 2 and 3.

In this video you can see a expert-level waterfall template that correctly allocates both the manager’s promoted interest and his pari-passu distributions:

Harmful to investors: distributing a performance fee before earning a preferred return

There are two frequent types of equity waterfall structures: European and American. In the European waterfall structure managers get a performance fee only if investors have already received both their return of capital and their preferred return. The European waterfall structure, therefore, draws more performance fees from capital distributions than from operating distributions, and is more popular among large-cap funds.

In the American waterfall structure, however, managers may get a performance fee even if investors have not yet received their return of capital on condition that (i) investors have received their preferred return, and (ii) there are reasonable expectations that the deal will generate a return superior to the preferred return. The American waterfall structure, therefore, draws more performance fees from operating distributions than from capital distributions, and is more popular in deal-by-deal ventures with long-term business plans and with rare capital events.

The confusion here is when partners put forward American waterfall structures in which performance fees are distributed without first having paid the preferred return, delaying the preferred return distribution until a capital event takes place, and unfairly, and most times unawarely, allocating all operating distributions as performance fees. This inaccuracy is harmful for investors as they unreasonably lose a substantial share of profits.

Below is an example to compare the impact this misconception may have on the investors returns.

Let us suppose we have the following five-year stream of yearly cash flows in US dollars:

With those cash flows, we can see that the yearly cash-on-cash return would equal 10% (i.e. 100,000 / 1,000,000).

Let us assume the cash flows above would be distributed with an American waterfall which would be structured as follows:

With the information above we can deduct the following points:

- The manager puts up no equity capital.

- If the waterfall is structured correctly, the manager pays the 8% investor’s pref from the operating distributions, and only then allocates the remaining 2% cash-on-cash return as a performance fee.

- If the waterfall is structured incorrectly, the manager pays the investor’s pref until year 5 from the capital distributions, allocating in the meantime all operating distributions as performance fee.

- The manager is susceptible to earn a 20% promoted interest on any profits between an 8% and a 10% IRR, and so forth.

So if we run the comparison, this is how the investor returns would look:

When the waterfall is structured incorrectly, we can see how the manager not only pushes the investor’s IRR down by about four percent, but also receives equity distributions that exceed its fair share by around 160 thousand dollars (i.e. $575,083 minus $409,191).

Since the deal is now generating a lower IRR, the manager receives less promote, but because the manager delays the payment of the preferred return, he offsets those promote loses with higher and sooner performance fees coming from operating distributions.

Harmful to investors and managers: interspersed contributions and distributions

Interspersed contributions and distributions occurs when a stream of contributions is interrupted with one or more distribution events. When that occurs, two waterfall structuring problems arise:

- Investors’ IRR is artificially high, triggering both false expectations and unrealistic promoted interests.

- The risk of the equity requirement exceeding peak equity calculations increases, worsening cash flow reliability.

Let us think of peak equity as the outstanding equity at its lowest point, and equity requirement as the total equity necessary during the deal life. Most times these two metrics result in the same number, which is good practice.

However, there are times in which peak equity results in a lower number than equity requirement. This happens when the two following conditions are met:

- Contributions and distributions are interspersed.

- The distributions that are interspersed are NOT enough to completely offset past and future contributions.

Since the peak equity calculation implicitly assumes a perfect optimization of contributions against distributions, it is a problem when this estimation results in a lower number than the equity requirement as this divergence is an indicator of cash flow uncertainty.

In other words, if peak equity results in a lower number than the equity requirement, the manager does not know for sure how much, nor when, he should distribute so as not to deviate from that implicitly perfect optimization calculation that is peak equity.

To avoid these issues, I recommend offsetting present distributions against future contributions. In other words, equity distributions should only take place once partners are certain that no additional contributions will be made.

Otherwise, not only will IRR and promotes be unrealistically high, but also the risk of investors running out of funds to keep the deal alive increases as the manager does not know for sure how much nor when to distribute.

To illustrate these two problems, let us look at an overly simplistic example in the comparative table below:

Correct structuring: all contributions before any distribution Incorrect structuring: interspersed contributions and distributions

From the example table above, we notice that interspersed contributions and distributions artificially inflate the investor’s IRR by 0.8%, triggering a manager’s promote surplus of $16,792.

All things equal, in real life it is probable that this promote surplus would not have ended in the manager’s pocket because the contributions would not have produced that extra 0.8% IRR. This is because most likely any careful manager would have saved that $200,000-profit in year one and used it to finance the $200,000-loss in year two.

Additionally, in the “incorrect structuring” example above, even though the peak equity is $1 million, the equity requirement is in fact $1.2 million. This is because the equity requirement calculation, contrary to peak equity, which implicitly assumes a perfect optimization of distributions against contributions, simply follows what the cash flows report: that the profit in year one is distributed, and that the loss in year two requires a contribution.

Naturally, for the manager the situation becomes exponentially more difficult if instead of managing just one cash flow stream, he needs to simultaneously run multiple streams of equally confusing interspersed flows.

In a way this problem is for him like being at the center of a crossroads with three dead-end streets:

• Dead-end street one: Distributing less than what he should, and he sacrifices his promoted interest.

• Dead-end street two: Distributing more than what he should, and he faces the embarrassing situation of having to ask his investor midway into the venture for more capital than what they had initially agreed upon.

This outcome would not only be terrible for his reputation as investors could perceive him as someone who does not know what he is doing, but also risky as there is no guarantee that they would count with that additional capital.

• Dead-end street three: Distributing and contributing according to those confusingly-interspersed, erratic cash flows, and again having his reputation damaged as someone who does not how to manage cash in order to distribute nice and steady coupon-like dividends.

• Exit road: Optimally offsetting present distributions against future contributions, starting the distribution process only after he is certain that no additional capital calls will be made.

Opting for this last alternative from the beginning (i.e. all the way from the first financial model iteration):

• Improves the quality of the equity waterfall structure by starting off with a “cleaner” cash flow stream

• Provides a more conservative IRR and a more realistic promoted interest

• Guarantees enough cash savings to comfortably finance future losses without having to ask investors for more capital than what had initially been agreed upon

• Boosts partners’ confidence as the target equity is a more reliable estimation

• Improves investor relations by guaranteeing that after the first distribution, no more capital calls will be made

• Builds up the manager’s reputation as a dependable fund manager with effective cash-management and coupon-style, dividend payment skills.

Please refer to the following link to access an institutional-grade, expert-level cash management model that automatically offsets equity distributions against future equity contributions to avoid falling into the mistakes described above:

Expert Waterfall Structuring and Modeling Pays For Itself Multiple Times

Almost every time that I audit equity waterfalls, I notice that their authors fall into at least one of the aforementioned mistakes. These are only a few of the most common examples in which equity waterfall structuring and modeling can go wrong, but the main issue is that while these miscalculations are rather subtle, they can trigger losses around the tens or hundreds of thousands of dollars, and lead to mutually harmful malpractices between managers and investors.

Whether these malpractices are failures of conceptualization or modeling glitches, these inaccuracies end up representing financial and reputational damages that increase exponentially as deals sizes and risk profiles escalate in magnitude.

An investments advisor with meaningful institutional experience structuring and modeling waterfall structures can make the difference in preventing those losses, and fostering harmonious investor/manager relations as well as aligned value-creation efforts.