When you examine how the philosophy behind VCs (venture capitals) corresponds to an investment strategy on paper, you might conclude that the purpose of VCs is to find the “next big thing” and might believe that VCs are in the search to invest in revolutionary ideas or trends that promise great potential, based on the principle of “great risk, great return.”

You might think that rather than what the market values today, VCs are trying to understand what the market will cherish in 5 years or maybe ten years from now and take a position accordingly.

No. Perhaps that’s how it worked in its early days, but the vast majority of the VC world doesn’t act that way anymore. Today, the areas that mainstream VCs glorify and invest in are the areas that are thought to be still in our lives five years from now or ten years from now. Let’s check out where crypto is today in that regard.

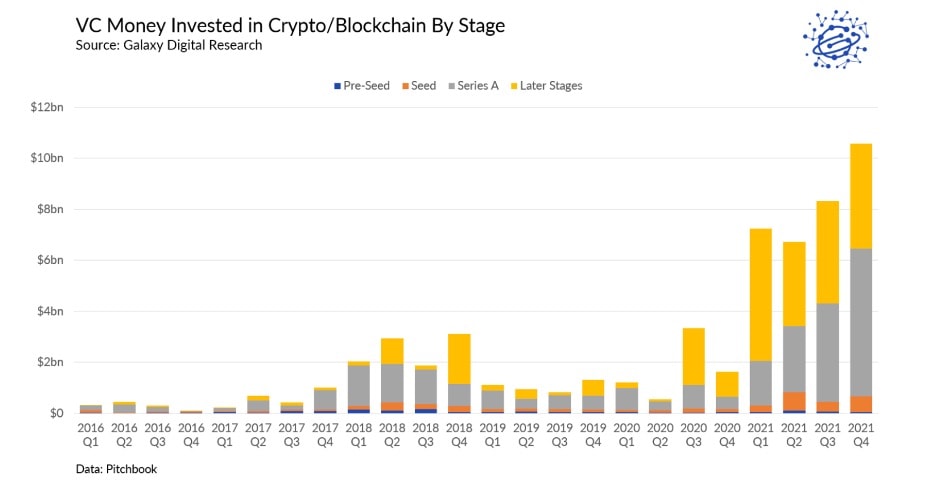

If you look at the chart below on VC interest in crypto, you’ll see how far crypto has come.

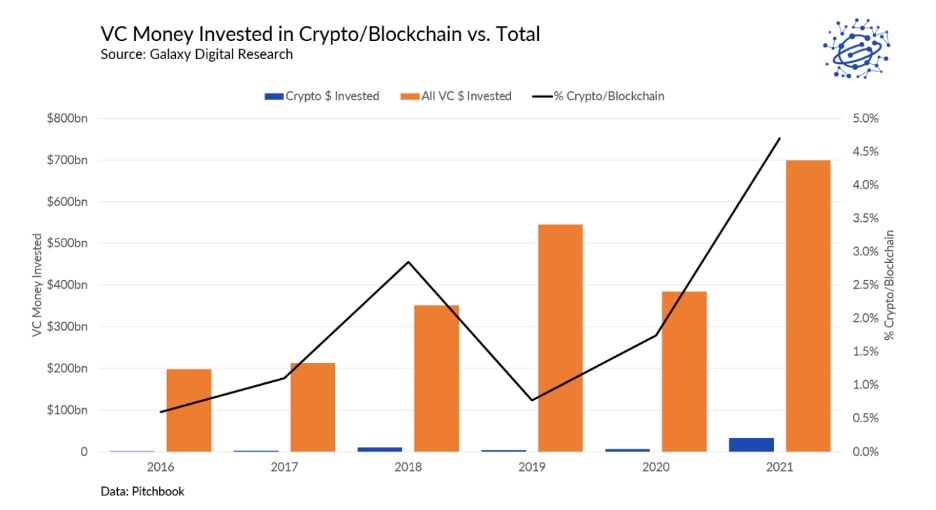

However, looking at the graph below, you can conclude how long the road actually is.

Understanding crypto’s current place and prospects in the VC world is critical as it gives us essential information about under what conditions crypto will become a legitimate investment area. Also, it will provide us powerful clues about the conditions under which crypto will be seen as an integral part of our lives, and it will be commonsense in the traditional finance world that it is here to stay. We can categorize these conditions under three main sections: legal clarity, successful exits, and institutional adoption.

Legal Clarity

VCs are companies that aim to collect funds from their investors, invest these funds in private companies in line with certain principles, and then earn returns from these investments. Since it is an area that is in close contact with liquidity (I mean money in its purest form), the area in which they operate is subject to stringent regulation to ensure investors are protected. As a result, the investment areas of VCs are limited by legal restrictions by the states. For example, in many parts of the world, VCs cannot invest more than a certain percentage of their holdings in liquid investment instruments (foreign currency, gold, etc.). As a result, leading VCs in the industry will be hesitant to enter the space unless governments make predictable and detailed regulations about crypto. Simply put, they will not risk investing in an area that could be declared illegal overnight. You may want to read this interview on the topic.

Successful Exits

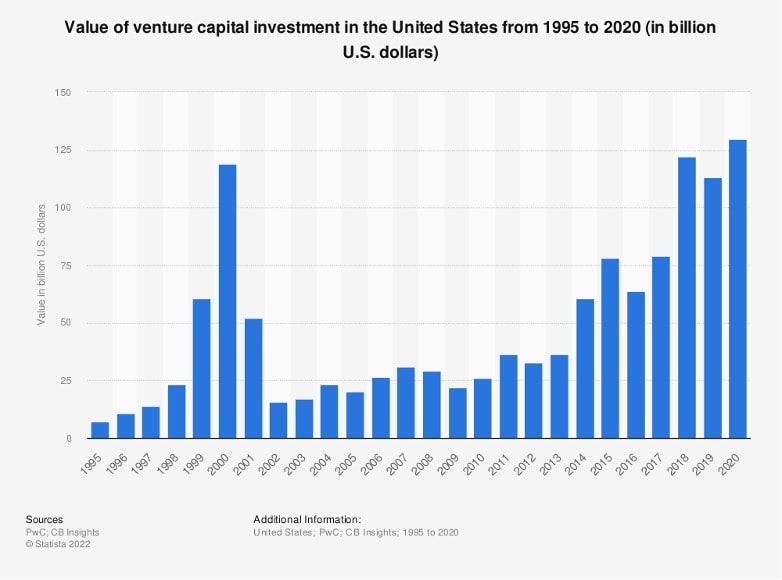

When VCs give money to a company, they don’t expect any interest in return for that money. Also, unlike a loan you get from the bank, if your company goes bankrupt, it cannot come and try to get its money back, even partially, by placing a lien on your office furniture. Because, in return for the money they give, VCs buy shares in a company. Their goal is to sell these shares later for more than their purchase price. So if there is a good exit possibility, you will see VCs appearing around you. These exits usually come in two forms: an IPO or the sale of shares in the secondary market. Companies that went public in the 2000 Dotcom Bubble and traded at incredible valuations triggered VC investments in the IT sector to an astronomical level. According to a PwC survey, around 90% of all VC investment was estimated to be in the IT sector. After the bubble burst, let alone the VC investments in the industry, the value of all VC investments could not reach the same level for a long time.

Imagine you are a high-net-worth individual, and your fund manager friend calls you and tells you that she has started a fund that mainly focuses on software, and you can invest if you wish. Just two minutes ago, you were watching a news piece on the television in your office covering how a software company went public with a record-high valuation, and its share price kept increasing for ten consecutive days. What would you do?

For successful exits to be made, the macroeconomic environment must also be suitable. The risk-off trend, which started with the FED’s rate hikes, probably will continue until rate hikes are expected to end in mid-2023. The deplorable state of the NASDAQ is evident. In this context, a slowdown or reversal of the trend of increased money flow to risk-off assets will be a promising development for crypto and the VC interest in crypto.

Coinbase’s IPO was an important step. However, it is somehow disappointing that its stock performance has been poor. Still, the VCs that participated in the funding rounds achieved a substantial return. Apart from that, companies like Marathon Digital and Riot Blockchain are seen as closely related to crypto, and consequently, their valuations are affected by expectations about crypto. It is essential that we see significant exit multiples and an increased number of exits to be optimistic about VCs’ attention in the sector. Because when a VC invests in any industry, it is always looking for a benchmark in that industry. It wants to create a target for the valuation of the company that the VC is investing in by looking at that benchmark.

Institutional Adoption

If you would pick anyone on the street today, they could give you at least five reasons for how important institutional adoption is. Everyone knows that this is important. However, this article will look at institutional adoption from a different perspective. Here, institutional adoption means large companies increase their crypto-related activities. For example, Robinhood developing a Web3 wallet is an example of institutional adoption. Guess what will happen when crypto and blockchain become ever-growing trends among established big companies? When VCs consider investing in a crypto company, they will begin to take the multipliers and valuations of these vast and highly profitable companies as benchmarks. It doesn’t matter if PayPal is starting to allow crypto payments simply because it increases blockchain technology’s “user count.” This means Paypal stock is now starting to enter the composite indices of crypto companies.

Another effect of institutional adoption is the creation of a certain kind of FOMO (fear of missing out) effect. As big companies that everyone knows enter the crypto space, prominent VCs, followed by everyone, are slowly starting to invest in this area. The result of this can sometimes be a FOMO wave. Yes, you heard right. Organizations can also act under the influence of FOMO because people run them. Especially if it’s a VC, let’s take a mediocre VC with an average performance. The fund manager receives the information that a funding round will be organized for Company A, a growth-stage start-up. What do you think the fund manager will ask first? How big is Company A? How was its sales performance? What is the ticket size for the funding round? No. She will ask first: Who else is participating in the round? If she likes the answer to this question, she will ask the other questions.

Conclusion

The interest of VCs in the crypto space is increasing day by day. Predicting when this interest will evolve crypto into a mainstream investment area such as machine learning or artificial intelligence is closely related to the aforementioned factors. I should also note that I have simplified VCs’ operations at a certain level to underline some points around the article’s main idea. The investment processes of VCs are multi-layered and complex. So, it would be helpful to keep this fact in mind while reaching concise conclusions on this issue.