Vendor due diligence (VDD) plays a critical role in mergers and acquisitions, as it ensures the accuracy and completeness of a seller’s financial, legal, and operational information. By conducting VDD, sellers can identify potential risks and liabilities, allowing them to address any concerns before engaging with potential buyers. This guide will walk you through the VDD process and provide insights on selecting the right consultant to ensure a successful M&A transaction.

Understanding Vendor Due Diligence

Vendor due diligence is a proactive and comprehensive review of a company’s financial, operational, and legal information, conducted by the seller to identify potential risks and address any concerns prior to engaging with potential buyers. By performing VDD, sellers can present a transparent, credible, and well-organized picture of their company, thus expediting the M&A process and increasing the likelihood of a successful transaction. It’s different from commercial or financial due diligence in that sense, because it specifically refers to the sell-side of the M&A deal, whereas most due diligence activities typically happen on the buy-side.

Scope of Vendor Due Diligence

The scope of VDD varies depending on the nature of the business and the specific transaction. Generally, it includes the following components:

- Financial due diligence: A detailed review of historical and projected financial information, including revenues, expenses, cash flows, working capital, and debt.

- Operational due diligence: Evaluation of the company’s operations, including its products or services, facilities, equipment, supply chain, distribution channels, and management team.

- Legal due diligence: Examination of all legal aspects, including contracts, licenses, intellectual property, litigation, and regulatory compliance.

- Tax due diligence: Assessment of tax-related matters, such as historical tax filings, outstanding tax liabilities, and potential tax exposures.

- Environmental due diligence: Review of environmental risks, liabilities, and compliance with environmental regulations.

- Human resources due diligence: Analysis of workforce-related matters, including employee contracts, compensation, benefits, and labor relations.

Vendor Due Diligence Process

The VDD process typically consists of the following stages:

- Planning: Define the scope of VDD, set objectives, and establish a timeline.

- Data collection: Gather relevant financial, operational, and legal documents.

- Analysis and evaluation: Review the collected data, identify potential risks, and assess the company’s performance.

- Report preparation: Compile the findings into a comprehensive VDD report, highlighting key risks and opportunities.

- Presentation: Present the VDD report to potential buyers and address any concerns or questions.

Benefits of Vendor Due Diligence

Conducting VDD offers several benefits, including:

- Enhanced credibility: A thorough VDD report demonstrates transparency and preparedness, increasing the seller’s credibility in the eyes of potential buyers.

- Expedited M&A process: VDD enables sellers to address concerns before engaging with buyers, which can significantly reduce the time spent on negotiations and due diligence.

- Higher transaction value: By identifying and addressing potential risks, sellers can potentially increase the company’s valuation and achieve a higher transaction value.

- Reduced likelihood of deal failure: VDD helps sellers avoid surprises during the M&A process, reducing the chances of a deal falling through.

How to Find the Right Vendor Due Diligence Consultant

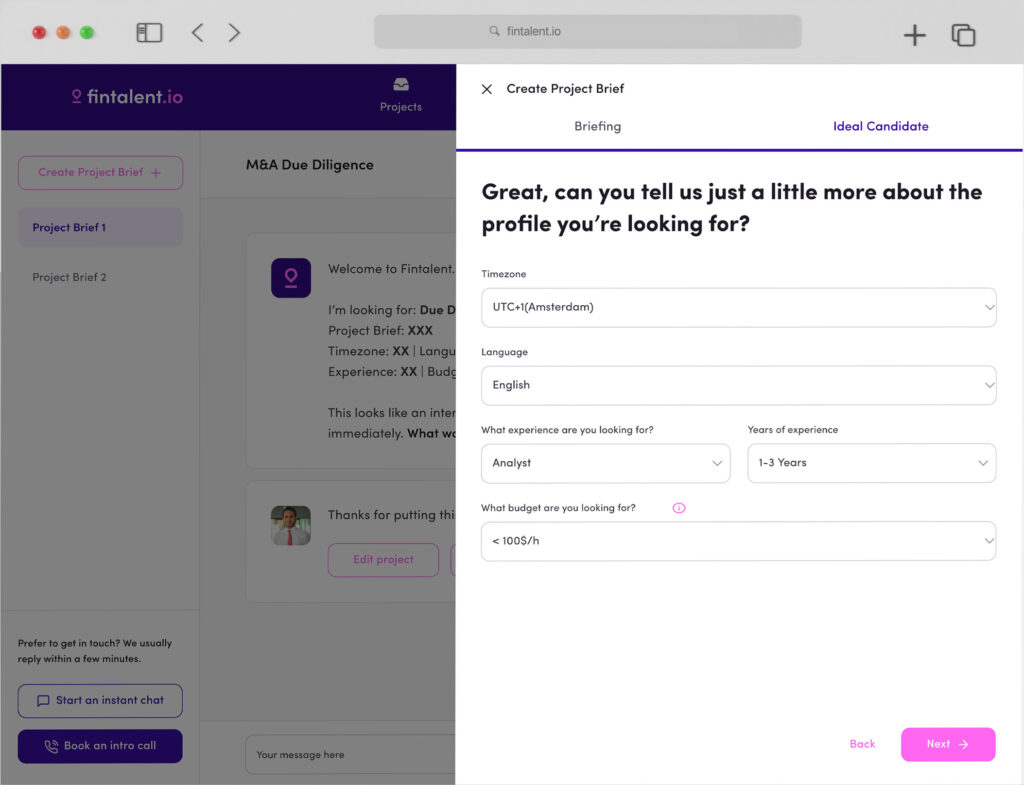

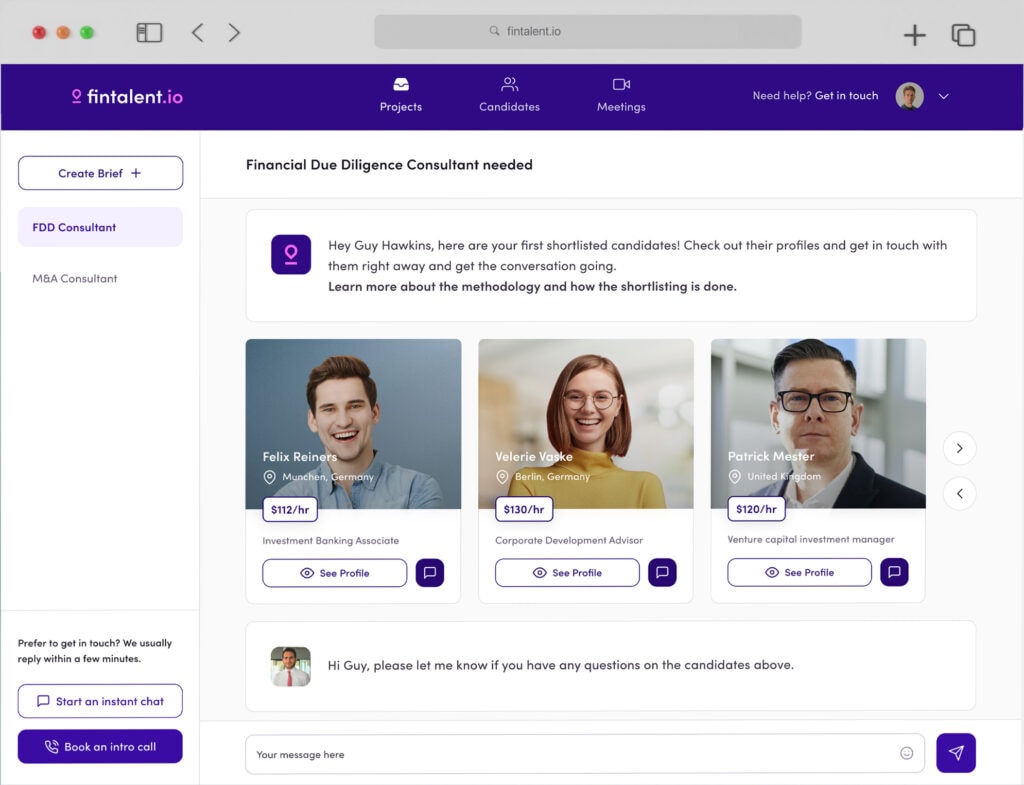

Choosing the right VDD consultant is crucial to ensure a successful M&A transaction. Consider the following factors when selecting a consultant:

- Experience and expertise: Look for consultants with a proven track record in your industry and experience in similar M&A transactions. Their expertise should cover all aspects of VDD, including financial, operational, legal, tax, environmental, and human resources due diligence.

- Reputation and references: Research the consultant’s reputation in the market and seek recommendations from industry peers or previous clients. Check online reviews and testimonials to gauge their level of client satisfaction.

- Communication skills: The consultant should be able to effectively communicate complex findings and insights to both you and potential buyers. Good communication skills are essential for presenting the VDD report and addressing any concerns or questions.

- Resources and capabilities: The consultant should have the necessary resources, such as a team of experienced professionals and access to specialized tools, to conduct a thorough VDD. They should also be able to scale their services to meet the specific needs of your transaction.

- Flexibility and adaptability: The VDD process can be time-consuming and unpredictable. Choose a consultant who is flexible and can adapt to changes in the scope, timeline, or requirements of the project.

- Fees and pricing structure: Request a detailed proposal that outlines the scope of work, deliverables, and pricing structure. Compare fees and pricing structures across different consultants to ensure you are receiving competitive rates and value for your investment.

Conclusion

Vendor due diligence is a critical component of the M&A process that helps sellers present a transparent, credible, and well-organized picture of their company to potential buyers. By conducting vendor due diligence consulting, sellers can identify and address potential risks and liabilities, expediting the M&A process and increasing the likelihood of a successful transaction. Choosing the right VDD consultant is crucial to ensuring a smooth and efficient due diligence process. By considering factors such as experience, reputation, communication skills, resources, flexibility, and pricing, you can select the best vendor due diligence services for your specific needs and maximize the value of your M&A transaction.