Due Diligence Consulting experts play a pivotal role in M&A transactions, offering specialized skills in risk management and profit maximization. These specialists meticulously evaluate business ventures to identify potential issues before sealing an M&A deal.

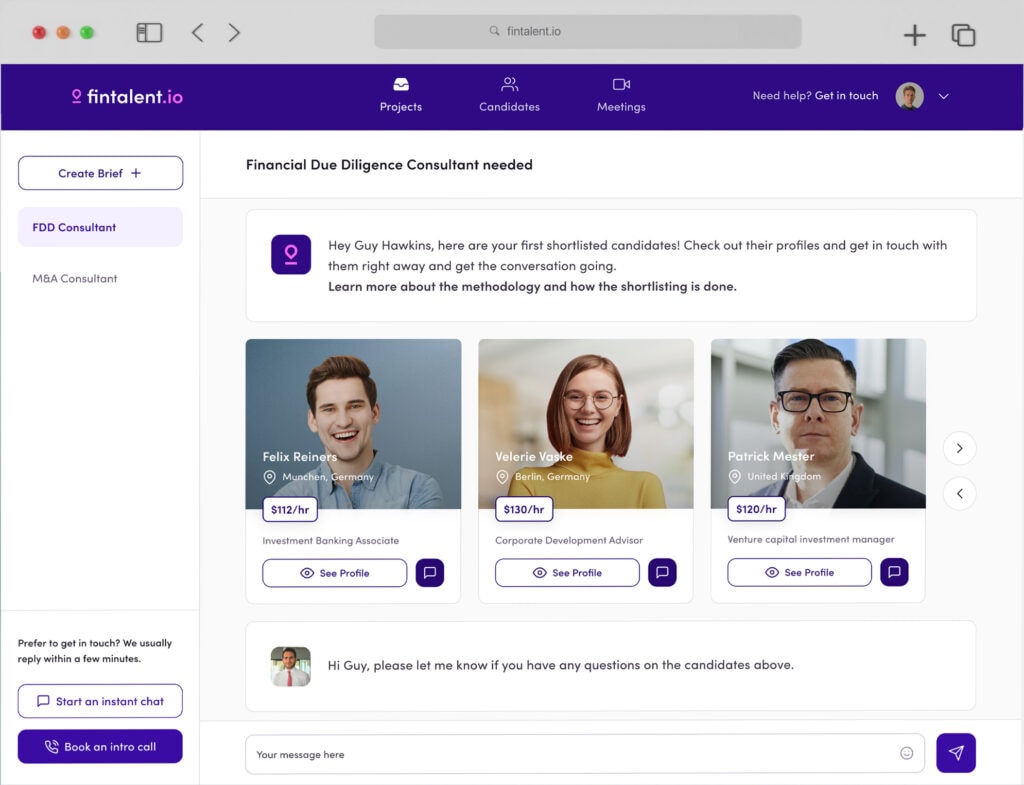

We have more than 3,000 freelance Due Diligence Advisors registered on our platform. They all are experts in their respective fields. But how will you choose the best for your needs?

In this comprehensive guide, we will learn about how to choose the perfect Due Diligence Consultant for your situation and what expertise they will bring to your business.

What is Due Diligence?

Due Diligence refers to the careful and thorough examination of business transaction before making a decision. It involves analyzing all relevant aspects of the deal to eliminate any potential risks. In Due Diligence Services, the primary goal is to gather information about the business factors to make informed decisions and reduce the probability of loss.

A Due Diligence consultant is an important component that navigates this process. Know your needs and choose the best one.

What is the Role of a Due Diligence Consultant?

A Due Diligence consultant assists businesses in complex transaction, Legal, and decision-making processes. This examination normally includes mergers and acquisitions, private equity investments, or other strategically important collaborations.

Let’s explore the roles of Due Diligence Consultants:

Planning Your Project

They outline the scope of the Due Diligence process, indicating crucial areas specific to the transaction type. They can also assist corporations in identifying potential hidden dangers in a deal’s history.

Collecting the Data

Due Diligence professionals gather and meticulously assess crucial data from various sources like legal documentation and industry analyses. They use this data to conduct a thorough assessment of the target company.

Risk Assessment

They detect concealed risks and early indicators of the transaction. The risks may include financial irregularities, legal complexities, or operational hindrances.

Preparing Reports and Giving Recommendations

Due Diligence Consultants investigate your projects and crafts reports. They also recommend ways to eliminate identified risks or enhance the transaction’s value.

What Background Should a Due Diligence Consultant Have?

Due Diligence consultants come from many professional backgrounds, including:

- Investment and Banking: They have expertise in financial markets, mergers & acquisitions, and valuation methodologies.

- Management Consulting: Consultants with management consulting backgrounds are pro in strategic thinking, process optimization, and organizational knowledge to examine Due Diligence thoroughly.

- Corporate Finance or Strategic: These individuals possess a deep understanding of financial systems and how companies make decisions. This skill is incredibly valuable when conducting Due Diligence assessments.

- Legal or Accounting: These Consultants are experts in regulatory compliance, risk assessment, and financial auditing. They ensure a meticulous assessment of all legal and financial aspects.

Moreover, many positions demand advanced education in business or finance, like an MBA, a CFA, or pertinent legal and accounting certifications.

What Skills Should You Consider While Choosing Due Diligence Consulting Services

A skilled Due Diligence expert should possess the following refined capabilities:

- Analytical Skills: Consultants should have strong analytical abilities to sift through complex data and information, identifying potential risks and opportunities.

- Industry Expertise: Industry-specific knowledge can be valuable, especially in complex sectors with specific regulations and challenges.

- Financial Acumen: Understanding financial statements, valuation methods, and financial modeling is crucial for assessing a company’s financial health.

- Legal Knowledge: For legal due diligence, expertise in contract law, regulatory compliance, and litigation history is essential.

- Technical Competence: In IT due diligence, consultants should have technical knowledge to assess IT infrastructure, security, and systems effectively.

- Communication Skills: Your consultant must have clear and effective communication skills. It is vital for conveying findings and recommendations to clients and stakeholders.

- Project Management: Due diligence often involves managing complex projects so that project management skills can ensure a smooth process.

- Research Skills: Consultants need to be adept at researching public records, company documents, and industry trends.

- Attention to Detail: Due diligence requires meticulous attention to detail to spot potential issues.

- Negotiation Skills: In some cases, consultants may assist their clients with negotiations. Check whether your consultant has good communication and negotiation skills.

- Client-Centric Approach: Consultants should be client-focused, tailoring their services to meet the client’s specific needs and goals.

- Ethical Standards: High ethical standards are essential in a Due Diligence Specialist to ensure the integrity of the due diligence process.

Tips to Find the Right Due Diligence Consulting Services for Your Needs?

In order to get the best results, consider the following aspects while choosing Due Diligence Advisory services:

Identify Your Needs

Understand the specific type of due diligence you require, whether it’s financial, legal, IT, HR, or ESG due diligence. Different types may require different expertise.

Check the Background

Look for Due Diligence Support provider with relevant experience in your industry or sector. They should have the expertise to address your sector’s unique challenges and opportunities.

Fees

Understand the pricing structure and ensure it aligns with your budget. Clarify any potential additional costs or expenses with your Due Diligence Specialist.

Ethical Standards and Communication

Ensure that your consultants adhere to high ethical standards and maintain confidentiality throughout the due diligence process. Make sure that your consultant is good at communicating in various scenarios.

Ask Questions

Ask all the questions to satisfy your job needs. Don’t hesitate to ask detailed questions about their process, methodology, and how they handle difficult challenges.

Get Testimonials from Other Clients

Request testimonials and references from previous clients to confirm the consultant’s worth in handling your tasks.

Buy-Side vs. Sell-Side Freelance Due Diligence

Buy-side Due Diligence: In buy-side Due Diligence, a buyer or investor hires a consultant to evaluate the target company. The primary goal of buy-side Due Diligence is to identify potential risks and provide an in-depth assessment of the target entity’s worth and valuable insights. It will help the buyer to make the best decision.

Sell-side Due Diligence: Vendor Due Diligence services are crucial when a company wants to sell its product or business. In this situation, a Due Diligence consultant investigates the buyer’s side and compares it to the client’s business. They find and tackle any possible risks and offer insights to help make profitable decisions.

Why Should you hire a Due Diligence consulting Freelancer?

A freelance Due Diligence consultant’s services can benefit you in many ways. Here are some benefits of hiring a freelancer for Due Diligence:

- Expertise: Freelance consultants often specialize in Due Diligence, bringing a high level of expertise and experience to the table.

- Cost-Efficiency: Freelancers can be more cost-effective than hiring a full-time consultant or establishing an in-house team. You pay for their services only when you need them.

- Flexibility: Freelance consultants can adapt to your specific project requirements and timelines, providing flexibility that might be challenging with permanent staff.

- Customization: Freelance Due Diligence consulting services are truly distinguished by their ability to approach each project from a different angle. They deal with each client individually and provide personalized solutions based on specific project needs.

- Resource Efficiency: By outsourcing Due Diligence tasks to a freelancer, you can free up your internal resources to focus on core business activities.

- Scalability: If your Due Diligence needs fluctuate, you can easily scale up or down by engaging or disengaging freelancers as required.

- Timeliness: Freelancers often have shorter response times, enabling you to complete Due Diligence processes more quickly and make timely decisions.

- Confidentiality: Freelance consultants are typically well-versed in maintaining confidentiality, which is crucial when dealing with sensitive business information.

Different types of Due Diligence Consultant Services?

Operational Due Diligence Consulting Services

Operational Due Diligence consultants help you thoroughly check a company’s operations. They look at things like the management team, how things are made, the supply chain, and quality control. Their insights provide crucial information for making smart investment decisions.

Legal Due Diligence

Legal Due Diligence is crucial in the mergers and acquisitions field. A legal Due Diligence Advisor checks if a company follows all the laws and rules. They review contracts, patents, past legal issues, and employee agreements to find and fix legal problems before a deal is done.

Commercial Due Diligence

Commercial Due Diligence complements Financial Due Diligence by evaluating the business’s market position, competitive landscape, customer base, and prospects for growth to ascertain its commercial feasibility. Together, these due diligence processes provide a comprehensive assessment of a company’s financial and strategic suitability for investment or acquisition.

Financial Due Diligence

Financial Due Diligence consulting examines a company’s financial statements, transactions, and records to assess its financial health and stability. It scrutinizes factors such as revenue, expenses, cash flow, and debt to uncover any potential risks or opportunities. This process helps potential investors, lenders, or acquirers make informed decisions by providing a comprehensive understanding of a company’s financial position. It is a crucial step in evaluating the feasibility and potential profitability of an investment or business transaction.

ESG Due Diligence

An ESG (Environmental, Social, and Governance) Due Diligence Specialist examines how a company affects the environment, what they do for charity, and how it manages its business. Their job is to make sure the company meets ESG rules, which is crucial for socially responsible business practices today.

HR Due Diligence

Human resources Due Diligence is vital for understanding a company’s workforce. It reviews how the target organization is set up, what it pays its employees, how well they get along, and how it handles talent. HR experts help find HR-related problems and opportunities, giving a full view of the workforce.

Taxes Due Diligence

Tax Due Diligence advisors are important for checking a company’s tax matters. They look at whether the company follows tax rules, assesses possible tax problems, and determines what taxes it owes. Their knowledge helps investors understand tax laws and avoid Legal issues after a deal.

IT Due Diligence

IT Due Diligence consultants examine the target company’s technology, systems, security, and strategies before the deal. They make sure it matches the buyer’s plans, like merging or growing in the long run. This process helps their clients avoid IT-related problems after a deal.

How Does Due Diligence Consulting Work?

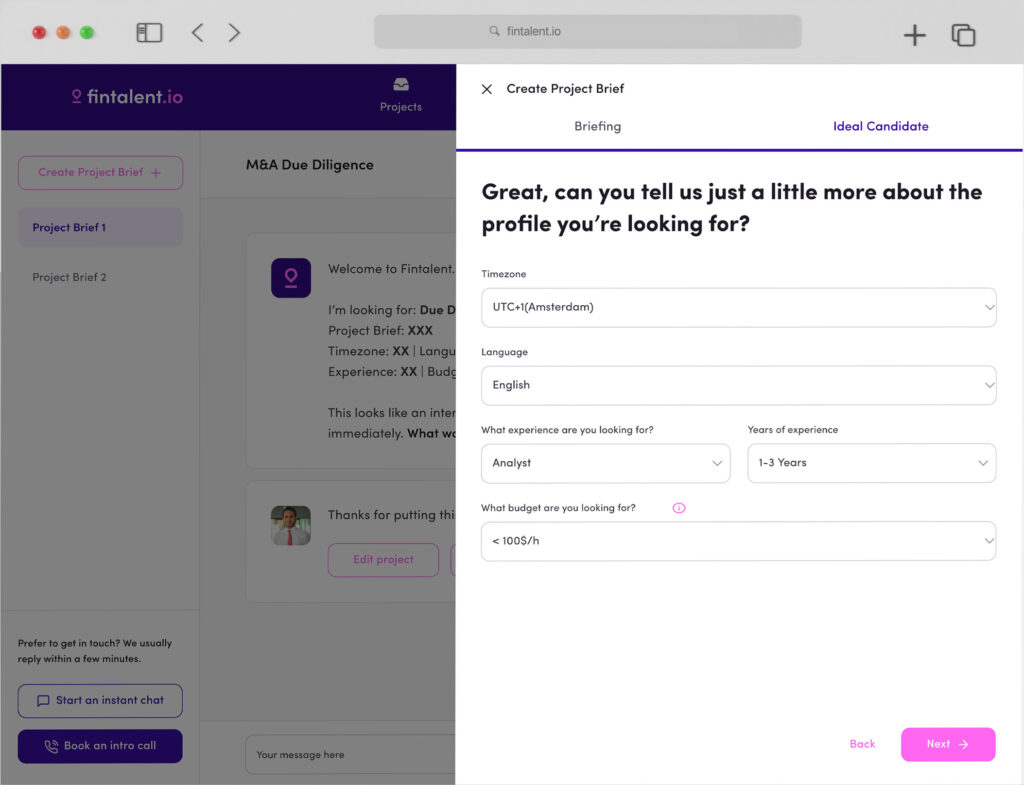

The process is so simple. From defining the scope to executing the plan, your Due Diligence Consultant will be there with you. Let’s understand it step-by-step:

Step 1 – Identifying the Scope

A Due Diligence consultant begins by outlining the whole process. They examine the type of transaction, the industry, and possible risks. Together with the client, they decide which areas must be addressed in the project. This sets the scope for the Due Diligence process from the beginning.

Step 2 – Collecting Data and Analysis

After identifying the scope, the Due Diligence services expert starts collecting data associated with the business. They gather data from various sources like bank records, legal documents, and business reports. This phase involves hard work as they go through a lot of data to find important information and insights.

Step 3 – Risk Assessment

In this step, the specialist examines the gathered data to find any potential threats or warning signs. These risks might range from inefficient business practices to ethical issues to financial irregularities. The goal is to identify these potential problems early so that the client can make informed decisions.

Step 4 – Reporting

After that, your Due Diligence professional reviews the data and identifies the risk factors. The report gives a complete explanation of the consultant’s observations and findings. Then, they recommend the required actions for the best results. It works as a roadmap to enhance the transaction’s value, mitigate risks, and make decisions.

Step 5 – Execution of the Recommendations

Once all the steps are complete, the Due Diligence advisor will help you in the implementation of the recommendations. They provide effective methods of implementation to minimize the risk while maximizing the growth outcomes.

Wrapping It Up

Hiring a freelancer for your Due Diligence consulting can be beneficial for your team. They bring a wealth of specialized assistance throughout the whole Due Diligence process. So, whether you’re planning an acquisition, a merger, or a strategic alliance, investing in freelance Due Diligence services can pay off spectacularly.

Make sure to carefully evaluate their relevant experience before hiring. This thoughtful approach ensures that you select the most suitable Due Diligence consultant tailored to your specific needs.

Join us to hire the best Due Diligence Services or help others as a Professional Consultant.