Hiring a Freelance Venture Capital Consultant can be a strategic move for your company. Venture capital raising is a complicated process. A reliable advisor can help you connect with the right funding partners and eliminate any potential risks in the deal.

Hiring a Venture Capital Advisor can be cost-effective and brings personalized expertise to your business. But they work remotely and you might not even meet your freelancer during the whole project. So it becomes highly important to hire the right candidate. This comprehensive guide is designed to navigate you through the key steps of the hiring process, ensuring that you secure a freelance professional equipped with the expertise and insights needed to elevate your fundraising projects. Let’s get started!

Creating a Detailed Job Description:

An important starting point of this hiring process is to create a comprehensive job description that goes beyond a mere listing of responsibilities. Clearly articulate the scope of work, emphasizing the freelance nature of the role with a focus on flexibility and project-based assignments. Define the duration of the engagement and the expected time commitment to set realistic expectations from the outset.

By establishing a solid foundation in these initial steps, you lay the groundwork for a hiring process that not only attracts top-tier talent but also aligns seamlessly with your company’s specific fundraising goals.

Why Do You Need a Freelance Venture Capital Consultant?

Hiring freelance venture capital consulting services can offer several advantages for individuals or businesses looking to navigate the complex world of venture capital. Here are some reasons why you might consider hiring a freelance venture capital consultant:

Field Expertise

- Specialized Knowledge: Venture capital is a niche field with its own set of rules, trends, and best practices. A freelance consultant brings specialized knowledge and experience in navigating this specific landscape.

- Industry Connections: Consultants often have established networks within the venture capital community, including connections with investors, startups, and other key players. This network can be invaluable in sourcing deals and making strategic partnerships.

Identifying Better Deals

- Access to Opportunities: A consultant can help identify potential investment opportunities that align with your investment thesis or goals. They may have access to a wider range of deals through their network.

- Due Diligence: Venture capital involves thorough due diligence consulting before making investment decisions. A consultant can assist in evaluating startups and assessing their financials, market potential, and other critical factors.

Strategic Guidance

- Portfolio Management: Once investments are made, a consultant can help manage and optimize your portfolio. This includes monitoring the performance of existing investments and providing strategic advice on how to enhance portfolio value.

- Risk Mitigation: Understanding and mitigating risks is crucial in venture capital. A consultant can help identify potential risks associated with investments and develop strategies to mitigate them.

Market Insight

A freelance consultant can keep you informed about industry trends, emerging technologies, and market dynamics. This insight is essential for making informed investment decisions and staying ahead in a rapidly changing environment.

Cost-Effective Solution

Hiring a freelance consultant allows for a flexible engagement model. You can bring in expertise on a project basis without the long-term commitment and costs associated with hiring a full-time employee.

Objective Perspective

An external vc consultant can provide an unbiased perspective on investment opportunities. They don’t have the same internal biases that may exist within a company, ensuring a more objective evaluation of potential investments.

Which Industries Should Hire Freelance Venture Capital Consulting Services?

- Startups: Startups seeking initial funding rounds can benefit from a freelance venture capital consultant’s expertise. These consultants can navigate the fundraising landscape, provide Initial public offering consultancy, and connect with potential investors.

- Investors: Angel investors or high-net-worth individuals looking to make strategic investments in startups can also hire freelance venture capital consultants. They can help them to identify promising opportunities, conduct due diligence, and manage their investment portfolios.

- Corporate Ventures: Large corporations may hire freelance consultants to help identify and evaluate strategic investments in startups that align with their business goals. Companies looking to forge partnerships or acquire innovative technologies can also benefit from venture capital consulting services to identify potential targets and assess their viability.

- Small and Medium-sized Enterprises (SMEs): SMEs looking to expand their operations, enter new markets, or launch innovative products may engage venture capital consultants to explore funding options and attract strategic investors.

- Government Agencies and Incubators: Organizations focused on promoting economic development may hire freelance vc consultants to support local startups and businesses in securing venture capital funding.

Educational Background and Essential Skills to Look for

Here are some educational qualifications and skills that you should look for in the ideal Venture Capital Expert candidate:

Educational Background

- Finance, Business, or Economics Degree – A strong foundation in finance, business, or economics is crucial. This provides the consultant with the necessary understanding of financial markets, investment principles, and economic trends.

- MBA or Advanced Degree – An MBA or an advanced degree in a related field can demonstrate a higher level of expertise and strategic thinking. It may also indicate a broader understanding of business operations.

- Venture Capital or Finance Certification – Certifications specific to venture capital or finance, such as the Chartered Financial Analyst (CFA) or Certificate in Private Equity and Venture Capital (CPEVC), can be valuable credentials.

Essential Skills

- Due Diligence – Ability to provide thorough due diligence advisory on potential investment opportunities.

- Financial Modeling – Their proficiency in financial modeling consultancy can help in assessing the financial health of potential investments and forecast future performance.

- Deal Sourcing – They must be skilled in deal sourcing advisory and identifying better investment opportunities.

- Portfolio Management – They should also be experienced in portfolio management advisory and making strategic adjustments as needed.

- Strategic Thinking – Ability to think strategically and align investment decisions with overall business goals.

- Communication and Negotiation Skills – Strong communication and negotiation skills are essential to effectively convey complex financial concepts and navigate agreements with entrepreneurs and other stakeholders.

- Networking and Relationship Building – Strong networking skills to build and maintain relationships within the venture capital community.

- Analytical Skills – Strong analytical skills to interpret data, identify patterns, and make data-driven investment decisions.

The Hiring Process

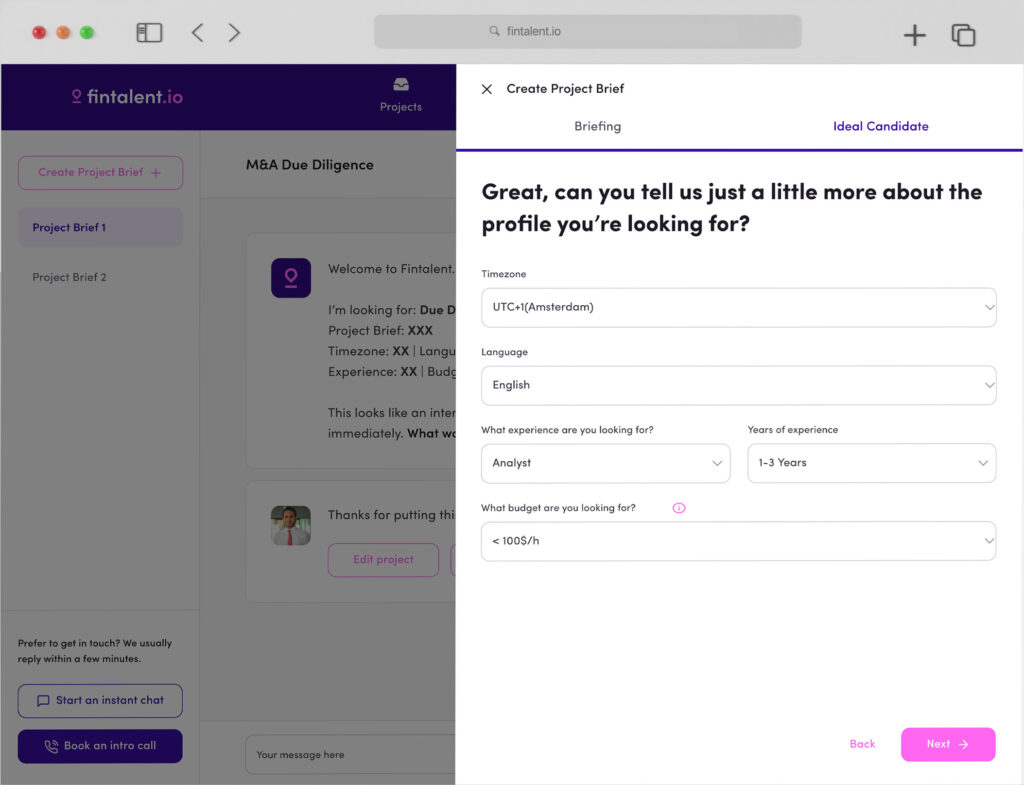

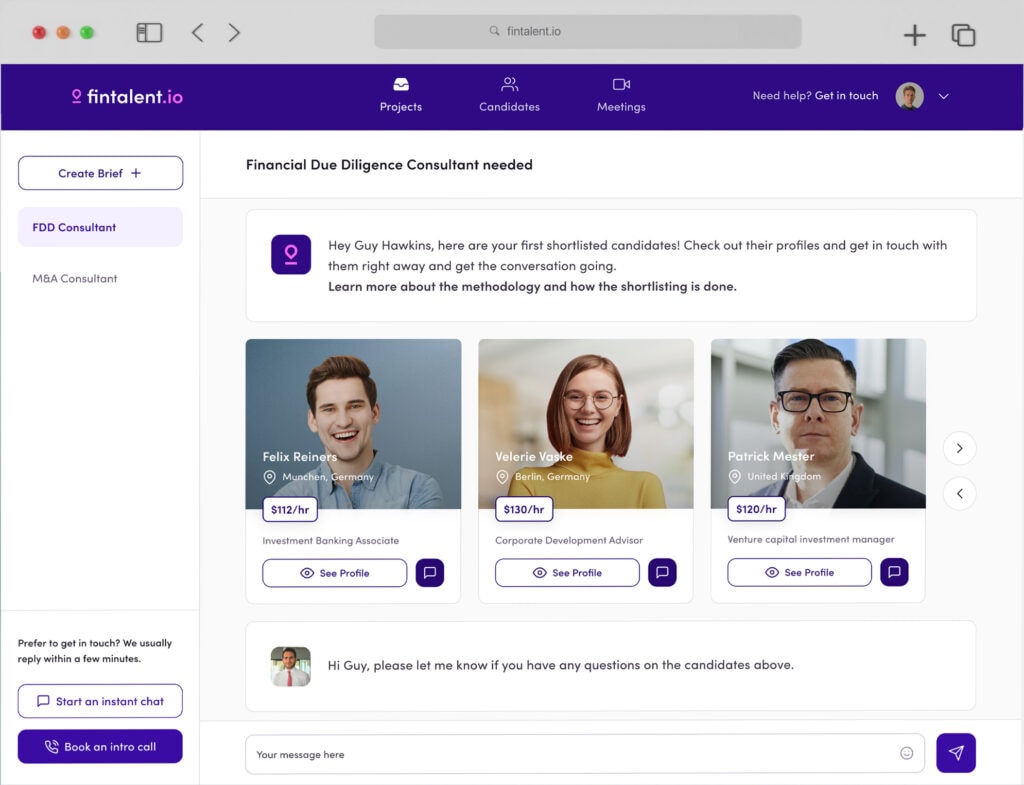

Step 1. Define Your Requirements – Clearly outline your specific needs, including the type of services required, the duration of the engagement, and any industry or sector preferences.

Step 2. Develop a Job Description – Create a comprehensive job description that includes an overview of your business or investment goals and specific responsibilities or background.

Step 3. Shortlist – Carefully review the received applications and shortlist candidates based on their qualifications, experience, and alignment with your needs.

Step 4. Conduct Initial Interviews – Conduct initial interviews with shortlisted candidates to assess their communication skills, and cultural fit, and further evaluate their expertise.

Step 5. Request Work Samples – For candidates who pass the initial interviews, request work samples or case studies showcasing their previous venture capital consulting projects.

Step 6. Check References – Contact references provided by the candidates to verify their work history, reliability, and the quality of their services.

Step 7. Final Interview – Conduct a final interview with top candidates to delve deeper into their approach to specific challenges and how they align with your business goals.

Step 8. Negotiate Terms – Once you’ve identified the ideal candidate, discuss and negotiate the terms of the vc consulting engagement. Clarify expectations, including deliverables, timelines, and compensation.

Step 9. Onboarding – Once the terms are agreed upon, facilitate a smooth onboarding process. Provide access to relevant resources, introduce the consultant to key team members or stakeholders, and establish clear communication channels.

Conclusion

Hiring a freelance venture capital consultant emerges as a strategic move, offering specialized expertise without the commitment of a full-time salary. Understanding the consultant’s role is crucial, emphasizing their industry connections, adaptability, and ability to provide strategic guidance. In assessing candidates, a balance of educational background, such as a finance degree or MBA, and essential skills like due diligence and strategic thinking, ensures a well-rounded selection. Follow this step-by-step hiring process to ensure seamless integration of the chosen consultant and a successful collaboration aligned with the company’s objectives.

Sign up now to hire the best venture capital specialists or Join as a talent!