The #1 resource for M&A tools

Short description

Boopos loan programs offer entrepreneurs an alternative to bureaucratic lenders, slow-moving business banks, and complex SBA loan approval processes.

Unlike traditional financial institutions, Boopos doesn‘t require your business plans, credit history, annual revenue, balance sheets, cash flow statements, tax returns, liabilities, bank accounts, or bank statements to kickstart your loan application.

Key Features

– Fast funding

Get pre-approved in 48 hours, funded in 7 days. High loan approval rates.

– Flexible repayment

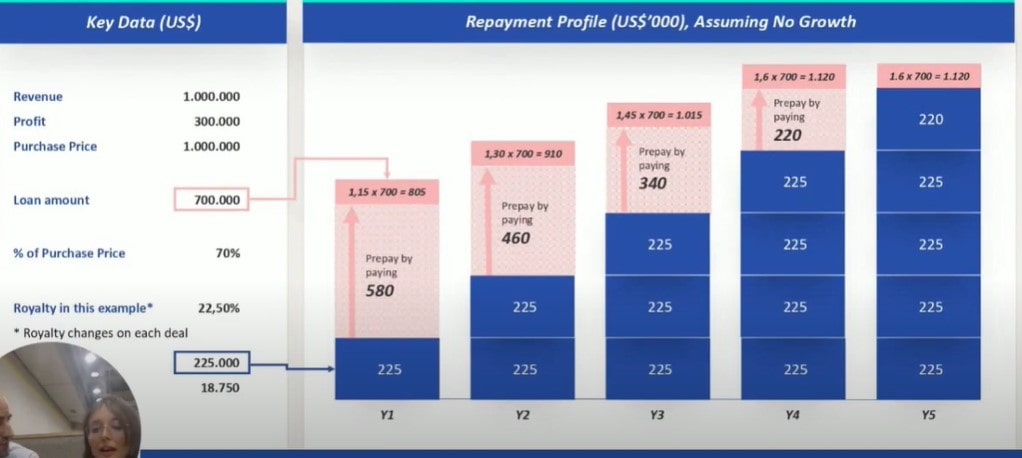

Repay your business acquisition loan in up to 5 years. No prepayment penalty.

– No personal guarantee

Non-diluted, revenue-based business financing for acquisitions. No need to put your personal assets at risk.

Pricing

There aren’t any fees for applying for Boopos Loan.

Boopos charges interest on the loans.