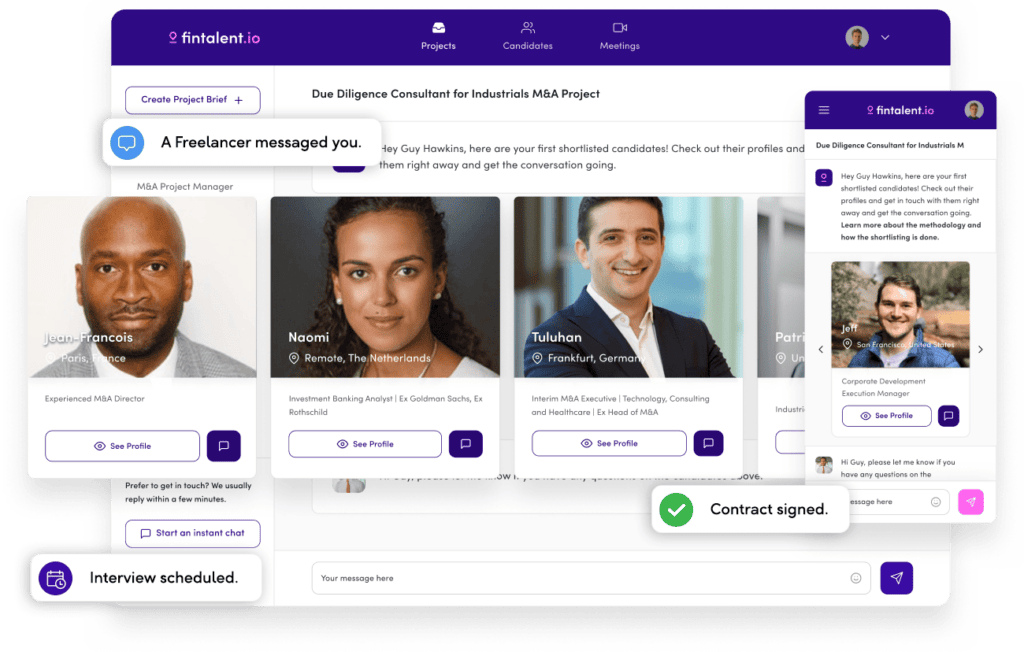

M&A Freelance Platform

The Fastest Way To Staff M&A Projects.

From Origination To Integration.

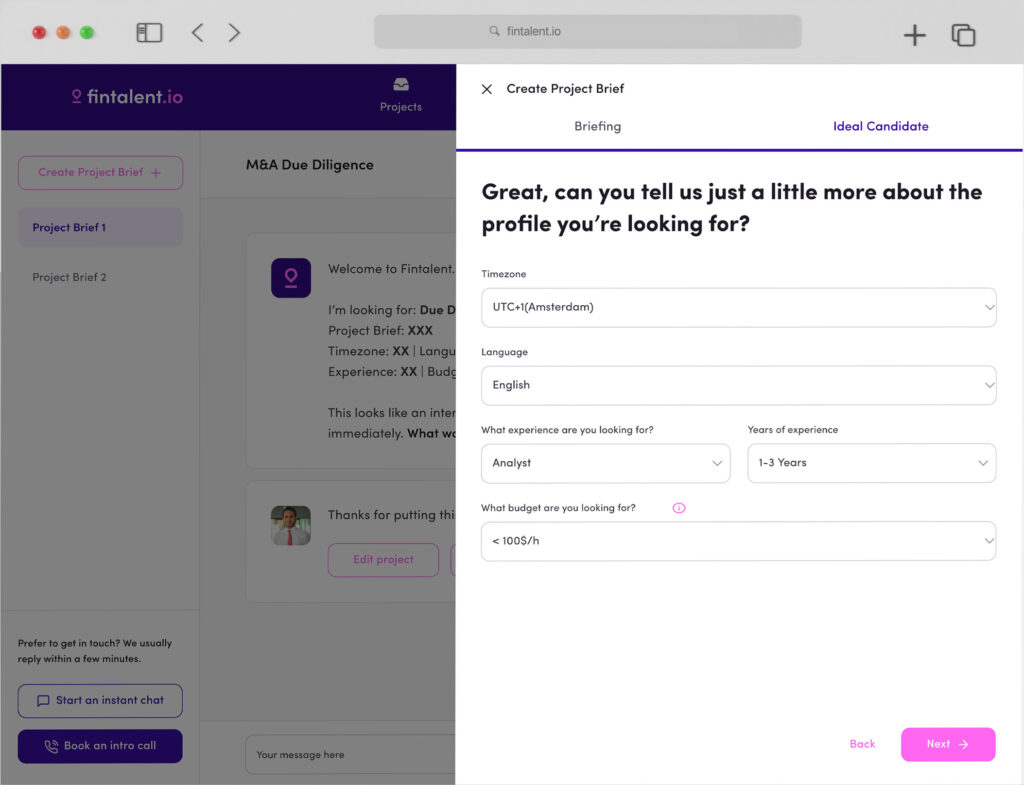

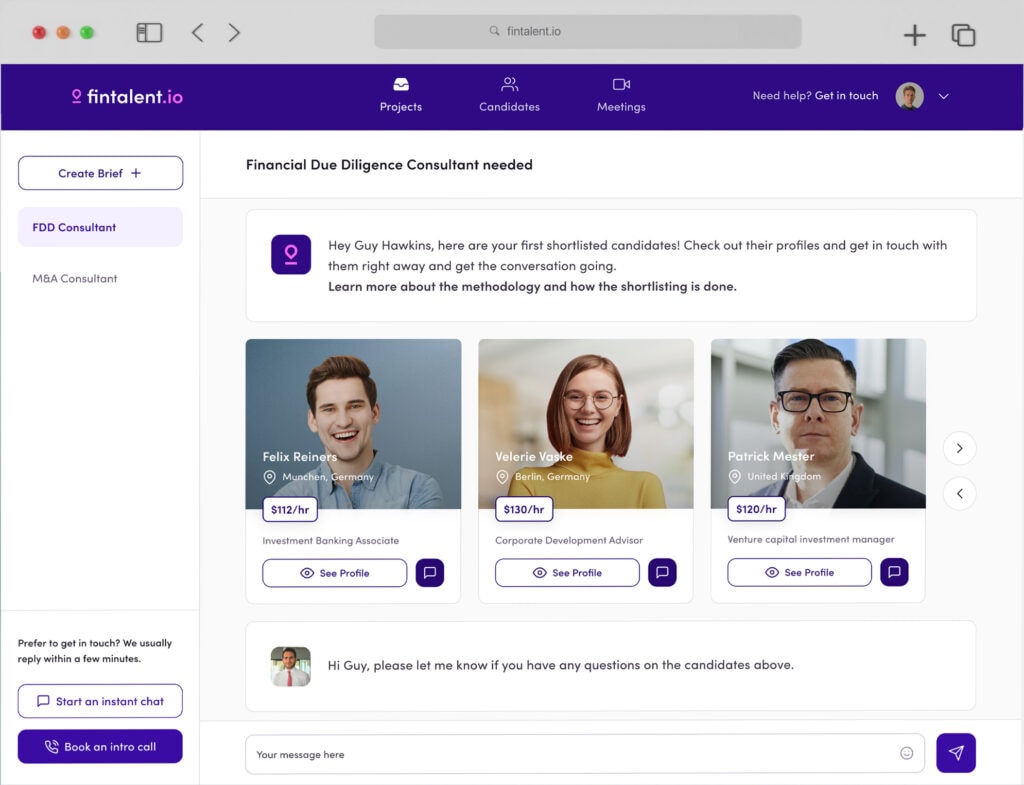

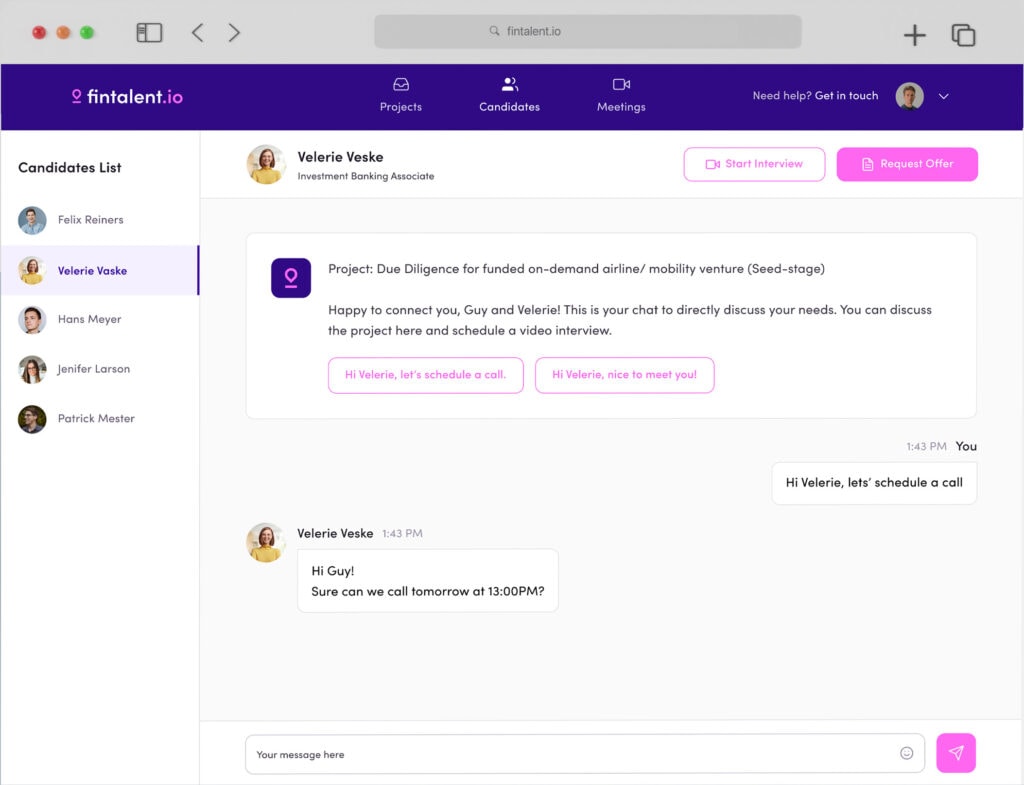

Get proposals from 3,000+ buy-side M&A freelancers within hours through the Fintalent platform.

- No signup fee

- Personal service

- 62 countries

Prefer to talk? Book a call. Want to sign up as freelancer? Learn more.

Trusted by M&A Teams at

We serve Leading Portfolio Companies and Corporate M&A Divisions Globally.

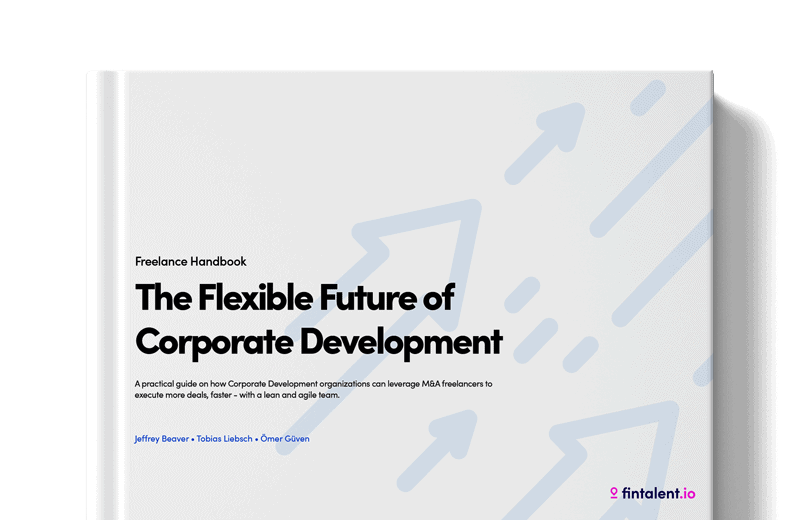

Want to build a more flexible M&A Team?

Download our free 25-page practical guide about M&A freelancers. Learn who they are, what projects they work on, and plan your onboarding with practical checklists and guides for your freelance collaboration.

Connect with the right M&A Freelancer within Hours

Find Freelance Consultants in these categories

Recently Posted Projects

German junior/ mid-level M&A/ PE professional to support PE on outreach for add-on acquisitions

Project

- We are looking for a M&A Freelancer, who can support us on a Buy-Side outreach Initiative for potenial Add-Ons aquisitions for one of our portfolio companys

- We would require the person to lead the project from sourcing a target list to sending out first POC letters/calls for us to take over each contact for a Management Meeting

- Project will probably take 6-12 weeks

Portfolio Services & Add-on M&A

France-based VP/Director level M&A/ PE Professional to soupport on buy & build assignments (deal Pipeline building, management and execution)

Project

Our Client is a specialized M&A Advisory boutique with various retained buy-side mandates, mostly for SMEs and Corporates. The client is looking for a client-facing, hands-on professional to work directly with clients on converting qualified European targets (with an identified buy-and-build strategy) into actual deals and executing them, engagement, and project management up to closing.

Corporate Development

US-based Fractional CFO for PortCo of US Private Equity firm

Project

Looking to hire a fractional CFO to help at private equity-backed portfolio company

Portfolio Services & Add-on M&A

eCommerce M&A/PE specialist to conduct FDD

Project

I'm looking for someone with deep financial experience within the consumer goods sector, including strong track record conducting diligence and investing in eCommerce brands. Initially, this will include a high-level primer on due diligence analysis for eCommerce channel specifically, and then into an consulting engaging on a live deal.

Due Diligence

France, Singapore or Australia-based PMI Manager to lead integration of recent acquisition

Project

Need a PMO for a post-merger integration project (Australian acquisition) in the cybersecurity distribution sector. the PMO has to have sufficient experience in integrations to drive and coordinate an integration project internally.

Project Management Office (PMO)

Post Merger Integration (PMI)

Value Creation & Enhancement

UK-based Strategy consultant to complete CDD of UK Dental Market

Project

Looking for a freelancer to completed commercial due diligence of a Dental consolidation play. Business currently has 4 clinics.

*Please indicate a fixed price estimate for this project in your application note

*Management/ Strategy Consultants only

*Prior experience in the UK-Healthcare Market

Due Diligence

Divestiture/ Disposal of Chinese operations for a global TIC player.

Project

Our Client is a global player in the TIC market looking to exit its business unit in China. The Clients is looking for an M&A advisory firm to support with the disposal.

*China-based, a track record of mid-market deals, and experience with Chinese SOE/ private buyers is a must

Sell-side M&A

📄 Germany-based mid- to Junior VP level M&A/ PE professional to support Corporate M&A Lead of leading electric utility company. Start: ASAP

Project

Our Client is a leading multinational electric utility company based in Germany. The Corporate M&A lead is looking for a (Junior) VP to support corporate development/ M&A activities for 3 months

Travel to Essen at least 3 days/ week may be required.

Tasks include: - Assist in the identification and evaluation of potential acquisition targets. - Support in transaction structuring, negotiation, and finalization. - Aid in the due diligence process – financial, legal, operational, and technical. - Collaborate with the finance team for financial modeling, valuations, and synergy estimations. - Coordinate with external consultants, legal counsel, and financial advisors.

Corporate Development

Due Diligence

Portfolio Services & Add-on M&A

Sell-side M&A

Junior AND Senior M&A professional based in Asia to support sell-side M&A mandate

Project

Our Client is a former bulge bracket Senior banker who has a sell-side mandate on hand who is in need of two (2) Fintalents:

1. Analyst AND

2. Senior Associate/VP (6+ yrs experience) to help with the execution of sell-side M&A, primarily Q&A VDR and completing project. IM and VDR are done.

*FIG experience preferred but no must

Sell-side M&A

VC/ M&A Consultant to support UK-based mobility/ delivery service platform in the fundraising process (*logistics experience preferred)

Project

A freelancer to help a start-up on designing an investor pitch.

Assisting the company's founder and senior management to prepare a professional investor deck. The candidate is expected to take full leadership and execution, incl. competitive landscape research, understanding the company's product and unit economics and benchmarking it to others, and upgrading the business plan to the standard expected in the investor community.

As the company operates an on demand same day intracity delivery digital platform in the UK, a good understanding of B2B logistics and courier services is important.

Capital Raising

Fundraising strategy

Sell-side M&A

Reclaim your freedom.

Sign up as M&A Freelancer.

- Join 3,000+ other vetted Fintalents on the largest platform for independent M&A consultants.

- Find exciting projects and decide where and when you want to work on M&A deals.

- Message and connect with other community members and build your own neo M&A boutique.