An Interim CFO is a temporary chief financial officer who works for a company for a limited time period. They play a pivotal role during CFO transitions, workload crises, or in the need for specific financial expertise. Organizations use Interim CFO services to keep their financial work running smoothly and accurately.

We connect you with a wide network of expert freelance interim CFOs to help your business in critical times. The candidates listed on Fintalent are highly skilled and have the necessary qualifications to do the job. However, there is no one-size-fits-all candidate. You must select the proper temporary CFO with the suitable skill set to meet your needs.

In this guide, we will help you navigate the vast realm of freelance interim Chief Financial Officers. Keep reading till the end and know how to hire one for your company. Let’s start!

Understanding Temporary CFO

An interim CFO, also known as a temporary Chief Financial Officer, is an accounting executive hired by organizations to fill the CFO role for a defined period. They are typically brought in to address specific financial challenges, provide strategic financial planning and analysis, and manage financial functions. These executives play a crucial role during leadership transitions, financial crises, mergers, startups, and special projects. Their expertise and experience help organizations to effectively address financial issues and meet specific objectives within the timeline.

List of Interim CFO Services – Roles and Responsibilities

Here is an overview of the temporary CFO services:

- Financial Analysis and Strategy: Interim or Temporary CFOs analyze the company’s financial performance to identify underlying strengths and weaknesses. Afterward, they implement optimized financial strategies focusing on financial stability, growth, and profitability

- Risk Management: They assess and mitigate financial risks, such as market fluctuations and internal control issues, to safeguard the organization’s financial health.

- Regulatory Compliances and Financial Reporting: A reliable interim CFO is responsible for accurate and on-time financial reporting. They prepare financial statements and comply with regulatory requirements, laws, and industry standards to avoid legal issues.

- Cost and Cash Flow Management: Temporary CFOs monitor the organization’s cash flow and forecasting to maintain liquidity, support operations, and make investments where necessary. They also identify opportunities to reduce costs and improve cost-efficiency across the organization without compromising quality.

- Tax Planning: A temporary CFO optimizes your tax strategies to minimize the organization’s tax liability while staying compliant with tax laws.

- Succession Planning: Organizations hire interim CFOs for a temporary time period. They may assist the businesses in transitioning and onboarding a permanent CFO after the interim assignment ends.

- Special Projects: Interim CFOs are well known to bring specific financial expertise. They take on special financial projects, such as system implementations or process improvements, to address particular organizational needs.

What Are the Benefits of Freelance Interim CFO Services:

- Cost-Efficiency: Freelance interim CFO services are often more cost-effective than hiring a full-time CFO, as you can engage their services for specific projects or durations.

- Specialized Expertise: Freelance interim CFOs typically have diverse industry experience and technical skills. It allows them to address unique financial challenges and bring fresh insights to your organization.

- Immediate Availability: You can onboard freelance interim CFOs quickly, providing immediate financial expertise during critical times, such as transitions or crises.

- Flexibility: You can tailor the engagement to your organization’s needs, whether a short-term project or a longer-term assignment.

- Objective Perspective: Freelance interim CFOs offer an unbiased outsider’s perspective, helping to identify and address financial issues without internal biases or politics.

- Knowledge Transfer: They can facilitate knowledge transfer to your existing team, enhancing the skillset and capabilities of your existing staff.

Educational Background Of Interim CFOs?

Interim CFOs basically come with a bachelor’s degree in accounting, finance, or business administration. However, many interim chief financial officers pursue advanced degrees such as MBA, CPA, CMA, CFA, or ACCA to enhance their financial expertise and marketability. While formal education is important, what sets CFOs apart is their extensive industry experience and track record of success in executive financial roles, often accrued over many years.

Essential Skills to Look For:

- Financial Expertise and Strategic Vision: An interim or temporary CFO should have a deep understanding of financial management and accounting principles. They should have the ability to develop and implement strategic financial plans according to the organization’s objectives.

- Industry Knowledge: Choose a candidate with industry-specific knowledge for navigating sector-specific challenges and ensuring compliance with relevant regulations.

- Problem-solving and Analytical Skills: Strong problem-solving and analytical are essential for identifying financial issues and developing effective solutions swiftly.

- Leadership and Communication: Effective leadership skills, coupled with strong communication abilities, are necessary for guiding the finance team, motivating staff, and interacting with stakeholders.

- Adaptability: They should be able to quickly adapt to the organization’s culture, processes, and team dynamics. It will help in a smooth transition and effective performance.

- Risk Management and Project Management: Skills in assessing and mitigating financial risks, plus managing complex financial projects, are essential to protect financial stability and achieve specific objectives. They should also be able to manage strong internal control.

Practical Steps to Hire Interim CFO:

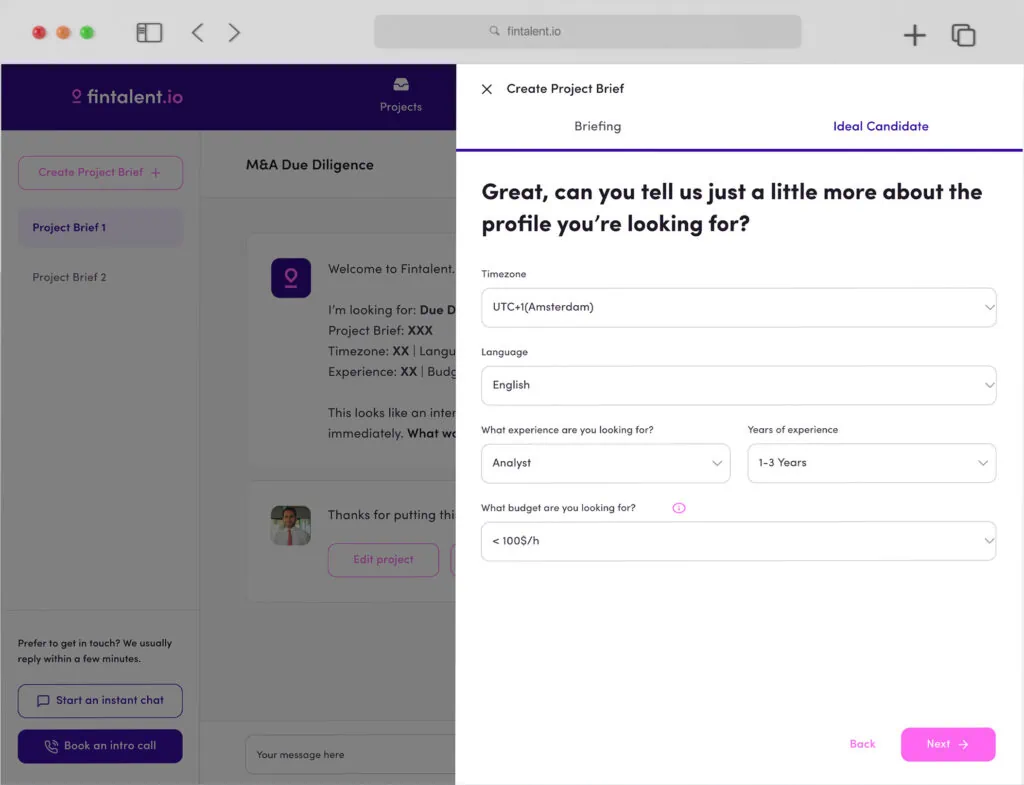

Define Your Needs – Clearly identify why you need an interim CFO. Ask yourself about your specific goals, challenges, and timeframes. Set a minimum and maximum budget limit for more clarity. It will help you create a detailed job description and better understand your expectations.

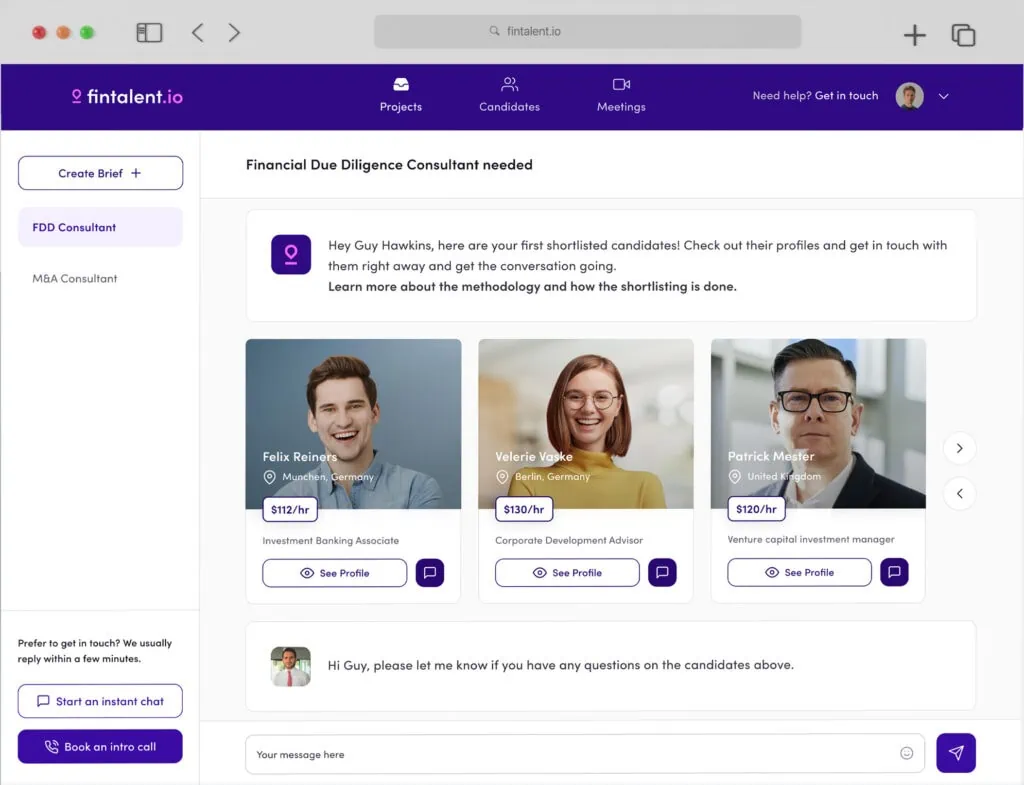

Shortlist Candidates – Based on qualifications, professional credentials, and industry-specific designations, shortlist candidates who closely meet your job description.

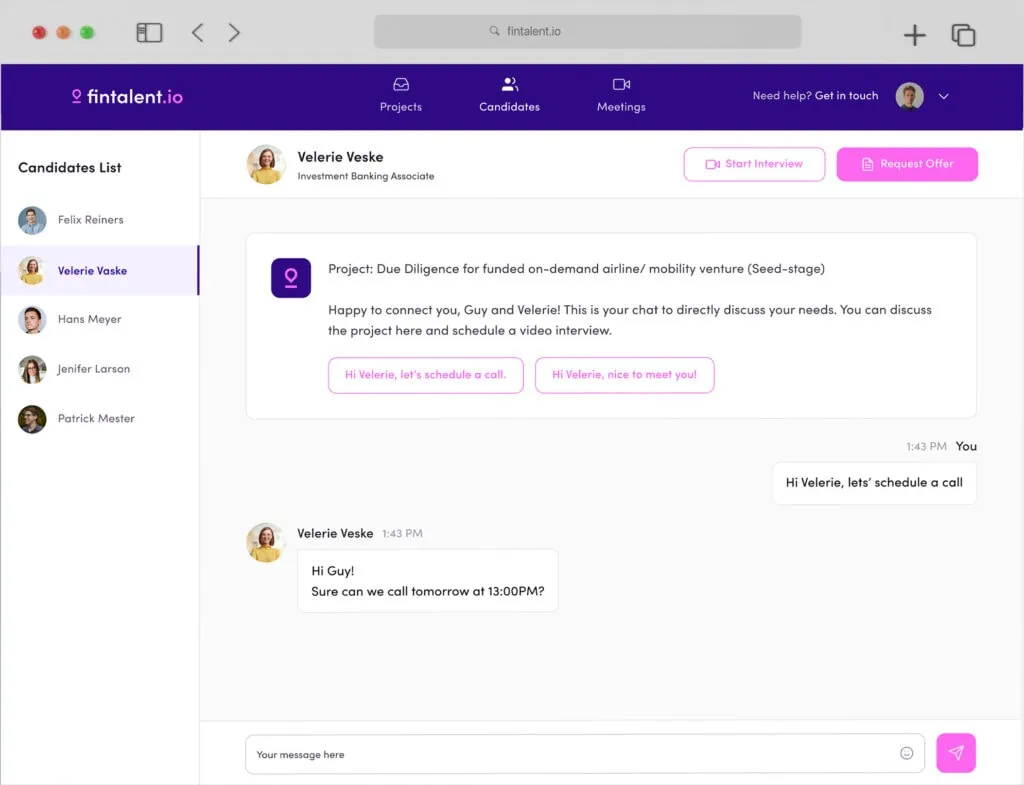

Conduct Interviews – Conduct in-depth interviews with the shortlisted candidates. Assess their technical skills, problem-solving abilities, leadership qualities, and their fit with your company culture. Ask about their communication skills, teamwork, work approach, and adaptability to ensure you are hiring the right fit.

Ask for Preferences – Check their professional references to verify their qualifications and learn about their past performance. Ask about their previous jobs and contact with the clients to know more about their work approach.

Contract and Expectations – After selecting the interim CFO, clearly outline the terms of the contract. Discuss the duration of the assignment, compensation, and any other expectations related to the project. Make sure that the candidate understands the scope and deliverables.

Who Should Hire a Freelance Interim CFO?

Any organization that needs assistance with its financial affairs may benefit from an Interim CFO. However, a temporary CFO may be more beneficial for Startups, Small and Medium-Sized Enterprises (SMEs), Companies in Transition, Financially Distressed Organizations, Project-Based Initiatives, Nonprofit Organizations, and Companies with Seasonal Needs.

Difference between Fractional and Interim CFO consulting

A Fractional CFO and an Interim CFO serve distinct roles within a company, primarily differentiated by the duration and scope of their responsibilities.

A Fractional CFO works part-time, offering financial expertise on a long-term but less than full-time basis. Typically engaged by small to mid-sized businesses, they help with strategic planning, financial forecasting, and improving operational efficiencies. Fractional CFOs often work with multiple companies simultaneously, focusing on high-level financial strategy.

An Interim CFO, on the other hand, is a full-time position filled on a temporary basis, often during a transitional phase for a company. They may be hired during mergers, acquisitions, or while searching for a permanent CFO. Interim CFOs dive deep into the company’s financial matters for a short period, focusing on immediate needs such as crisis management or transactional activities.

In summary, Fractional CFOs offer long-term, part-time strategic financial guidance, while Interim CFOs offer full-time, short-term solutions for immediate financial challenges.

Conclusion:

Hiring the right interim CFO services is a critical decision for any organization, and it involves careful consideration of various factors. It’s imperative to define your organization’s specific needs, shortlist candidates with the right qualifications and skills, and conduct thorough interviews to ensure a good fit. The educational background, industry knowledge, and essential skills of an interim chief financial officer are key factors to evaluate. By following these practical steps and understanding the benefits of hiring a temporary CFO, your organization can make an informed decision to navigate financial challenges and achieve its objectives effectively.