Financial Modeling: From esoteric to required skill

Not long ago, in the early 90’s, Financial Modeling was a bit of weird, esoteric fringe-topic. Excel was still pretty new at the time.

Today, it’s probably the first skill any finance professional thinks of when it comes to describing a part of their career. Financial modeling, valuations, Excel – few topics are so closely linked to the world of finance and investment.

Ian Schnoor, Co-Founder and Executive Director of the Financial Modeling Institute (or short FMI), has been on the forefront of that shift. Over the past 20 years, he’s taught thousands of professionals all over the world the intricacies of financial modeling – and how to make business and investment decisions with them.

First things first: what is a Financial Model, really?

On the surface, any spreadsheet that helps you make financial decisions is a Financial Model. But in the context of corporate finance, it’s a tool that forecasts financial statements into the future. And that’s why today, it’s the groundwork for pretty much any investment decision in the finance world.

The key: Financial Models should facilitate business and investment decision-making. And that’s where things get tricky: Just because something looks, sounds, and smells like a spreadsheet, it doesn’t mean it’s a useful Financial Model.

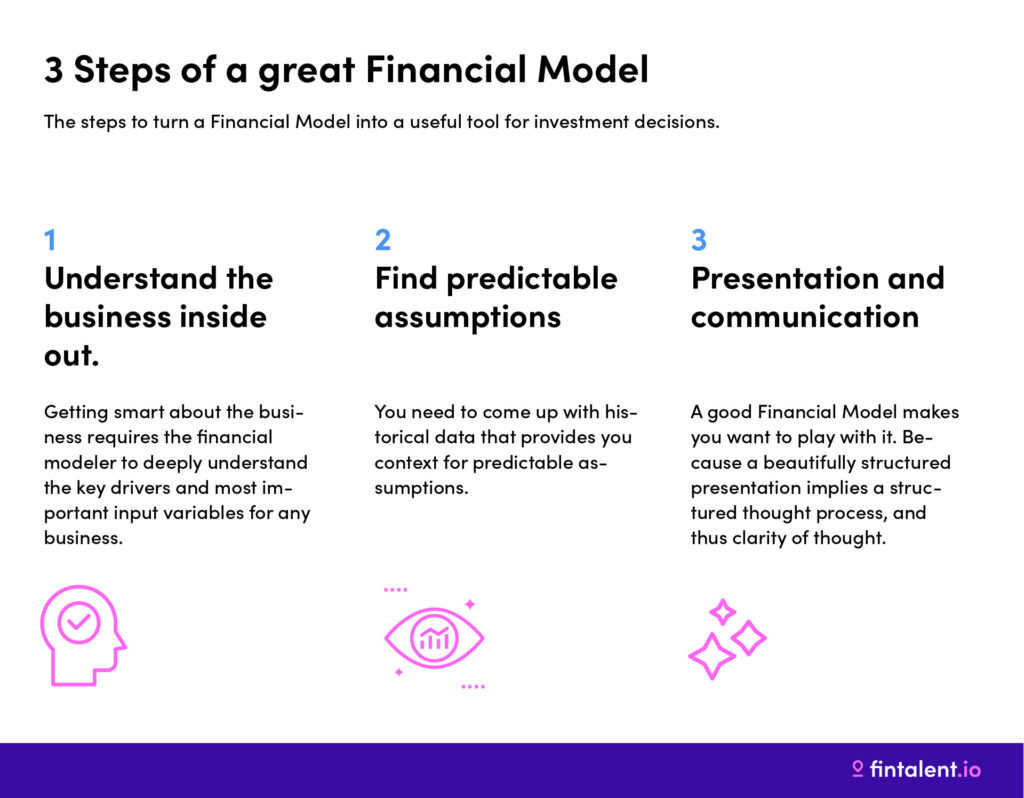

In the interview (find the full episode below), Ian walks through the three steps to turn a Financial Model into a useful tool for investment decisions. And it all starts with understanding the business.

Step 1: Understand the business inside out

“The most important job of a good financial modeler is not just to build some calculator in a spreadsheet”, Ian says. “It’s to get really smart to understand the business.”

Getting smart about the business requires the financial modeler to deeply understand the key drivers and most important input variables for any business.

What is the business selling? What prices do they try to realize? What are their interest rates?

A good modeler only spends half their time inside their spreadsheet. The rest of the time they’re doing researching, trying to learn about the business.

Ian Schnoor

Any business can be modeled in five minutes. But is that really useful? Read what Ian says about the example of Tesla:

“A major pitfall with models is that the business is not being understood. Let’s take Tesla as an example.

They’re in the news. Everyone talks about it. Building a Financial Model for them would take five minutes. Literally, we could do it in five minutes because what we could do is download last year’s financial statements for Tesla.

And then what a lot of people do to forecast the future of a company is simply apply growth rates. So I could say, let’s assume revenue for Tesla’s gonna go at 5%, and the costs are gonna go 3%, and the depreciations gonna stay constant. And interest is like so. You and I could make some very high-level assumptions and build a forecast for Tesla in five minutes.

But we would understand nothing. We would have no insight into the business. We would not be able to speak intelligently with anybody, but we would have a forecast. And so many models that I look at are like that. Someone built a forecast, they applied growth rates across the board, and they know nothing, and it’s useless.

Instead, we have to dig deeper:

- What exactly is Tesla selling?

- What are the top five products?

- The top five cars they’re selling?

- Okay, what are the additional features that they sell?

- What do we expect the volumes to be and why is that gonna happen?

- And what do we think prices are?

- They just offered a pricing discount at the end – How do we think they’re gonna hold pricing?

- What kind of costs do they have?

If we can truly go through and understand the business, and we can, then we come away with a tremendous understanding and we can speak intelligently to anybody about the future prospects of a business.”

Step 2: Find predictable assumptions

Our job in a model is to understand what are the inputs we need to forecast and drive each of those elements? And this is where it gets interesting. This is where it gets creative and bespoke.

Ian Schnoor

For Ian, step two of a Financial Model is to list all the assumptions that will be predictable – financial statements, business news, etc. The goal is to get historical insights into the development of the business, to make predictable assumptions for its future.

If you model a startup, you probably don’t have that kind of historical data, but you can still talk to people and ask what they think will happen, what the cost structure looks like, what the debt is, what the interest rates and tax situation looks like.

Either way, you need to come up with historical data that provides you with context for predictable assumptions.

Step 3: Presentation and communication

“When your analysis and your model is clunky, people assume that your entire thought process is clunky”, Ian says. “They assume that your ideas are not well thought out. They assume that it’s hard to follow.”

Financial Models need to work, but they need to deliver more than just a functional Excel sheet. They need to be beautiful – and beautiful means ease of use and a good user experience. Can I play with the switches? What are some upside and downside scenarios?

A good Financial Model makes you want to play with it. Because a beautifully structured presentation implies a structured thought process, and thus clarity of thought.

“Investors will take a pass cause there’s no clarity of insight and ideas. On the flip side, a well-designed model makes it look like you put a lot of thought into the issue”, Ian concludes.

Conclusion

Financial Modeling is not rocket science, and the underlying factors of any business are pretty simple. But in order to make well-grounded financial decisions, a great financial model needs to show a deep understanding of the business, take historical insights into account, and present the data in an engaging way.

“Modeling doesn’t need to be that difficult. It’s not that complicated. People understand companies are not that difficult. They, they have revenues, they have costs, they generate income”, Ian Schnoor concludes.

“It doesn’t need to be brain surgery, and people make a real mess of their models. And that’s why there’s a huge need for consistency for elevating people’s skills so the world can make better financial decisions regarding companies.”

Listen to the full story in The Wall Street Lab podcast.