Are you looking for a freelance financial due diligence expert but are confused by too many options? Don’t worry; we’ve got you covered!

Companies or investors hire FDD consultants to conduct comprehensive research on the financial health of the target company. This process ensures that the transaction is good for the business and will provide lucrative benefits in the future. An FDD consultant examines all the financial aspects of a target company. It helps firms capture hidden growth opportunities and make plans to mitigate any type of risk.

So, join us as we explore the best way to find a freelance FDD consultant that perfectly fits your project’s needs. Get practical tips and make an informed decision!

What Does an FDD Consultant Do?

A freelance financial due diligence consultant is like a financial detective who carefully investigates the money-related aspects of a company, investment, or deal. They dig into financial records, look for money problems or hidden risks, identify corporate governance issues, and create detailed reports. These reports help people or businesses make smart decisions about their money. FDD consultants are experts at spotting financial troubles and advising both the buyer and seller side.

Buyer Side and Seller Side FDD

We usually think that FDD is only conducted by the investor or buyer side during the M&A process. But it’s not true! Sellers or companies also go through this process to eliminate potential risks. Let’s understand both the buy side and the sell side FDD:

- Buy-side FDD – In this process, the buy side hires an FDD consultant to investigate the financial health of the target company. Buy-side financial due diligence can help you know the actual value of the transaction and make an informed investment decision.

- Sell Side FDD – Most deals fail because of the financial issues inside a company. Business owners also conduct financial due diligence in the context of an exit readiness project to understand the condition of their organizations and make essential changes. It prepares them to deal with potential buyers and investors more efficiently and increases success rate.

Who Needs Financial Due Diligence Consultants?

An FDD consultant is typically needed by various individuals, organizations, and entities in different situations and contexts. Here are some of the key stakeholders who often require the expertise of an FDD consultant:

Buyers and Investors: Individuals or companies considering acquiring another business or making an investment often engage FDD consultants to assess the target company’s financial health, risks, and opportunities. It helps them make informed decisions about their investment.

Sellers and Business Owners: Sellers preparing to divest their businesses may hire FDD consultants to conduct sell-side due diligence. This process helps identify and address any issues or weaknesses that could impact the sale and enhances transparency to attract potential buyers.

Investment Bankers: Investment banks and private equity firms may employ FDD consultants when evaluating loan applications or potential financing opportunities. It helps assess the creditworthiness and financial stability of the borrower.

Individual Investors: High-net-worth individuals and individual investors may seek financial due diligence consultants’ services when considering investments in financial instruments. Consultants help them make informed investment decisions by evaluating the potential of the target entity.

How Do Freelance Financial Due Diligence Consultants Work?

Step 1 – Meeting and Planning

After hiring, the freelance FDD consultant will arrange a meeting with you and the target company to make an optimized strategy. In this meeting, your freelance consultant will discuss the project’s scope, specific mechanism, documents to be collected, employee list, and procedure of the FDD.

Step 2 – Field Work

Once the strategy is final, your freelancer financial due diligence consultant will approach the target company and perform the following activities:

- Collecting and Analysing the financial data

- checking accounting documents and related papers

- Interviewing people related to the financial field

- Re-calculating data with proper models

- Observing Physical inventories and client base

Step 3 – Reporting

This is the final step of the process! After the fieldwork, the consultant will prepare and send you the FDD reports. If the report contains something critical, they can request a direct meeting for a better understanding.

What to Look for in an FDD Consultant – Educational Background and Skillset

1) Educational Qualifications: You should look for an FDD Consultant with at least a bachelor’s degree in finance, accounting, or a related field. Prefer consultants with special certifications like Certified Public Accountant – CPA, Chartered Financial Analyst – CFA, Certified Management Accountant – CMA, or Certified Due Diligence Professional – CDDP.

2) Relevant Experience: Ensure the consultant you choose has a proven track record in financial due diligence in similar industries and transaction types. They should also have work experience in M&A. For extensive Financial Due Diligence execution, professionals with a background in auditing and risk assessment, for instance at a Big 4 company, might be a good choise.

3) Financial and Analytical Skills: An FDD consultant should have strong financial analysis skills. It will help you analyze financial statements and identify any irregularities or inconsistencies in financial records.

4) Communication and Negotiation Skills: Your consultant should have effective communication and negotiation skills to convey recommendations. It will help businesses stay connected with all the stakeholders and understand in-house processes.

5) Data Analysis Tools: They should be well familiar with the latest tools and software to make financial due diligence efficient.

Things to Consider While Choosing a Freelance FDD Consultant:

Now, you know almost everything about FDD consultants. Follow these steps and choose the right freelancer for your unique needs:

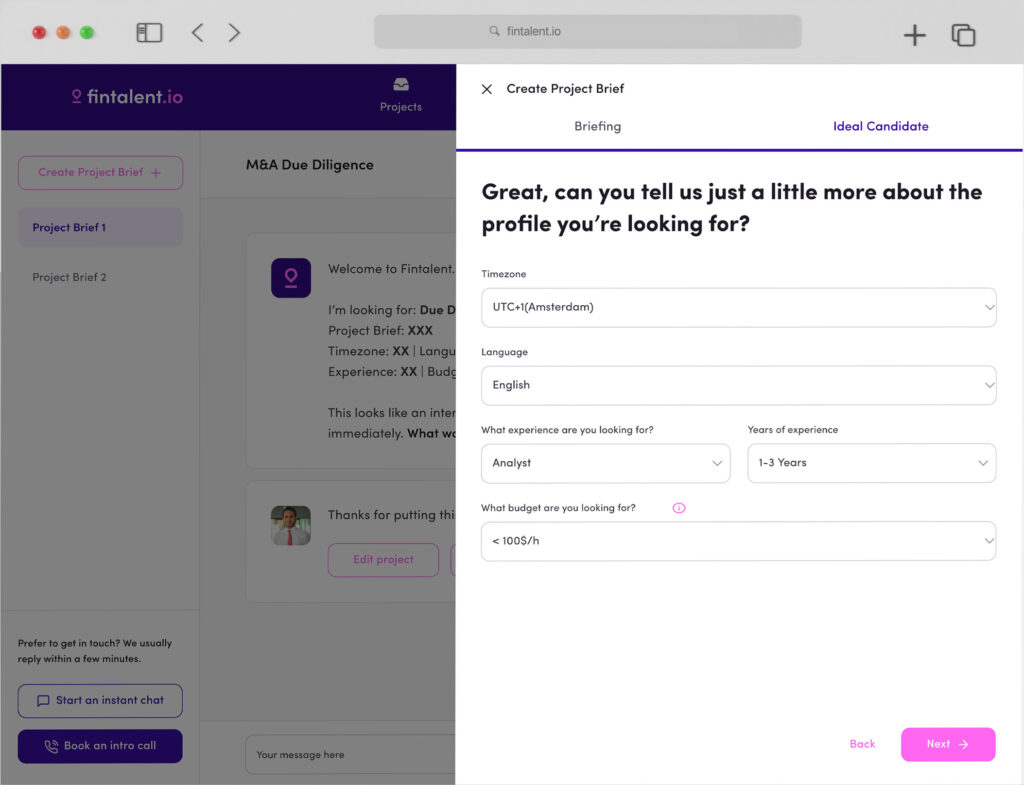

Understand your needs: Know the requirements of your project and identify any specifications required for the evaluation. Outline your needs clearly and search for a freelance FDD consultant that fits your job description.

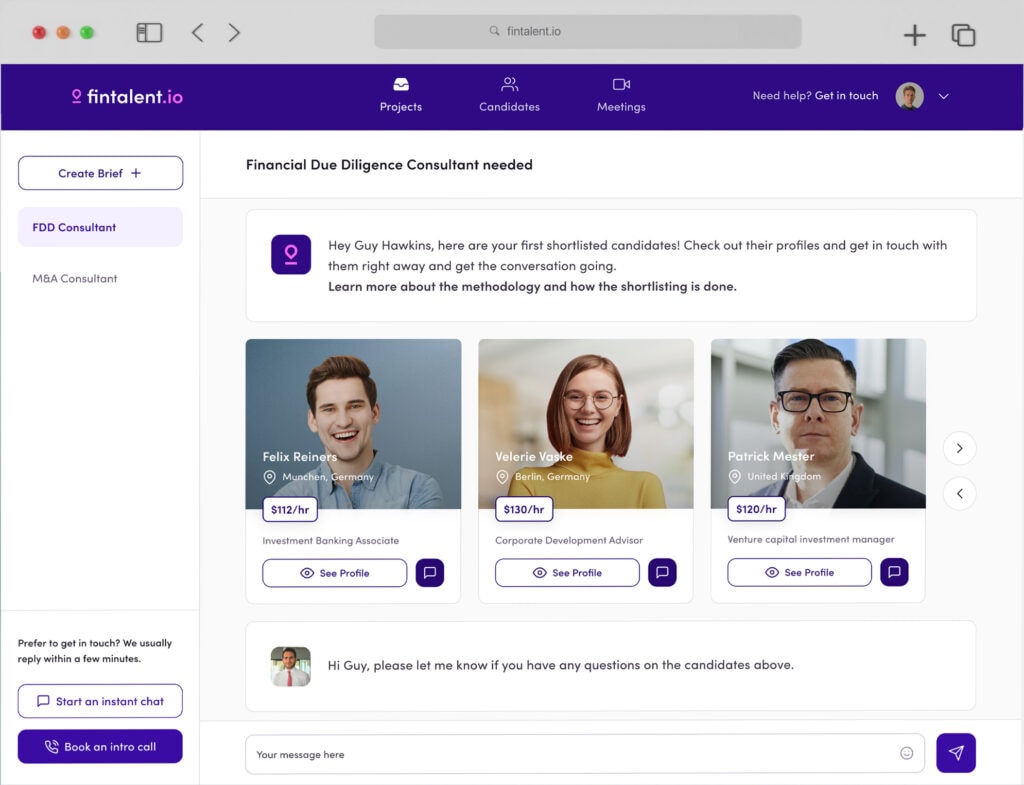

Expertise and Experience: Look for a consultant with a proven track record in financial due diligence. Their experience in similar industries and transaction types can significantly impact the quality of their analysis.

Reputation and References: Check for client references and reviews to assess the consultant’s reputation. Positive feedback from past clients can provide valuable insights into their reliability and professionalism.

Cost and Budget: Clearly define your budget and expectations upfront. Ensure the consultant’s fees align with your budget constraints and that no hidden costs are associated with their services.

Communication and Reporting: Assess the consultant’s communication skills. Effective and transparent communication is crucial for conveying findings and recommendations throughout the due diligence.

Availability and Timing: Discuss the consultant’s availability and project timelines. Ensure they meet your deadlines and are committed to dedicating time and effort to your project.

Interview Candidates and Take Your Time: Interview more clients and get as many options as possible. Compare them all, ask questions, and hire the best one. A wrong FDD consultant can be hazardous to your business’s financial health. So, take your time and choose carefully.

Some Red Flags to Avoid While Choosing an FDD Consultant:

Here are some Red Flags that you should avoid while hiring a good freelance FDD consultant:

- Lack of Experience: You are dealing with money, so don’t rely on inexperienced people.

- Unclear Communication: If the consultants do not provide straightforward answers to your questions, they might be hiding something!

- Unwillingness to Share References: It could be a sign of past performance issues or a lack of credibility.

- Inflexible Terms and Pricing: Consultants unwilling to negotiate terms may not be a good fit for your needs.

- Limited Availability: If the consultant is too overwhelmed with other tasks, they might be less effective for your project.

- Inadequate Technology or Tools: Consultants who lack access to modern financial analysis tools or software may not be efficient enough.

- Dragging you away from the Platform: If the freelancer is asking to communicate outside the platform, be aware! It might be a fraud!

Final Thoughts:

It is necessary to choose the right freelance FDD consultant for the good financial health of your business. Whether you’re on the buy side or sell side of a transaction, these consultants can help you make an informed decision. Follow the steps in the guide and choose the freelance FDD consultant according to your needs. Always look for the red flags and avoid such consultants that can harm your business. With your dedication and the right FDD consultant on your side, you can achieve your desired results.

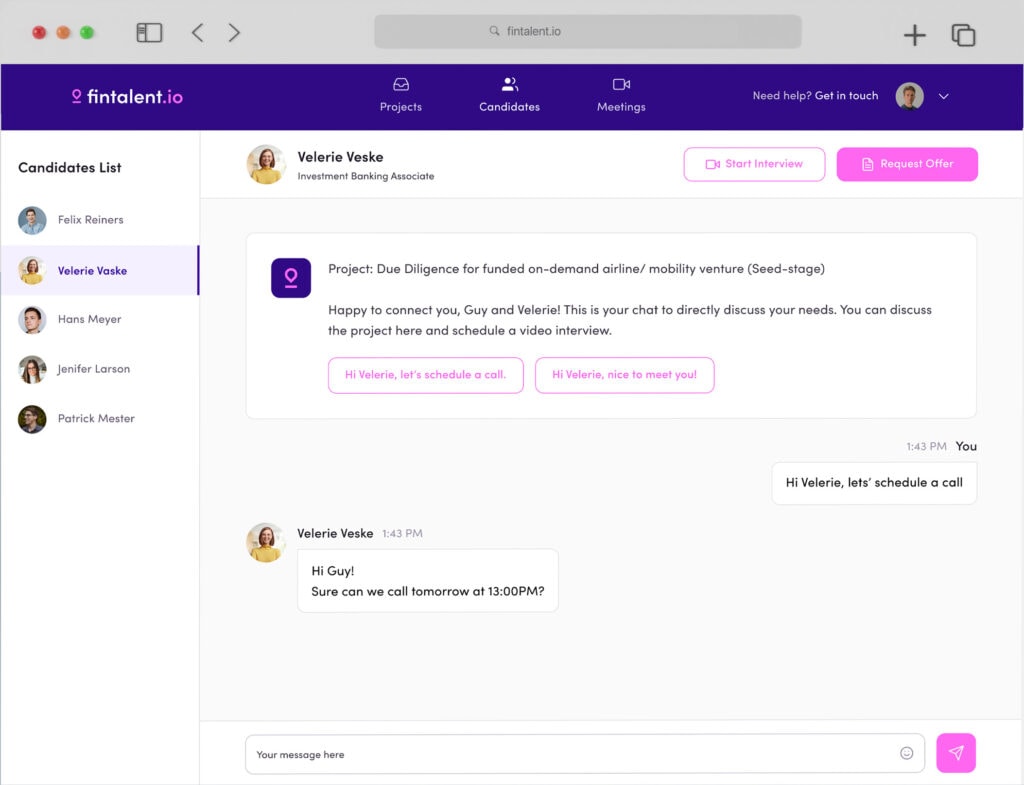

Access a vast network of freelance financial due diligence consultants and hire now.