Commercial Due Diligence is the strategic foundation of a successful M&A deal. “CDD” is the basic first step to understand the strategic potential of an acquisition and shines a light on potential synergies or challenges.

With the help of a reliable commercial due diligence consultant, you can easily track a business opportunity and identify potential risks. The right consultant can increase your profit outcomes and decrease the probability of making costly mistakes. In this step-by-step guide, we will tell you the right process for hiring the perfect CDD consultant for your needs.

How can a Freelance Commercial Due Diligence Consultant Help Your Business?

Hiring a CDD consultant can be very beneficial for your business growth. They provide accurate insight and analysis of the target business during the critical decision-making process. Imagine you are planning to invest in a particular company named ‘ABC’. How do you know that the ‘ABC’ company will grow in the future and your investment will be fruitful? The answer is – with the help of Commercial Due Diligence Consulting Services.

Commercial Due Diligence Consultants conduct comprehensive market research and provide a clear picture of the target company’s current position and growth potential. This information is valuable and can help you make the right investment decisions. In short, a reliable CDD consultant is your strategic financial ally who enables you to identify beneficial deals and avoid risky ones.

What Services do CDD Consultants Provide?

Commercial Due Diligence Services are usually used by buyers who will invest or make deals. But the Seller side or companies can also use these services to improve their organizational processes to increase deal success. Here are the primary services they provide:

Buy Side CDD – They evaluate the target company and provide a fact-based accurate report to help Buyers understand investment potential and associated risks. It is an important process and can shape the outcomes of an investment.

Sell Side CDD – Sellers or Companies can also hire a Commercial Due Diligence Consultant. It can help them understand the potential causes of a deal failure and make plans to enhance their profit outcomes.

Red Flag Reports – A good Commercial Due Diligence Consulting Services also helps you identify the most dangerous points during a deal. It can help them re-make their strategy and avoid costly mistakes.

Assessing Market Dynamics of the Target Company – They also evaluate the target company’s current market competition and other financial aspects. It provides a rough but accurate overview of the company’s financial situation and growth potential.

Risk Identification – Commercial Due Diligence Consultants can identify the risk factors associated with the target company’s growth. It helps buyers or investors to make risk mitigation strategies.

What Are the Skills and Educational Backgrounds of a CDD Consultant?

The right Commercial Due Diligence consultants should have a combination of skills and educational backgrounds. Here’s an overview of the skills and educational qualifications of CDD consultants:

Skills to Look For

- Financial Analysis Skills: They should have strong financial knowledge, including the ability to analyze financial statements, cash flows, and financial ratios. Also, choose a consultant who is proficient in financial modeling, forecasting, discounted cash flow (DCF) analysis, and market research.

- Industry Knowledge: Always choose a freelancer with In-depth industry expertise in the relevant sector of your business. It will allow your consultant to assess market dynamics and competitive landscapes more effectively.

- Due Diligence Methodologies: Your freelance consultants must be knowledgeable of different due diligence processes, methodologies, and best practices. They must be able to design and execute due diligence plans.

- Risk Assessment: Investment and financial processes contain risk factors. Your consultant must know how to identify and minimize various risks associated with deals. They should have analytical skills to evaluate financial and operational risks.

- Legal and Regulatory Knowledge: They should be familiar with laws and regulations related to your field of business. These processes can impact your due diligence process.

Educational Backgrounds:

There is no strict educational requirement for the role of a commercial due diligence consultant. They usually come from educational backgrounds like:

- Finance: Degrees in finance, accounting, or economics provide a strong foundation for financial analysis and modeling.

- Business Administration: In this role, MBA degrees with a focus on finance or strategy are common, as they provide a broad business perspective.

- Industry-Specific Degrees: In some cases, CDD consultants have degrees related to the industry they specialize in, such as healthcare, technology, or manufacturing.

- Law: Some CDD consultants have legal backgrounds, which can be beneficial for assessing legal risks and compliance issues.

- Data Analysis/Statistics: Degrees in data science, statistics, or quantitative fields can be valuable, especially in industries where data-driven insights are crucial.

Tips to Find the Right Freelance Commercial Due Diligence Services?

Here is a step-by-step guide to help you choose the right freelance CDD Consultant

- Define Project Objectives: Clearly outline the scope and objectives of your due diligence project to find a consultant with the right expertise.

- Set a Budget: Determine your budget and seek consultants whose rates align with your financial constraints.

- Do Your Research: Don’t make a rush! Make a shortlist of candidates with the required skills and qualifications.

- Evaluate Experience: Assess consultants’ industry-specific experience to ensure relevance to your project.

- Review Past Projects: Examine their previous CDD projects and case studies for relevant experience and successful outcomes.

- Check Qualifications: Verify their educational background, certifications, and professional affiliations.

- Conduct Interviews: Schedule interviews to assess their communication skills and suitability for your project.

- Ask for References: Request references and contact past clients for insights into their work quality and style.

- Discuss Terms: Have a transparent discussion about fees, payment schedules, contract terms, and project timelines before making a decision.

How to Connect with the Right Freelance CDD Consultant on Fintalent?

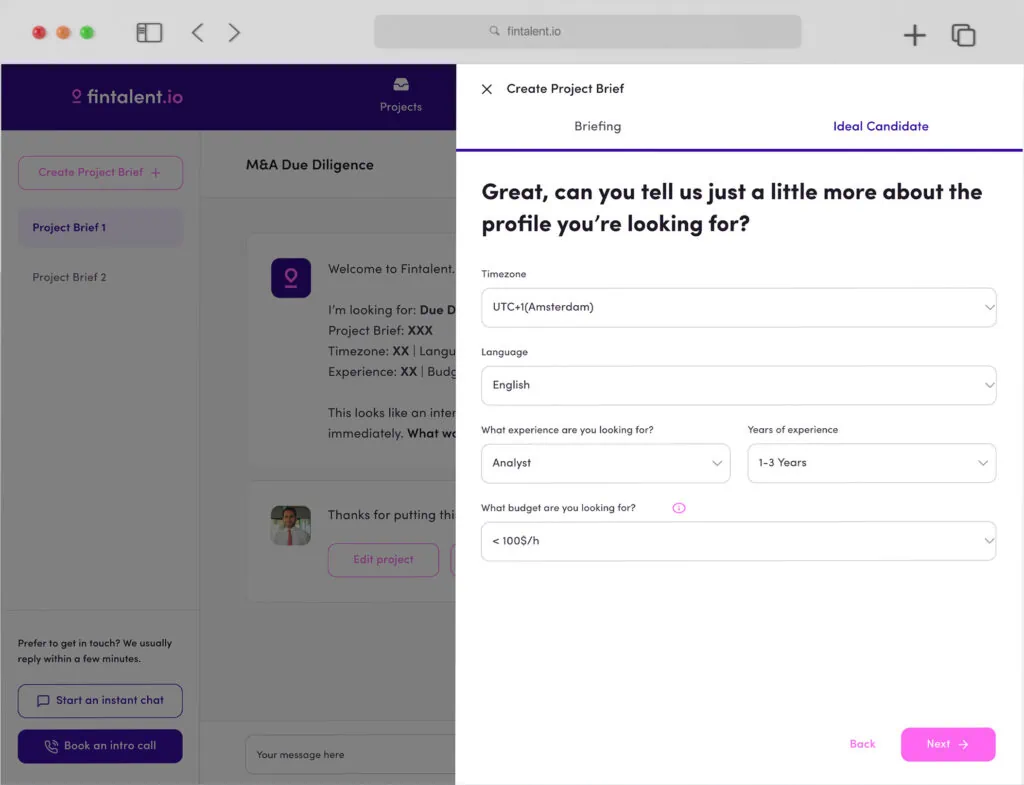

Step 1 – Post Your Project Briefing: Post the details of your project and what specifications you need for the freelance consultant. Fill the basic details of your project type and include a description of your desired candidate.

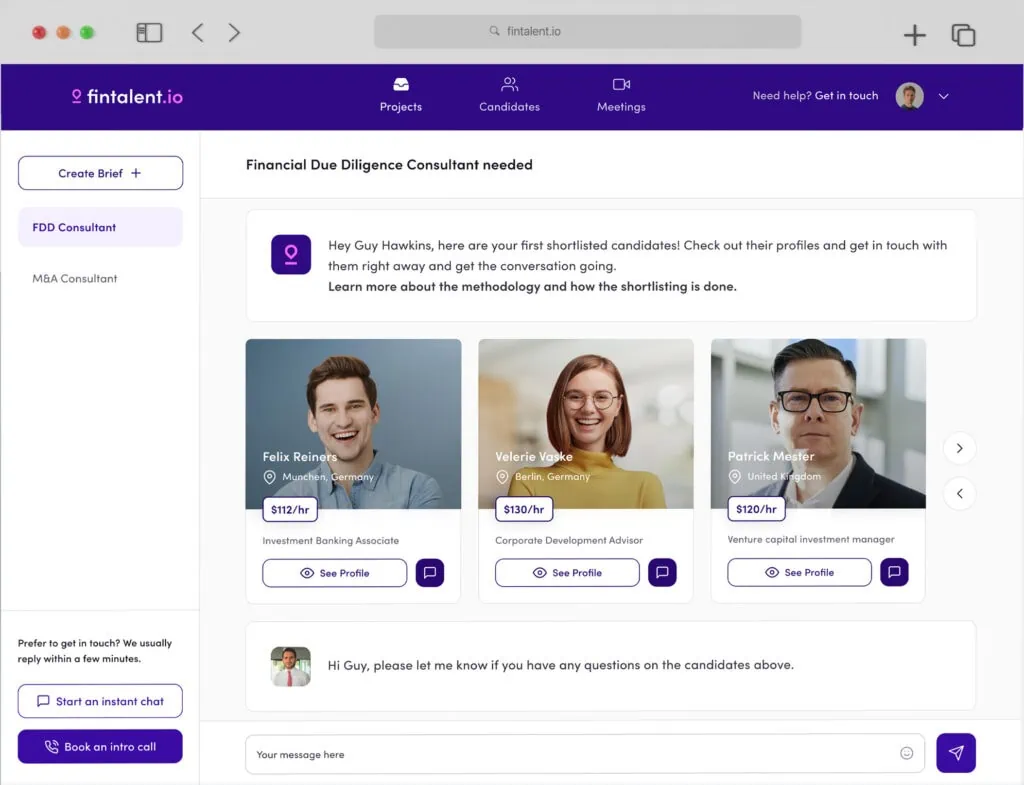

Step 2 – Receive a Personalised Shortlist – Once you have filled in all the details of your project and the required freelancer, we will provide you with a list of candidates. This shortlist will be according to your job description and closely match your preferences.

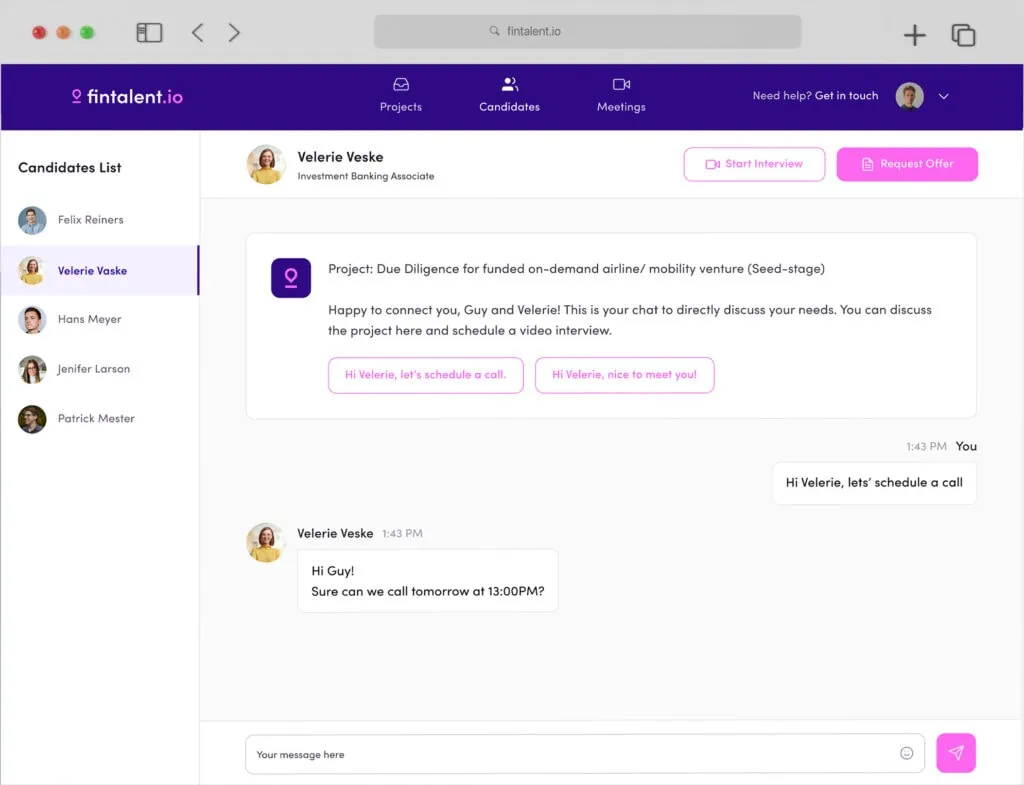

Step 3 – Connect and Request Proposals – Use the steps mentioned in this guide and select the right candidate according to your needs. Get connected with them and communicate about your project.

Boom! You are all set. Now rest easy and let your freelance commercial due diligence consultant do the work!

A Piece of Advice

Always remember that commercial due diligence is not child’s play. It includes a lot of financial and operational processes to make an effective due diligence report. A typical CDD report may take around 6-12 weeks. It depends upon the target company’s size, business model, and other processes. So, have patience and let the professional do the work!

CDD in a nutshell

Hiring the perfect freelance commercial due diligence consultant can help you make informed business decisions. Understand the types of their services, skills, educational backgrounds, and follow the selection process to identify the right candidate. Remember, commercial due diligence requires patience. Trust in the expertise of your chosen consultant, and together, you can pave the way for successful business ventures.