60-70% of all M&A transactions don’t create value. In diagnosing the reasons for that, integration errors or was never really integrated are commonly recurring themes.

But especially for companies that are new to acquisitions, proper integration is often an afterthought. So what is post-merger integration, and how should it be done?

This article is specifically aimed toward first-time acquirers, with the goal to guide you through the fundamentals of post-merger integration, best practices, and common challenges.

Poor integration and the problems it creates

Post-merger integration (or short PMI) is a crucial step in each M&A project. It includes all initial actions that need to be successfully completed to ensure that the value expected in the business case of a transaction can really be created.

Issues caused by poor integration can occur in various operational areas:

- Loss of key customers

- Major delays in the planned development of new business streams

- Loss of key people

- Delays in the generation of cost savings (e.g. on the purchasing side)

- Organizational incompatibilities or even business interruptions.

So, what needs to be done to avoid such issues and to really create value?

To understand this, let’s first look at the typical process of post-merger integration.

The post-merger integration process

A typical PMI process involves several stages:

Due diligence

During Due Diligence, the Integration leader participates and starts the high-level integration planning. The objective is to understand the business, its risks, and opportunities, and draft a first integration concept.

Offer and signing

Between Binding Offer and Signing, the Integration team must be identified, integration principles and governance need to be aligned, and a Day 1 readiness plan must be drafted. The objective is to align and prepare your internal organization for integration.

Signing and closing

Between Signing and Closing, the integration team is mobilized, the Day 1 readiness plan is finalized, and a 100-Day plan (may also be 30 or 60 days) is drafted. The objective is to get ready for Day 1 and further specify the planning.

Day 1 plan

On or right after Day 1, the Day 1 plan is executed, integration team members of the target are onboarded, the 100-day plan is executed, a detailed integration plan is developed, and post-closing Due Diligence is done. The objective of Day 1 is to take control, communicate, and ensure business continuity. The objective afterward is to confirm your integration assumptions, adjust your planning, and start working on the priorities, now that you have access to all data and people.

Day 100

After 100 days (or earlier), the integration plans are implemented, and performance is monitored. The objective is to get things done and create value.

Hand-over

Hand-over: The project is closed – at once or function by function. The objective is to move from project/hyper care mode to “business as normal”.

During all stages, the integration leader interacts regularly with the integration steering committee where key stakeholders and decision takers should be represented.

Almost all integration projects require substantial internal resources, usually from both sides, to plan and implement the integration measures. While the overall integration management leadership position is one of the roles that can be considered to be outsourced, the functional experts need to come from the two organizations, as their activity requires intimate knowledge about the corporate cultures, processes, procedures, and resources.

Post-merger integration: Best practices

Rule 1: Start early!

The best practice is to start with the integration planning already during the due diligence process and not only after signing the deal. When a European consumer goods manufacturer acquired a competitor, they started integration planning only after signing the deal. It took them more than 4 weeks to align internally on the integration team and key priorities. As a consequence, they lost several key employees of the target company who, in absence of a clear message about their future career, accepted offers from competitors. At the same time, customers were confused as they didn’t get clear answers how the acquisition will impact them and lots of money was left on the street as the realisation of purchasing synergies started only with a delay.

Ideally, the integration leader should be already nominated at the same time as the due diligence team and then participate in the due diligence and the business case creation. As the knowledge about the target increases during the process and the due diligence team members articulate their integration thesis and shape together the target operating model for the business to be acquired, the integration leader should actively participate. This allows them to get already familiar with the business and to slot in his/her experience, particularly when it comes to risk mitigation measures and the estimated time and cost of integration activities.

Rule 2: Prepare for Day 1!

This is the day when you get the keys to the car you were buying and when you are in the driver’s seat. Crucial things that need to happen on Day 1 in terms of internal and external communication, factually taking ownership of the business, and business continuity need to be identified and addressed upfront.

Rule 3: Set clear priorities!

When it comes to priority setting in the integration process, identify the initiatives that will create the most value and ensure they are kicked off early, well resourced and permanently monitored.

Rule 4: Fast Transition!

Long transition phases are often a source of low growth and inefficient processes and may damage people’s morale. So cut them to the required minimum.

Rule 5: Don’t neglect the soft factors!

Not addressing cultural differences between acquirer and target can substantially delay value creation. A prominent example is the acquisition of the organic supermarket chain Whole Foods by Amazon where the tight, hierarchic, process-based culture of Amazon clashed with Whole Foods’ loose, egalitarian, decentralised culture. Therefore, it is important to understand the differences in the two companies’ values, beliefs and behaviours. Apply the same attention, analysis and discipline for the cultural integration as you do for the operations. Better over- than under-communicate to both external and internal stakeholders.

Rule 6: Keep senior management involved!

An M&A project needs a senior management sponsor who promotes the project to his/her peer leaders and above, provides resources, and removes roadblocks. This support and involvement must not stop once the deal is closed and other things may attract management’s attention.

Rule 7: Take decisions fast!

Clarify upfront the governance aspects of who has the decision right on topics like staffing, organisational design, expense budgets, Capex, etc. so that these decisions can be taken quickly when needed.

The scope of PMI projects differs a lot and eventually depends on the business case and the question “what do we want to do with the acquired business?” It can reach from a very light minimal integration to the full assimilation of the acquired business. The project timelines vary accordingly between a few weeks and more than a year.

Post-merger integration: Common challenges

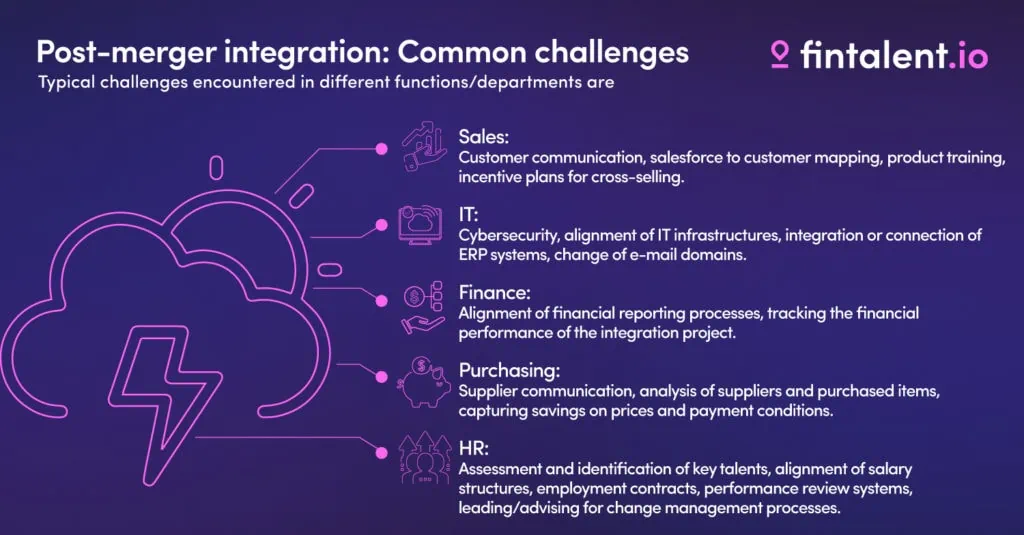

Typical challenges encountered in different functions/departments are:

Sales

- Customer communication: your customers want to know what will and will not change for them and who will be their account manager; your competitors will try to poach your customers, telling them your service level would deteriorate because you are so busy with the acquisition

- Salesforce to customer mapping: clarify as soon as possible which salesperson will call on which customer for which product or service – avoid “double bookings” and gaps

- Incentive plans for cross-selling: why would your sales team start selling the products of your acquisition targets if their bonus depends only on their pre-acquisition budget?

IT

- Cybersecurity: In today’s cyber threat environment it is key to understand quickly what’s the real level of cybersecurity of your acquisitions and what gaps need to be closed asap

- Integration or connection of ERP systems: depending on the degree of integration you want to achieve, alignments of ERP systems might be a prerequisite for synergies in operations or other areas.

Finance

- Alignment of financial reporting: Even as a private company, sooner or later you need to produce consolidated accounts that include your acquisition; differences in closing deadlines, accounting standards and financial year-end dates are typical topics to be addressed

- Tracking the financial performance of the integration project: When you structure the business case and the synergies of an acquisition, you should already ask yourself the question “2 years after closing, will I really have the data to track this?”

Purchasing

Supplier communication: Similar to customers, suppliers want to know what will and will not change for them

Capturing savings on prices and payment conditions: if you have an overlap of suppliers and raw materials with the target, synergies from picking the better of both sides’ suppliers, prices, and payment conditions can generate substantial savings – but it requires an in-depth upfront analysis

Human Resources

Assessment and identification of key talents: In many acquisitions it is extremely important to retain the key people of the target e.g. who know the company’s technology, the deciders of the major customers, how to run operations etc. Not identifying / neglecting / losing them can create a lot of damage to your post-merger integration project

Driving cultural integration: clearly understand the differences and commonalities of both companies, define the attributes of the new culture, develop a culture change plan

Summary

A post-merger integration can be a complex project that requires a lot of planning, flexibility, and collaboration. During the project journey, one learns more and more about the acquisition target, and the project team needs to draw the right conclusions from this and adjust the planning if needed.

At the same time, in order to be successful, the project team must take into account the soft factors and remain focused on the value creation priorities. There are a lot of balls up in the air, and it requires sufficient experienced resources to ensure none of them falls on the ground.