What is a Carve-Out?

A carve-out is an alternative form of merger that allows firms to maintain their separate legal identity and financial autonomy while sharing some operations. In business, a carve-out is a mechanism for separating a profitable segment from an organization which is no longer considered to be a “core” part of the company. This type of transaction might occur when one or more divisions have been acquired or merged into the company by purchase, but then becomes less strategically valuable. The term “carve out” originated in 1984 when William J. Abernathy and Kim B. Clark used the term in the Harvard Business Review article “Managing Our Way to Economic Decline”, which was published in 1984. The term has since lost its connection to the original article. The term “carve-out” is an example of functional jargon, which is jargon used to make the language of group-think like managerial language like jargon in order to make it easier for others in the group to understand what they are talking about. Abernathy and Clark argued that the most common reason for failure in companies was that management abandoned their businesses because of poor results. They believed managers needed the autonomy to keep making mistakes, because by making mistakes you can discover exactly where your company is headed.

The underlying principle of “core” businesses is that they are essential to generating revenue for the company as a whole, and as such they should be safeguarded from competition and other threats. In contrast, those businesses that do not generate substantial revenue for the firm are typically less important and might not have much strategic significance at all. An example might include a large company which has been acquired from a small family-owned business.

In the context of corporate mergers and acquisitions, a carve-out is a similar mechanism by which one company acquires another. In this instance, the business to be acquired is divested entirely, and in return the acquirer takes over the profitable part of the company that was previously held by the investors who were divested. This can be a common occurrence when a company acquires a smaller competitor, and the business of the acquiring company is significantly larger than that of the smaller one. In such an instance, it might make little sense for the acquiring company to take responsibility for managing the overall sales and marketing operations of the smaller firm as well as its own, so instead those responsibilities can be carved out into a separate business unit. This type of transaction is common in industrial sectors such as pharmaceuticals and medical devices, where innovation and public relations are integral parts of a company’s business.

In the case of a corporate acquisition, a carve-out can be both an effective and an ethical form of corporate governance. On one hand it is the traditional legal mechanism by which businesses – particularly those that are large, ambitious and successful – can be divided into smaller units for more efficient management. On the other hand it allows those who have lost their investment in the original business to continue to benefit from its ongoing success. For example, in the case of a company acquisition, it might be possible for existing shareholders to disassociate themselves from open market trading in company stock by selling all their stock in the acquired business, thus enabling them to profit from dividends without actually having committed their financial capital to its growth or success.

Nonetheless, while some carve-outs can result in a great deal of value being created for the original shareholders, there are also many situations where this is not true. For example, in the case of a small business that has been acquired from a larger company, the acquired business may not be profitable, and thus it is likely that any new investors who take control of the business will have to spend time and effort trying to turn it around. In addition, some investors may refuse to sell out completely, instead trying to set terms under which they can continue to benefit from the ongoing success of the old company. Thus, one of the downsides of a carve-out is that it can be potentially unsound as a corporate governance mechanism since it can lead to an inefficient and unprofitable business being run by those who brought the firm into being.

In addition, many carve-outs also naturally take place in industries where businesses are naturally cyclical, such as that of “cyclical” or fashion industries. For example, a corporation might decide to sell off a non-valued division to reduce their overall operating expenses. However, what would ordinarily happen is that the company’s revenue would decrease instead of increase because the value of its inventory decreases. In this sense, start-ups are seen as a form of carve-out. Rather than having resources to address all aspects of business at once, the focus is narrowed to enabling the core business function. It is not uncommon for smaller firms to invest in firms yet to be carved out. This can result in future economic value being created within the markets served by the start-up and the other firm.

The concept of internalization is vital to understanding carve-outs, because it is basically “internalization” that enables the two concepts to be combined into one tool for management. The idea of internalization is that the corporate management team needs to be more focused on the firm’s core business, and can not allow individual divisions to run amok. In particular, Abernathy and Clark believed that it would be a mistake for a company to try to grow through acquisitions, because it would distract managers from managing their core business.

They also believed that companies should carve-out not only parts of their businesses, but whole divisions or companies. Fidelity had spun-off its mutual funds division because it believed that the management team could not effectively direct what they viewed as an asset/liability bottom line like mutual funds. On the other hand, if Fidelity had carved-out its brokerage business, the relationship between the company’s market activities and it management team would have been more direct.

Abernathy and Clark argued that managers needed to make mistakes because by making mistakes they could discover exactly where their company was headed. It is basically this same argument that is used by start-up firms that seek to carve out a niche in some market or industry. Firms that manage to carve out new markets are sometimes referred to as “disruptive innovators.”

It can be seen from this example that Abernathy and Clark were not arguing against corporate acquisitions. Big companies can acquire other companies for value, and the management team should be capable of running the new company too. However, they believed that acquisitions should not be pursued for efficiency purposes.

Abernathy’s and Clark’s core idea was that there are many good uses for carve-outs because they give managers the focus to do the kind of things that you want them to do. Abernathy and Clark believe that by focusing on their core business, managers will not only achieve better financial results, but also achieve better results in other areas like innovation. It can however be argued that while this may happen in some cases, carving out other parts of a company does not necessarily improve or preserve core value creation processes or sustainable competitiveness.

The term “carve out” is used by firms to describe internal policies which allow them to avoid duplication of work. The aim of the policy is usually to lower internal cost, increase efficiency and improve profitability. However, if the policies are implemented incorrectly or fail to deliver value then it could put profits at risk. An example of this problem is when companies follow conventional wisdom in costing functions by simply adding up costs without costing for different types of service. For example, the firm may expect that its number crunchers will require the same level of training as its sales team will require without considering differences between work styles or how tasks are performed.

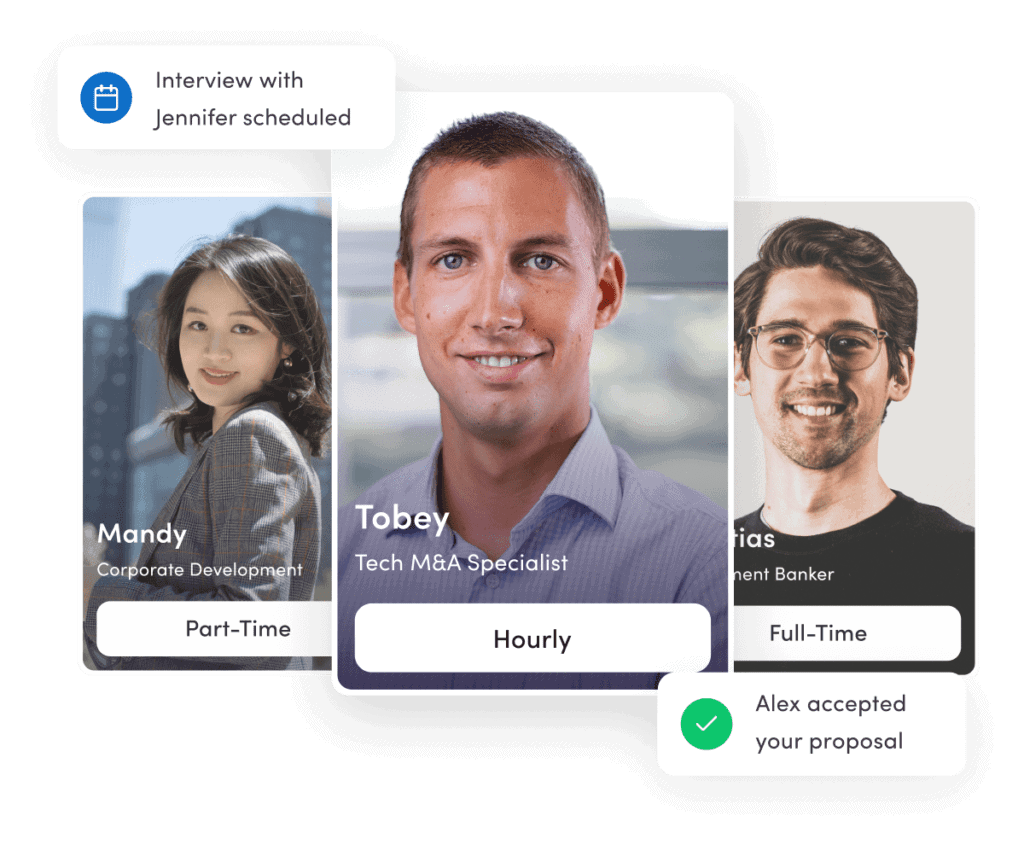

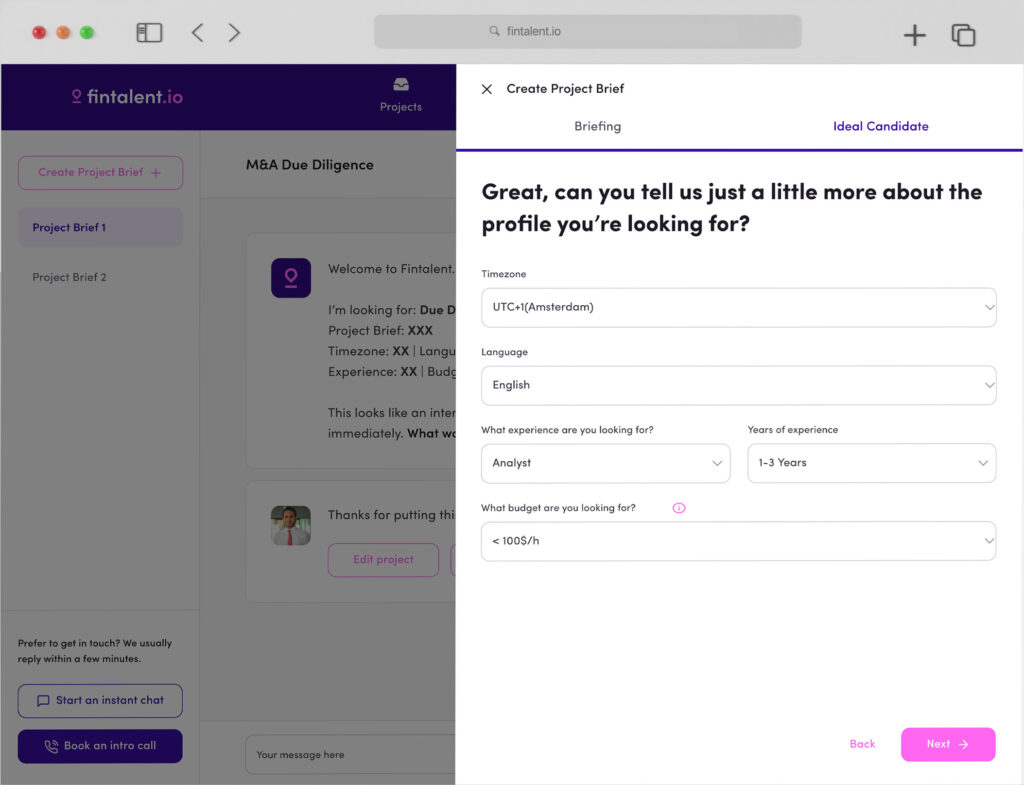

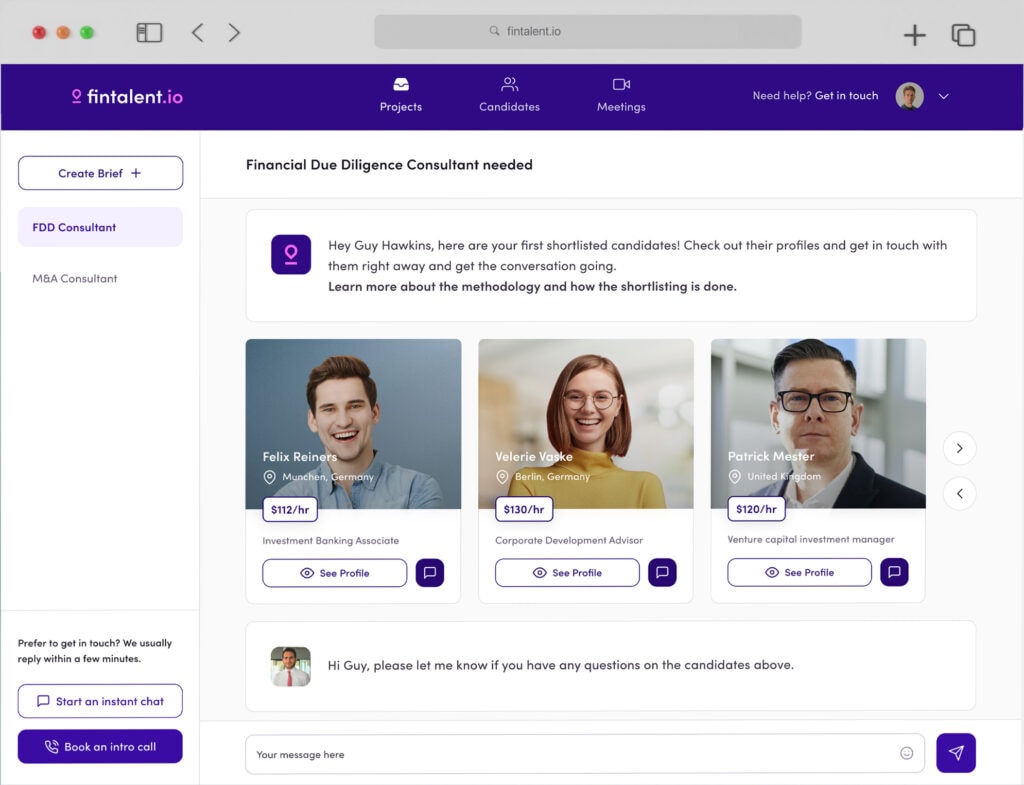

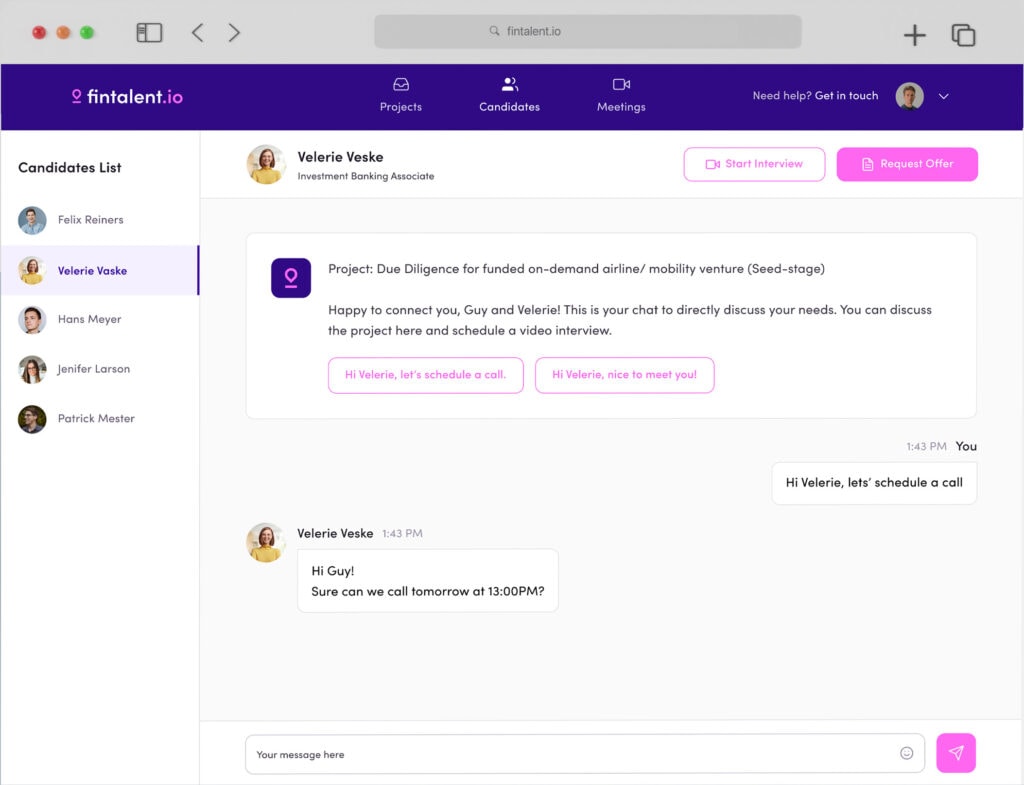

carve outs in business are important as they can help businesses trim up for effectiveness The most important thing is recognizing a business would benefit from a Carve-Out and carrying out the procedure effectively with the precision of a surgeon. Firm’s do not carry out Carve outs every other day as businesses rarely have need to do so. This means the process is highly specialized with few persons boasting of past experience in carrying out the procedure. Fintalent, the hiring and Collaboration platform for tier-1 strategy and M&A professional is your go-to platform when looking for experienced Carve-out consultants. Fintalent Consultants will carry out expert Business Analysis to determine the most effective Operational Strategy for your business and carry out appropriate Due Diligence to ensure a potential Carve-Out succeeds.