Corporate finance advisors are at the heart of any business deal – be it a buy-side M&A transaction, a divestiture, or raising funds to grow the business.

Investing in a corporate finance advisor is crucial for maintaining optimal financial performance within a company. By grasping the scope of this professional’s duties, understanding their clientele, and learning how to identify the best fit for your organization, you can make informed decisions that positively impact your business’s fiscal well-being.

Finding the right corporate finance consultant requires a thoughtful and deliberate approach, balancing their technical knowledge with your organization’s values and goals. By carefully evaluating potential advisors, you can create a seamless alignment between their skills and your unique financial situation, ultimately leading to long-term financial success.

This comprehensive resource offers a crucial understanding of the intricate realm of corporate financial consulting, empowering you to choose an advisor who will serve as a dependable ally and facilitate the growth of your organization.

What Does A Corporate Finance Advisor Do?

. Here’s an overview of what these professionals typically do:

- Financial Strategy Development: A corporate finance specialist crafts comprehensive financial strategies aligned with the long-term goals of a company. This involves assessing current financial health, identifying growth opportunities, and formulating plans for sustainable success.

- Capital Structure Management: They analyze and optimize the capital structure of a business, determining the right mix of equity and debt to maximize returns and minimize risks. This includes advising on fundraising strategies and debt management.

- Mergers and Acquisitions (M&A): A corporate finance expert is often involved in M&A activities, guiding companies through the complexities of buying or merging with other entities. This includes providing due diligence consultancy, negotiating deals, and ensuring a smooth integration process.

- Risk Management: Identifying and mitigating financial risks is a crucial aspect of the individual working with corporate finance advisory services. Advisors assess potential risks, such as market fluctuations or regulatory changes, and develop strategies to safeguard the company’s financial interests.

- Financial Analysis and Reporting: They provide in-depth financial analyst expertise, offering insights into the company’s performance. This includes preparing financial reports, conducting variance analysis, and presenting findings to key stakeholders.

- Strategic Financial Planning: They also play the role of a financial planning advisor and assist in developing and implementing strategic financial plans, aligning with overall business objectives. This involves forecasting, budgeting, and scenario planning to ensure financial stability and growth.

- Investor Relations: Managing relationships with investors is a critical responsibility. Corporate finance advisors communicate financial performance, investment opportunities, and strategic initiatives to stakeholders, fostering transparency and trust.

- Compliance and Regulatory Adherence: Ensuring that the company complies with relevant financial regulations is part of the role of corporate finance consulting services. Advisors stay abreast of changing regulations and work to ensure the company’s financial practices align with legal requirements.

- Cost Management: They help businesses optimize their cost structures by identifying areas for efficiency improvements. This includes evaluating operational costs, streamlining processes, and enhancing overall cost-effectiveness.

- Advisory for Special Situations: In unique or challenging situations, such as financial distress or restructuring, corporate finance professionals provide specialized guidance to navigate these complexities and emerge stronger.

What Kind Of Customers Does A Corporate Finance Advisor Work With?

A corporate finance professional commonly collaborates with an array of clients, spanning various sectors and sizes. These include:

- Small and medium-sized enterprises (SMEs) seeking expertise in financial strategies for growth and expansion.

- Large corporations that require help optimizing their financial plans or pursuing mergers and acquisitions seek help from corporate finance consultants for better business valuation advisory.

- Startup companies looking for guidance on fundraising and valuation issues.

- Family-owned businesses that are in need of assistance with succession planning and intergenerational transfer.

- Non-profit organizations seeking financial counsel to ensure long-term sustainability and growth.

How To Find The Right Corporate Finance Advisor

Now that you have a better sense of what financial advisors do, you’re ready to begin researching how to find great candidates for corporate finance consulting for your business growth and expansion advisory. To get started, look over the steps listed below.

Determine which type of advisor you need

Identifying the precise type of financial adviser you wish to add to your team is a wise first step. You might be interested in pursuing the following sorts of advisors:

- Investment advisors: Focus on providing investment advice to companies and individuals, aiming to optimize returns while minimizing risk.

- Certified financial planners: Approach financial matters holistically, helping clients create and execute customized strategies to match their goals.

- Chartered financial consultants (ChFC): Similar to certified financial planners but go through a more intensive process, covering topics such as estate planning, asset protection planning, and employee benefits planning.

- Registered representative: Perform client-facing work for financial firms, typically as brokers and portfolio managers, requiring them to pass the Series 7 and Series 63 exams.

Write a detailed financial advisor job description

Once you know the type of financial advisor you wish to hire, you can begin writing a job description to attract qualified candidates.

- A summary of the position

- A list of responsibilities and duties

- Important qualifications (such as education requirements, certifications, and work experience)

- Some information about your company

- Details about the salary range and benefits of the position

When putting your job description together, remember that this is your chance to sell the opportunity to the best candidates. Highlight the most enticing aspects of the job early in the description to attract more qualified applicants.

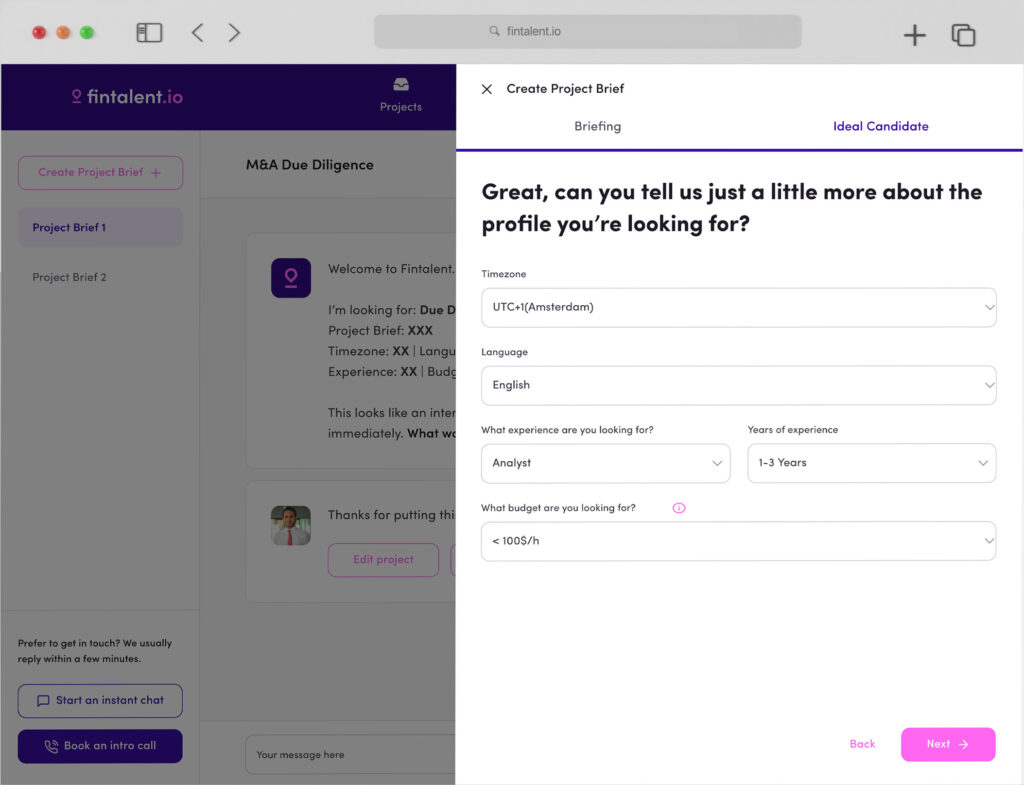

Choose a recruitment strategy

Developing a recruitment strategy is the next stage in the hiring procedure. This is the procedure you will use to identify and choose the top applicant for the position.

- Goals for hiring: Describe the kind of financial adviser you would like to collaborate with and the reasons you feel they should join your team.

- Budget: Determine how much you are willing to spend on salary and marketing the job opening.

- Marketing plan: Decide how to get the word out about your financial advisor job opening, considering online platforms and offline options like local organizations or schools.

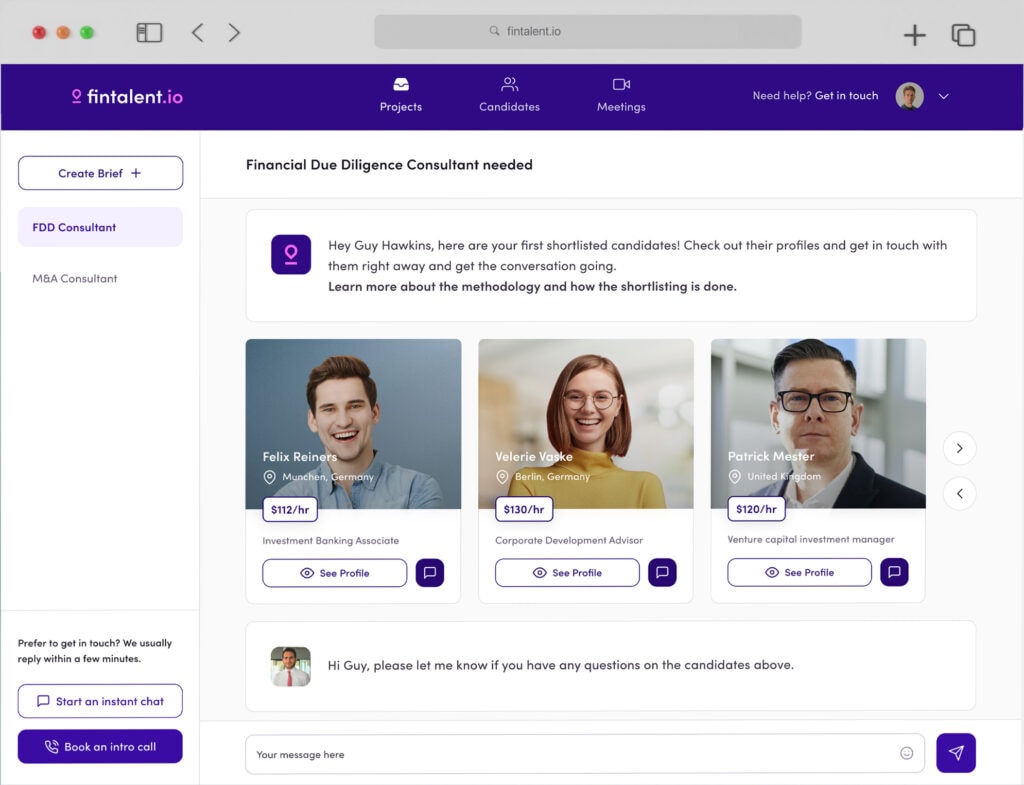

Evaluate your applicants’ qualifications, experience, and skills

As you implement your recruitment strategy, candidates will begin submitting their applications. The next step is to compare them based on academic background, certifications, experience, and skills.

- Eliminate candidates without the necessary certifications or work experience.

- Set aside the best resumes for further consideration.

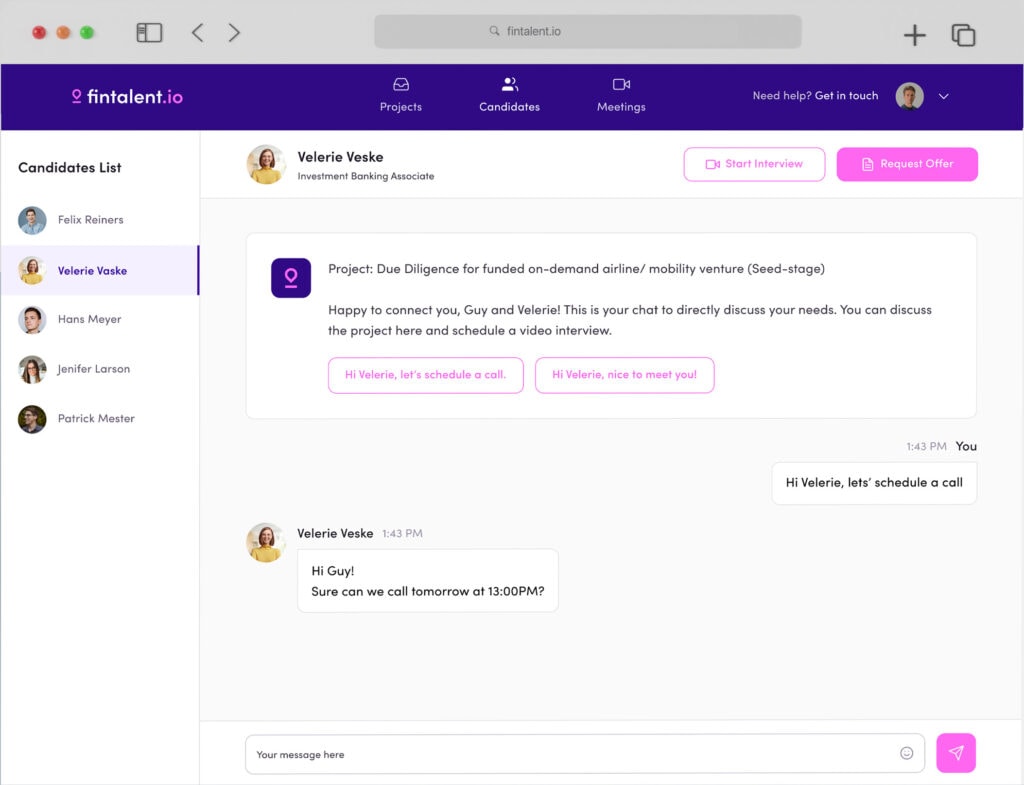

Interview the top financial advisor candidates

At this stage, you’re ready to begin scheduling interviews with your top applicants.

- Devise a list of skill-based and behavioral interview questions.

- Involve multiple people in the interview process to reduce biases and make well-rounded decisions.

- Consider multiple rounds of interviews to assess different aspects of a candidate’s skill set.

Select your new hire

Now you’re ready to make a hiring decision. If that means choosing between two great candidates, consider differentiating factors such as differences in salary requirements, work experience in your niche, intangible fit with your company and its culture, and any insights provided by corporate financial advisors.

Conclusion

Hiring the right corporate finance advisory services can help your company make informed decisions about spending, saving, and investing money. However, finding the ideal candidate requires a meticulous selection procedure tailored to specific requirements, including personalized questioning during interviews and an extensive recruitment plan. Use this guide as a reference throughout the hiring process and choose the ideal candidate according to your organization’s needs!