Mergers and Acquisitions consultants are an essential part of many business transactions. This guide will provide you with a detailed overview of what M&A advisors do, their backgrounds, and what to look for when hiring one to suit your needs.

What Is An M&A Consultant?

An M&A (Mergers and Acquisitions) consultant is a professional who specializes in advising and assisting organizations during the process of merging with or acquiring other companies. M&A consultants have expertise in finance, strategy, valuation, negotiation, and integration of businesses.

What Do M&A Consultants Do?

M&A consultants provide expert advice and guidance throughout the entire M&A process. This includes Due Diligence, Financial Modeling and Valuations, Deal Structuring and Origination, and Post-Merger Integration.

You might think of freelancers as designers, software developers, and writers – free spirits that work from co-working spaces in the hip neighborhoods of Brooklyn or Bali. But in fact, freelancing is a major trend across every sector and occupation. In the US alone, 90 million professionals are forecasted to work as independent contractors by 2028.

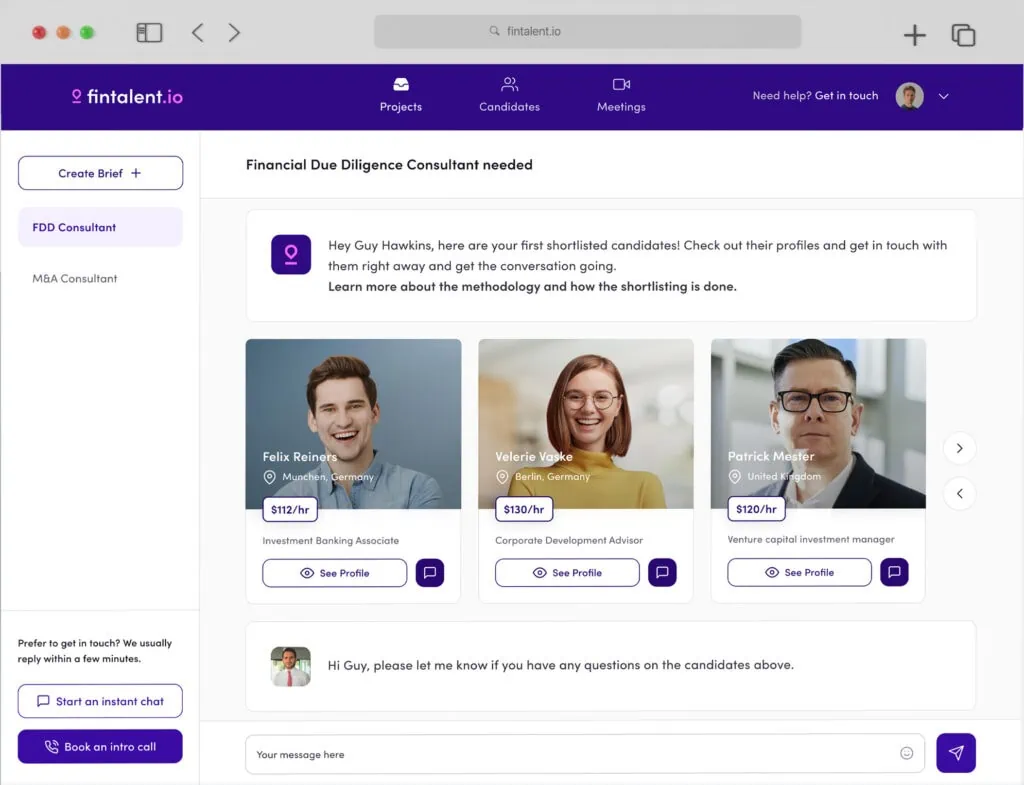

But freelancing in M&A – is that even possible? It is – with Fintalent.io, we’ve worked on more than 300 freelance M&A projects since 2019, and over 2000 M&A professionals from 42 countries have signed up on our platform.

In this guide, we will provide you with an overview of:

- Who M&A freelancers are (skills & qualifications)

- How can business acquisition consultants support your organization on the buy- or sell-side

- How your engagement with them will look like

- What they will cost

Interested in more specific questions? Don’t hesitate to use the chat on our website to reach out to us!

Who Are These M&A Freelance Consultants?

Background Of M&A Freelancers

Freelance M&A consultants on our platform usually have backgrounds in sell-side investment banking in elite boutique or bulge bracket firms, or Private Equity. Many of them have later moved to the buy-side, either by joining corporate M&A divisions or starting their own ventures.

Additionally, business acquisition consultants could have experience in senior roles at Big4 consulting firms – while not typical M&A profiles, these freelancers can provide specialist support projects such as valuations and financial modeling.

Qualifications And Skills Of M&A Freelance Consultants

M&A freelancers work with many organizations throughout the year – it’s not untypical to be involved in 2-4 deals per year as a freelance consultant. That means that an experienced freelancer is able to get running very fast, without an onboarding period comparable to a full-time employee.

Juniors

Junior M&A freelancers (with 2-3 years minimum experience in investment banking) can provide valuable legwork to a deal – may it be conducting research, or supporting existing associates on more complex projects.

Example:

Associates

Associate-level M&A freelancers (3-7 years of experience) can run financial models, offer deal support, coordinate the due diligence, and even originate and approach targets. They provide an effective addition to a Corporate Development leader who needs an independent professional to make a difference.

Examples:

Seniors

Senior M&A freelancers (7+ years experience) can act completely independently. They can act as Head of M&A as a service to lead the M&A efforts from planning to execution, and execute large deals as part of the core team. Very senior professionals can even lead large deals, carve-outs, joint ventures, or post-merger integration.

Examples:

What’s Their Motivation To Work As Freelancers?

For investment bankers and M&A professionals in general, freelancing is a rather new exit opportunity. Investment banking is a hard profession to exit, despite long and stressful working hours – few jobs pay a comparable amount or deliver the same amount of intellectual challenge.

Traditional exit options for investment bankers included:

- Leveraging their network and starting their own M&A boutique firm

- Joining the buy-side as Corporate Development professional

- Joining or funding ventures

M&A freelancing is another option for professionals in investment banking to leave their full-time job behind.

But the motivation for this exit varies wildly:

- Junior M&A professionals often name the strict and conservative working atmosphere as main reason, and the desire for more flexibility

- Associate-level M&A professionals want to work on more exciting projects or have more time available to work on side projects, or spend more time with their families

- Senior M&A professionals, up until Managing Director level, want to leverage their network to capitalize on their decades of experience

What unites all M&A freelancers is the desire to choose who they want to work with, and on which terms.

Hourly Rate Of Freelance M&A Consultants

The compensation rate of M&A freelancers depends strongly on seniority and region of the freelancer. With our experience of 3,000+ M&A freelancers on our platform, we currently see the following rates as realistic median values:

- Analyst: $110

- Associate: $130

- Manager: $160

- Senior: $180

You can learn about our pricing model on our pricing page.

Why Would You Work With Freelance M&A Consultants On The Buy-Side?

M&A freelancers are flexible alternatives to working with traditional M&A consulting boutiques. But what is the right time to try out a freelancer, and what are the benefits?

When It Might Be The Right Choice To Consider Freelance M&A Consultants For The Buy-Side

Time pressure and urgency

When a deal is already in the pipeline and the pressure to close grows, it’s too late to hire additional team members full-time. Freelancers can be ready pretty much immediately (our freelancers frequently start working on transactions within 2 days).

Understaffed M&A department

The beauty and challenge of M&A is the volatility of the workload. Especially in organizations with irregular or unsteady deal flow, it’s almost impossible to accurately plan the amount of staff required to originate and execute deals. Freelancers are a convenient solution to circumvent the talent gap and support the core team during peak times.

Skills gap and specific expertise

Some extremely complex transactions or new deal types might be out of the comfort zone of the core M&A team on the buy side. Especially senior investment bankers and Private Equity professionals can deliver much-needed specialist expertise, for example for complex carve-outs or specific deal structures.

Local expertise

If the M&a department has no expertise in a local market and wants to acquire a player, it’s difficult to find a boutique to support that cross-border transaction – and it’s frankly overkill. Experienced local M&A freelance consultants can supply guidance for local transactions in unfamiliar markets, without adding a massive overhead to the transaction.

Smaller “Nice to have” opportunities

Especially in corporations with large transactions, it’s easy to ignore small opportunities due to limited internal resources. But small ticket transactions can deliver massive synergies, especially when it comes to niche technologies. M&A freelancers can help shoulder smaller transactions that the core team just doesn’t have the capacity to handle.

Benefits Of Working With M&A Freelancers

Flexibility

M&A freelancers can deliver punctual support, with more availability during peak times, and on-demand standby time during more quiet times in a transaction.

Cost-effective

Traditional M&A boutiques sell the time and rate of a partner, and a group of analysts, or – even worse – off-shore workers from low income countries deliver the actual work. That’s neither transparent nor fair, but unfortunately common practice even in well-known M&A boutiques. A freelancer creates full cost transparency – you’ll know exactly who works on a project and what they charge, and there’s a clear commitment to the work.

Process ownership and speed

Freelancers are perfect to bring in even when the M&A process has not yet really started. They can help speed up the deal by delivering important strategic research and insight upfront, for example, to prepare a transaction together with the core team.

Comparability

How do you compare the quality of M&A consultancies against each other? It’s incredibly difficult. With a freelancer, on the other hand, there’s much less risk involved and a much higher degree of transparency when it comes to comparing resumes and deals.

Global reach

Only the bulge bracket investment banks truly work at a global scale. Other players, like the Big 4, have local offices in every country. That’s not beneficial if the aspiration is to have a global approach to M&A. Freelancers are country independent, and it’s much easier and more efficient to access local expertise through a freelancer.

How Does The Collaboration Work?

Now that we’ve explained what M&A freelancers do and how they can be beneficial to an organization, let’s examine what an exemplary engagement with a freelance M&A consultant can look like.

Common Use Cases For Freelance M&A Consultants

Exit Readiness

When there’s no clear plan for selling the company yet, an M&A consultant can step in to prepare the company and review the potential for a sale.

Target Identification

Freelance M&A consultants can support the existing team to identify potential acquisition targets.

Target Approach

Approaching potential targets as an intermediary is a key ingredient of M&A consulting. M&A freelancers can help approach potential targets in place of company representatives.

Due Diligence

When it comes to mergers and acquisitions consulting, due diligence is often assigned to specialized consulting firms. However, freelance M&A consultants can often support or lead the due diligence process more targetedly.

Business Valuation And Financial Modeling

Valuations and financial modeling are typical tasks of mergers and acquisitions services offered, especially for freelancers.

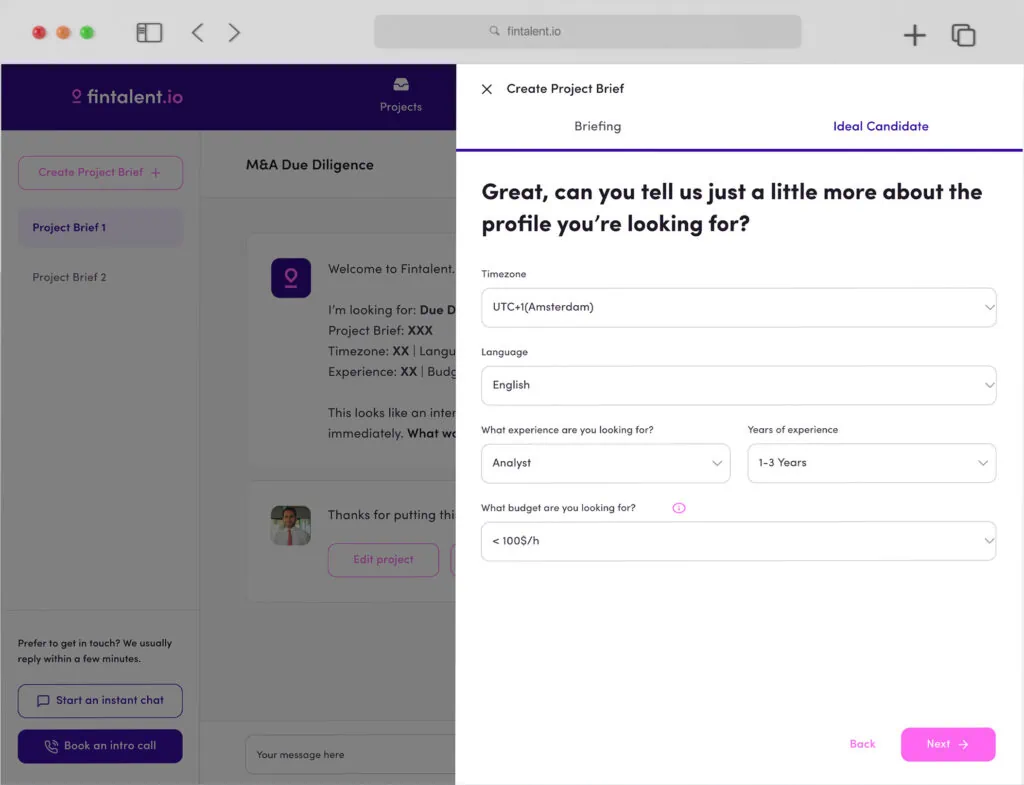

A Typical M&A Freelance Consultant Engagement Process

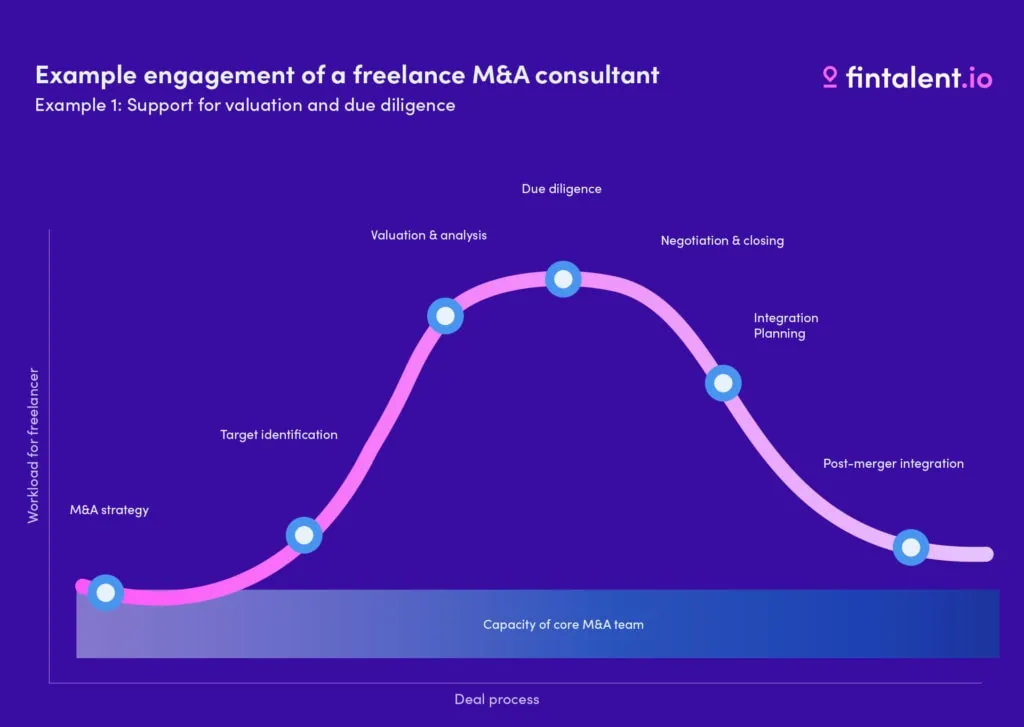

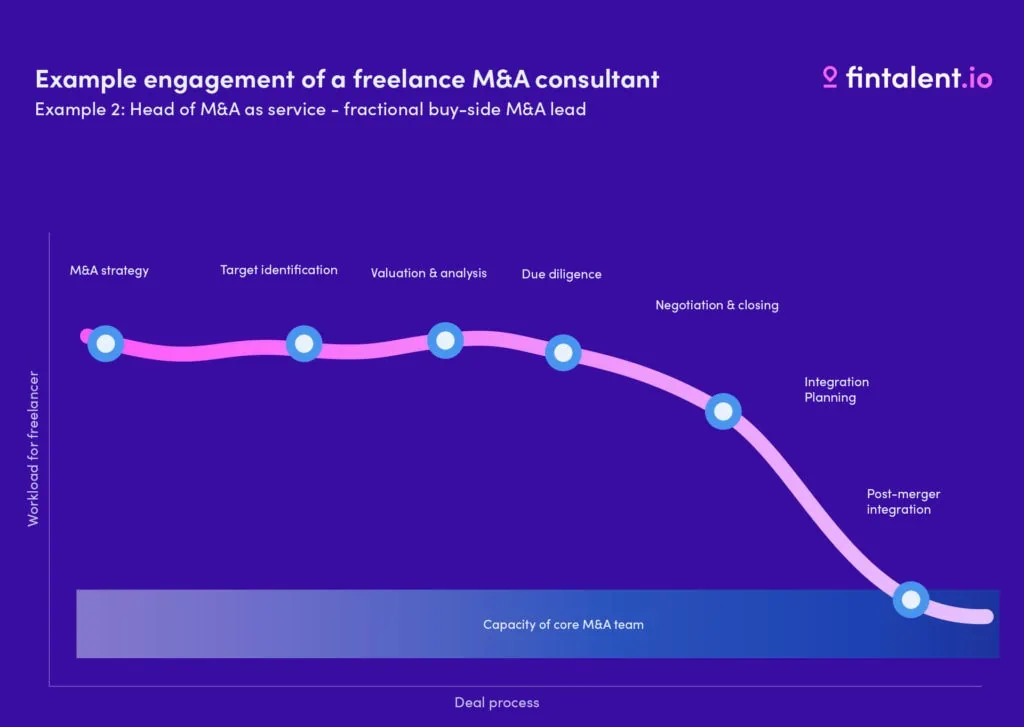

The biggest advantage of hiring freelance M&A consultants is the fact that they can support the M&A process exactly when it’s most needed. That can mean starting full-time in a deal with high pressure, but reducing hours to 1 day per week or on-demand when the pressure reduces. In later quiet phases, the professional can be available on stand-by for a few hours.

While the exact setup depends on the existing team structure and client needs, below are two examples of how this collaboration can look like.

Example 1: Support for valuation and due diligence

In this case, the client had an existing M&A team in place but needed extra hands to execute the valuation and due diligence on a deal with a tight deadline. The client decided to opt for an associate with experience in coordinating and leading the valuation, financial model, and due diligence. The transaction was led by the Head of M&A.

Example 2: Head of M&A as service – fractional buy-side M&A lead

The client wanted to leverage inorganic growth through M&A but had no previous experience with acquisitions. They decided to opt for a freelancer as a fractional M&A lead to build up the M&A pipeline and execute the first deals. The integration was guided by the freelancer, but led by the technical product departments.

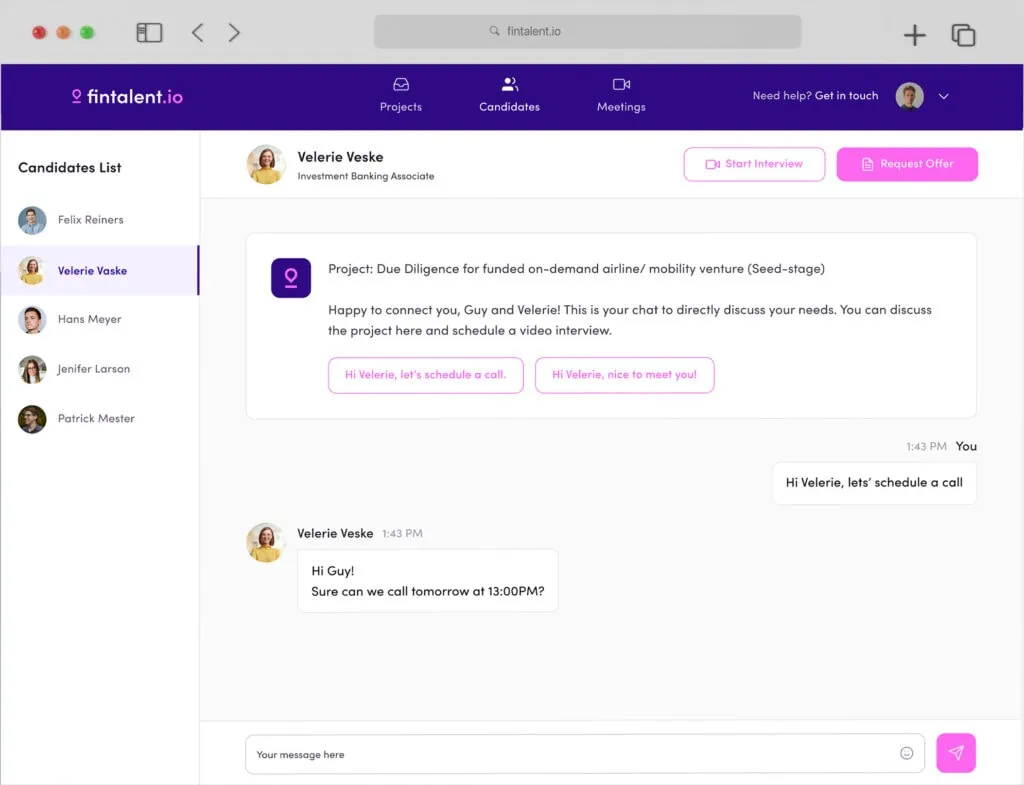

How Do Freelance M&A Consultants Communicate With The Client?

The work on M&A freelancers is fully adjustable to the needs of the client – most freelancers are also available to work in the office or in a hybrid model, and all freelancers will also be available to work remotely.

Some clients prefer to provide the freelancers with their own hardware due to internal security policies (telephone and laptop), while others let the freelancers use their own material.

Other consultancies or audit firms that are already involved in the M&A process pose no hindrance to the work of a well-suited freelancer – investment bankers and other M&A professionals are experienced in working with and coordinating third parties to bring the process to success.

Rules For Selecting The Right M&A Consultant

Because of the complexity of M&A projects, it may seem easier to just choose a local M&A boutique. This is a costly mistake, as freelancers can provide much more targeted support in almost any case.

At Fintalent.io, we provide our clients with help with defining the right profile for their M&A freelancers. If you don’t (yet) work with us, ask yourself these 3 questions first:

- Can we leverage freelancers with our team?

Working with freelancers is a skill that any team needs to learn. It’s a much more goal-oriented way of working – a muscle that needs to be built and trained. Give yourself the time to understand how to work with freelancers ideally.

- What background are we looking for?

Do you require a freelance with buy-side or sell-side experience? Should they have worked in Private Equity before? The background gives you the general direction of who you’re looking for.

- What expertise do I require?

A freelancer to support your financial due diligence requires a fundamentally different skill set than someone to support commercial due diligence or post-merger integration. Zoom in on the specific skills that you need to make your project successful.

- Where do they need to work from?

Our clients often put more effort than we recommend on someone locally, when a freelance professional in a different location could support the M&A process much better. It’s crucial to ask yourself if the professional needs to be available locally or not.

Conclusion

Working with freelance M&A consultants enables M&A teams to leverage their core team while adding flexibility. Interested in learning more? Get in touch via the chat or our client dashboard.