M&A Freelance Platform

The Fastest Way To Staff M&A Projects.

From Origination To Integration.

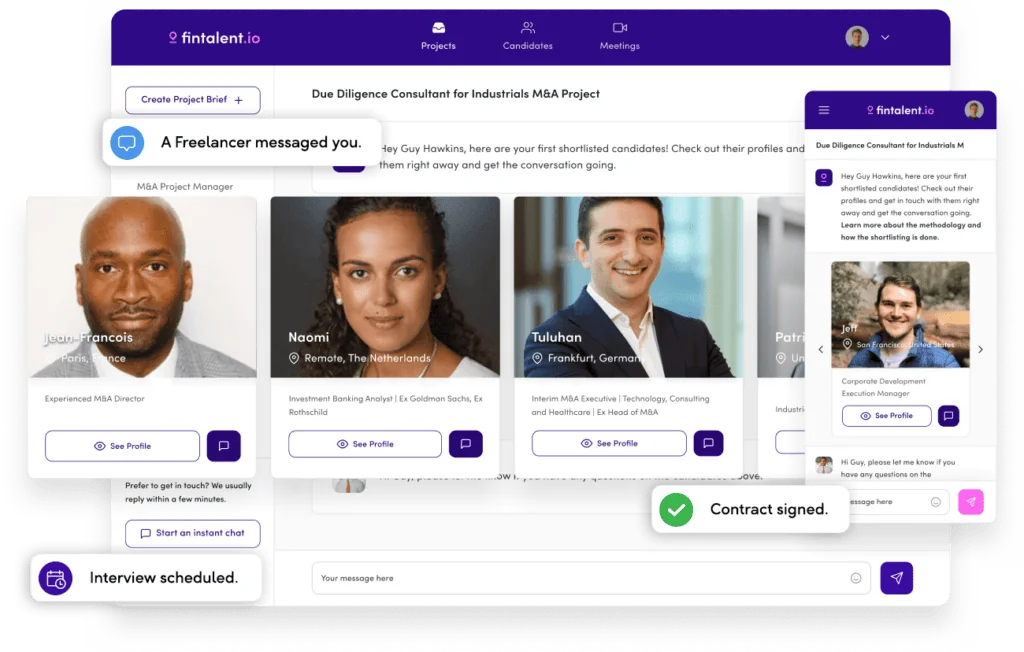

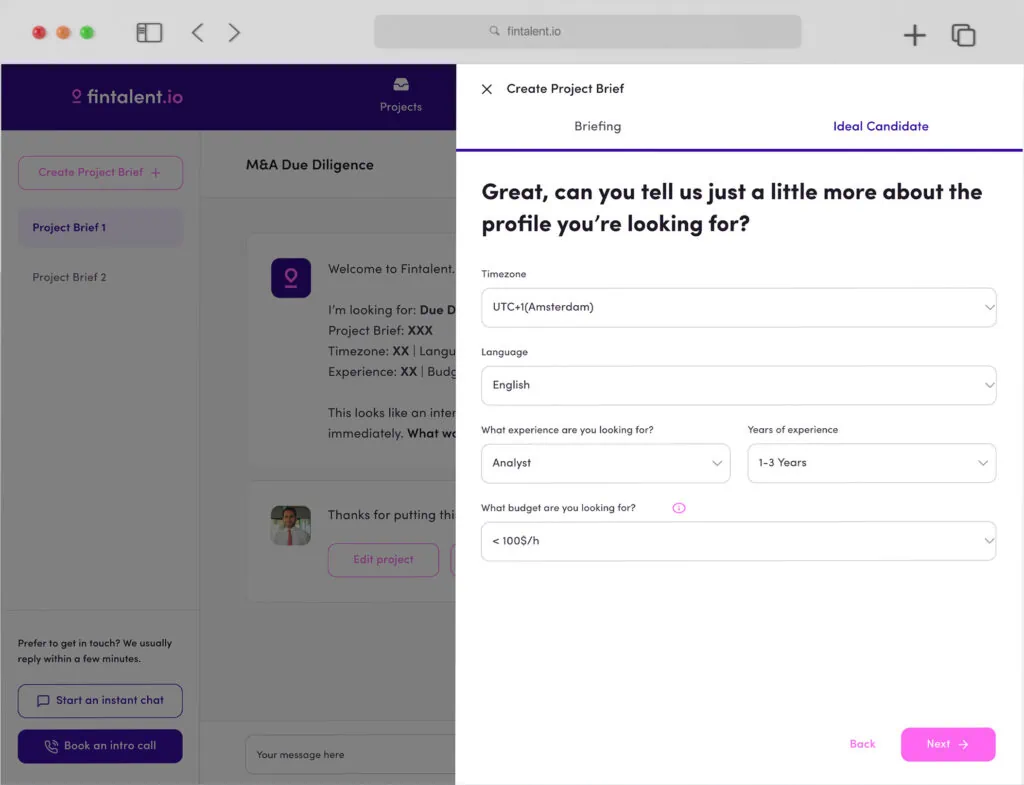

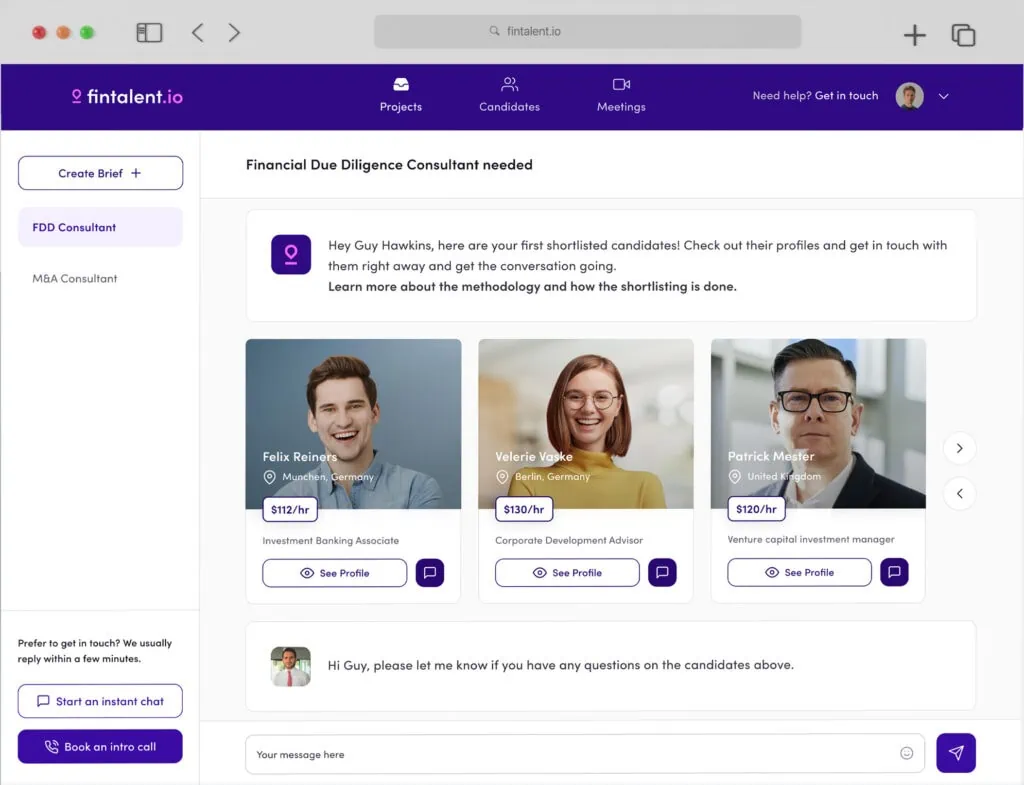

Get proposals from 3,000+ buy-side M&A freelancers within hours through the Fintalent platform.

- No signup fee

- Personal service

- 62 countries

Prefer to talk? Book a call. Want to sign up as freelancer? Learn more.

We serve Leading Portfolio Companies and Corporate M&A Divisions Globally.

Free Handbooks: Learn How Agile M&A Teams create more M&A value

How do you leverage freelancers for your M&A team? We’ve create two handbooks to guide you through the ins and outs of flexible talent for both M&A and PMI projects – how they work, pros and cons, and practical checklists and guidelines to get the most value out of your agile M&A team.

The Flexible Future Of Corporate Development

A practical guide on how Corporate Development organizations can leverage M&A freelancers to execute more buy-side deals, faster – with a lean and agile team.

The Path to PMI Mastery: Building and Staffing for Integration

A practical guide for first-time and serial acquirers on how external consultants support, lead, and deliver value in post-merger integration scenarios.

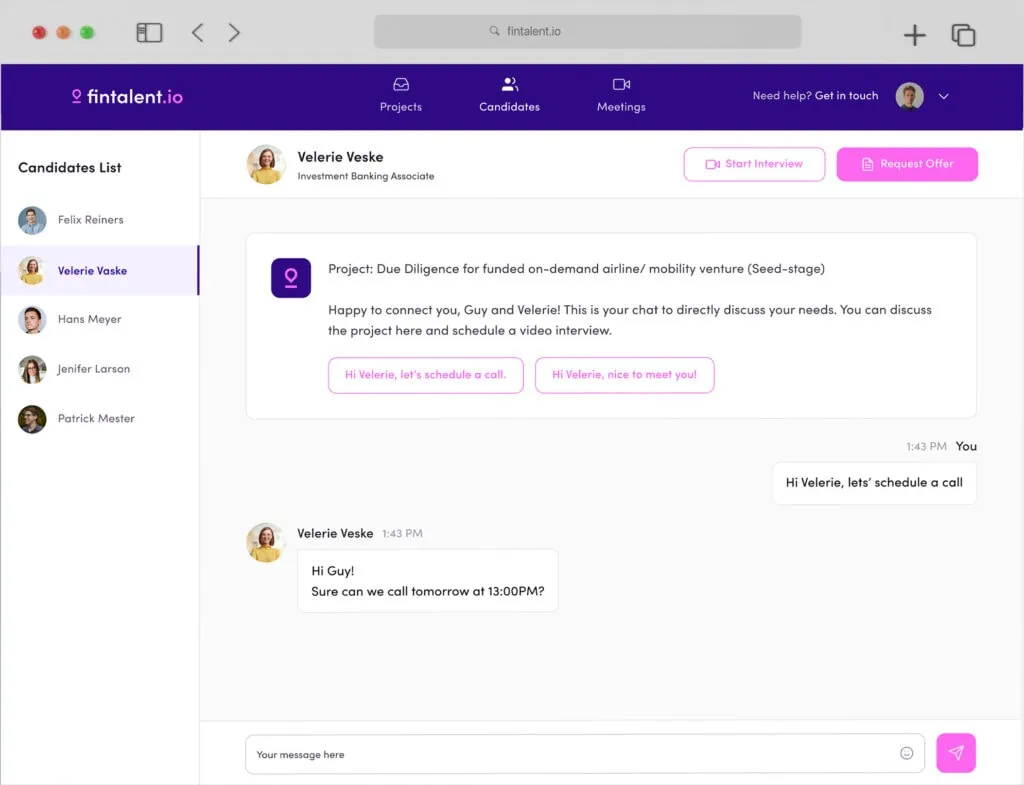

Connect with the right M&A Freelancer within Hours

Find Freelance Consultants in these categories

Recently Posted Projects

German-speaking Senior M&A professional (VP/Director level) to support Buy-side execution of PortCo

German-speaking Strategy consultant (Analyst/ Associate level) for a 2 months assignment to support FinTech (Crypto field) - Start ASAP

Technical DD for a SaaS business

German junior/ mid-level M&A/ PE professional to support PE on outreach for add-on acquisitions

France-based VP/Director level M&A/ PE Professional to soupport on buy & build assignments (deal Pipeline building, management and execution)

US-based Fractional CFO for PortCo of US Private Equity firm

eCommerce M&A/PE specialist to conduct FDD

France, Singapore or Australia-based PMI Manager to lead integration of recent acquisition

UK-based Strategy consultant to complete CDD of UK Dental Market

Divestiture/ Disposal of Chinese operations for a global TIC player.

Reclaim your freedom.

Sign up as M&A Freelancer.

- Join 3,000+ other vetted Fintalents on the largest platform for independent M&A consultants.

- Find exciting projects and decide where and when you want to work on M&A deals.

- Message and connect with other community members and build your own neo M&A boutique.